Get the free CD - NOTIFICATION OF APPOINTMENT OF TAX AGENT

Show details

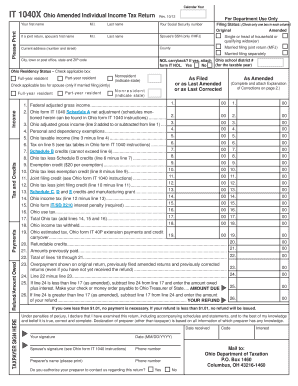

This document is used for notifying the appointment of a tax agent, including personal details and addresses related to the taxpayer and tax agent.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cd - notification of

Edit your cd - notification of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cd - notification of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cd - notification of online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit cd - notification of. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cd - notification of

How to fill out CD - NOTIFICATION OF APPOINTMENT OF TAX AGENT

01

Obtain the CD - NOTIFICATION OF APPOINTMENT OF TAX AGENT form from the tax authority's website or office.

02

Fill out your personal details, including your name, address, and contact information.

03

Enter the tax agent's information, including their name, address, and registration number.

04

Specify the type of taxes the agent is authorized to handle on your behalf.

05

Indicate the duration for which the appointment is valid or if it is indefinite.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed form to the relevant tax authority either in person or via their online submission portal.

Who needs CD - NOTIFICATION OF APPOINTMENT OF TAX AGENT?

01

Individuals or businesses who wish to appoint a tax agent to represent them in tax matters.

02

Those who require assistance with tax filings, negotiations with the tax authority, or other tax-related issues.

Fill

form

: Try Risk Free

People Also Ask about

When should I use a tax agent?

If you've got several jobs, earn additional income through the sharing economy, run a business, own rental property or juggle an investment portfolio, using a tax agent is definitely worth it.

Is it better to go to a tax agent or do it yourself?

If you have relatively simple tax affairs and take the time to understand what you're doing, you can do it yourself. A tax agent can be worthwhile for more complex advice on structuring for future and lodging late returns.

What are the biggest tax mistakes people make?

6 Common Tax Mistakes to Avoid Faulty Math. One of the most common errors on filed taxes is math mistakes. Name Changes and Misspellings. Omitting Extra Income. Deducting Funds Donated to Charity. Using The Most Recent Tax Laws. Signing Your Forms.

When to appoint a tax agent?

Appoint a tax agent Not mandatory but advisable Ideally, the tax agent should be appointed within 3 months from the date of commencement of the operations. The tax registration should be completed within 3 months from the beginning of the basis period for that year of assessment.

At what point should I get a tax advisor?

If you have a simple tax situation, you might be fine self-filing your return with tax software. But if you have a more complicated tax return or you've had some major life changes this tax year, hiring a tax advisor is usually the way to go.

Is the tax audit date extended for the AY 2025/26 due date?

The Central Board of Direct Taxes (CBDT) has decided to extend the specified date for filing various audit reports for the Previous Year 2024–25 (Assessment Year 2025–26), from September 30, 2025 to October 31, 2025, for assessees referred to in clause (a) of Explanation 2 to sub-section (1) of section 139 of the

How to respond to an income tax notice for cash deposit?

How to Respond to this? Step 1: Login to your Account: Step 2: Click on compliance section: Step 3: Submission of response: Explanation of Transactions (Cash Deposits) can be understood from the following table and screen .

What is the latest date for a tax extension?

If you need more time to file your taxes, request an extension by the April tax filing due date. This gives you until October 15 to file without penalties. Make sure you pay any tax you owe by the April filing date.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CD - NOTIFICATION OF APPOINTMENT OF TAX AGENT?

CD - NOTIFICATION OF APPOINTMENT OF TAX AGENT is a formal document that taxpayers use to notify tax authorities about the appointment of a tax agent to represent them in tax matters.

Who is required to file CD - NOTIFICATION OF APPOINTMENT OF TAX AGENT?

Any taxpayer who wishes to appoint a tax agent to handle their tax affairs and communicate with tax authorities on their behalf is required to file the CD - NOTIFICATION OF APPOINTMENT OF TAX AGENT.

How to fill out CD - NOTIFICATION OF APPOINTMENT OF TAX AGENT?

To fill out the CD - NOTIFICATION OF APPOINTMENT OF TAX AGENT, taxpayers need to provide essential details such as their personal information, the tax agent's contact information, and the scope of authority granted to the tax agent.

What is the purpose of CD - NOTIFICATION OF APPOINTMENT OF TAX AGENT?

The purpose of the CD - NOTIFICATION OF APPOINTMENT OF TAX AGENT is to ensure that tax authorities are aware of who is authorized to represent the taxpayer, facilitating efficient communication and management of tax obligations.

What information must be reported on CD - NOTIFICATION OF APPOINTMENT OF TAX AGENT?

The information that must be reported on the CD - NOTIFICATION OF APPOINTMENT OF TAX AGENT includes the taxpayer's details, the appointed tax agent's name and details, and the specific powers or duties the tax agent is allowed to perform.

Fill out your cd - notification of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cd - Notification Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.