Get the free Sample Certification - Form A

Show details

Este formulario es para individuos que hacen contribuciones a candidatos de la Asamblea General que participan en el Programa de Elecciones Ciudadanas.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sample certification - form

Edit your sample certification - form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sample certification - form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sample certification - form online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sample certification - form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

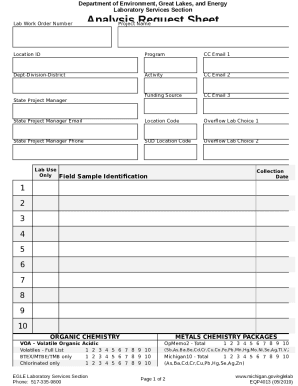

How to fill out sample certification - form

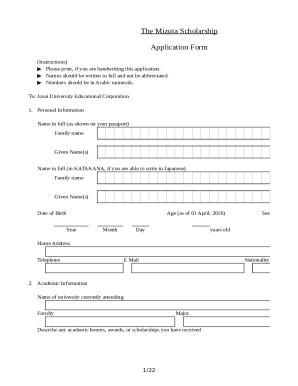

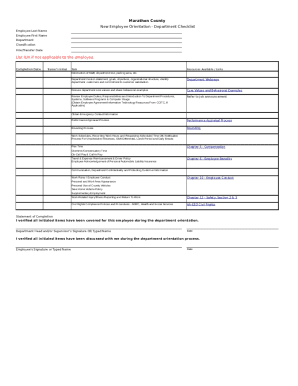

How to fill out Sample Certification - Form A

01

Begin by downloading Sample Certification - Form A from the official website.

02

Fill in your personal information in the designated fields, including your full name and contact information.

03

Provide the date on which you are completing the form.

04

Enter the specific details required for the certification, such as relevant qualifications or experiences.

05

Review the form for any errors or omissions.

06

Sign and date the form at the bottom to certify the information is accurate.

07

Submit the completed form to the appropriate authority as indicated in the instructions.

Who needs Sample Certification - Form A?

01

Individuals applying for certification in their respective fields.

02

Professionals seeking to validate their qualifications.

03

Organizations requiring certification for compliance purposes.

04

Students or trainees completing certification as part of their coursework.

Fill

form

: Try Risk Free

People Also Ask about

What is a GSP origin statement?

Proof of origin A statement on origin is a declaration of origin made by the registered exporter on an invoice, a delivery note, a packing list, or any other commercial document allowing identification of the goods and the exporter.

How to write a certification example?

“This certificate is awarded to [Name] in recognition of their successful completion of [Course/Program/Training Name] on [Date]. Your hard work, dedication, and commitment to learning have enabled you to achieve this milestone, and we are proud to recognize your accomplishment.”

What is an example of certification?

Certifications are earned when you complete an exam that confirms your professional development. They are often given by national organizations that set the standards for the industry and may be required for certain jobs. For example, you can be certified to be a personal trainer at a gym.

What is form a certificate of origin?

A certificate of origin (CO) is a document declaring in which country a commodity or good was manufactured. The certificate of origin contains information regarding the product, its destination, and the country of export.

How do you write your certification?

How to Format Your Certifications Add the title of the certification. List the full title of the certificate underneath the section header as a bullet point. Include the name of the awarding organization. List the date you earned your certification. List the date your certification expires. Provide details (optional).

What do I write on a certificate?

What to write on a certificate? Receiver's name. A certificate confirms a certain person's achievements and competency. Trainer's name. Workshop title. Results. Date when a certificate was issued. Trainer's signature. Certificate number.

What is an example of certification language?

I, THE UNDERSIGNED [name of the authority], hereby certify that the attached text is a true and complete copy of [title of the treaty, name of the parties, date and place of conclusion], and that it was concluded in [languages].

How to write a certificate example?

“This certificate is awarded to [Name] in recognition of their active participation in [Event/Program Name] between [Event/Program Dates]. Your participation, enthusiasm, and dedication have been an integral part of the success of [Event/Program Name], and we are pleased to recognize your involvement.”

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

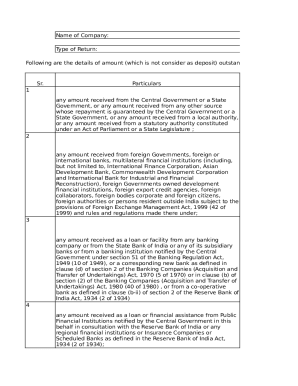

What is Sample Certification - Form A?

Sample Certification - Form A is a document used to certify the compliance of a sample with specific standards or regulations.

Who is required to file Sample Certification - Form A?

Entities or individuals who produce, distribute, or import products subject to specific regulations must file Sample Certification - Form A.

How to fill out Sample Certification - Form A?

To fill out Sample Certification - Form A, complete the required fields with accurate information regarding the sample, including product details, compliance standards, and sign the document.

What is the purpose of Sample Certification - Form A?

The purpose of Sample Certification - Form A is to ensure that products meet required compliance standards and to provide verification to regulatory authorities.

What information must be reported on Sample Certification - Form A?

The information that must be reported on Sample Certification - Form A includes product identification, compliance standards, manufacturer details, and signature of the certifying individual.

Fill out your sample certification - form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sample Certification - Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.