Get the free Cal STRS Recipient Designation Form - Information - 4cd

Show details

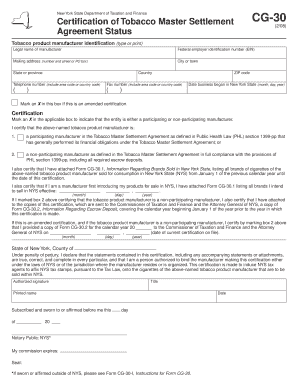

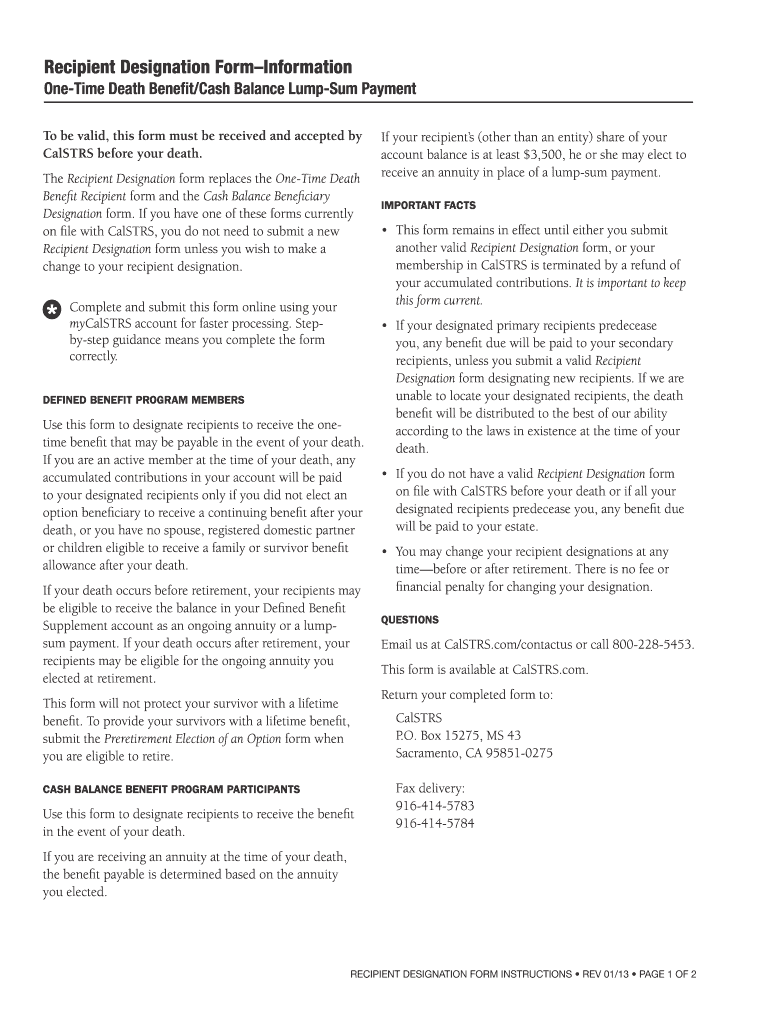

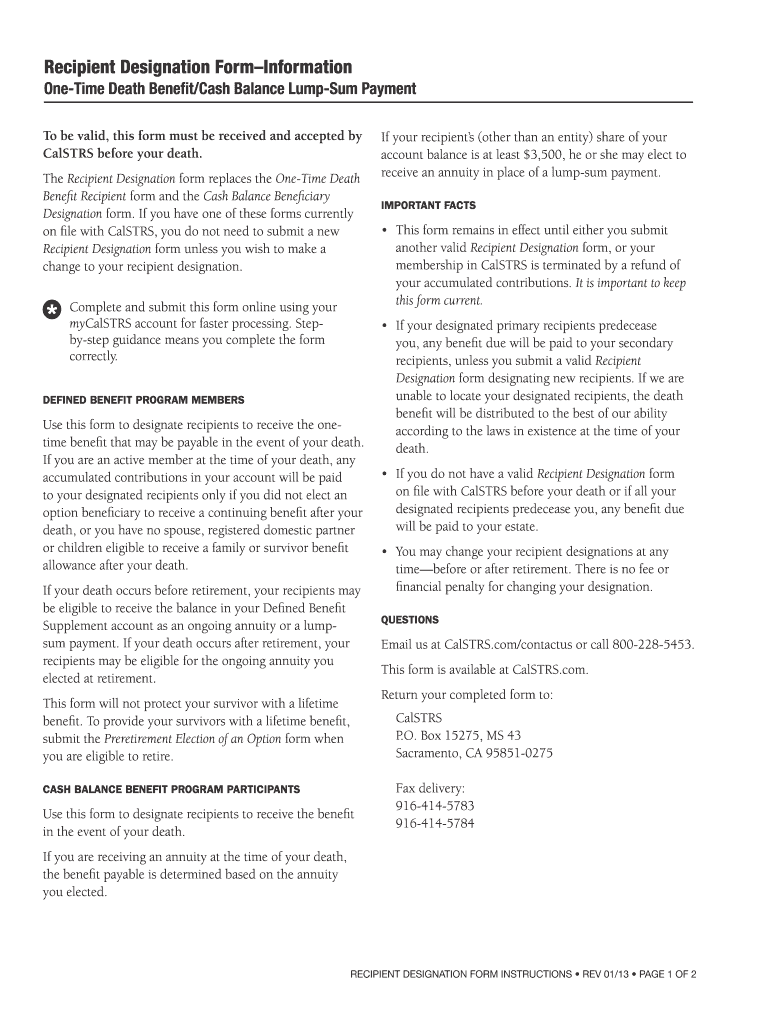

Recipient Designation Form? Information

One-Time Death Been’t/Cash Balance Lump-Sum Payment

To be valid, this form must be received and accepted by

Casts before your death.

The Recipient Designation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cal strs recipient designation

Edit your cal strs recipient designation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cal strs recipient designation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cal strs recipient designation online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit cal strs recipient designation. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cal strs recipient designation

How to Fill Out Cal STRS Recipient Designation:

01

Start by gathering the necessary information. You will need the full legal name, date of birth, and Social Security number of the person you wish to designate as your Cal STRS recipient.

02

Access the Cal STRS website or contact their customer service to obtain the required forms for recipient designation. These forms are typically available online and can be downloaded and printed.

03

On the recipient designation form, provide your own personal information as the plan member. This includes your full name, address, and contact details.

04

Follow the provided instructions to fill in the recipient's information accurately. Double-check the spelling of their name, ensure the correct date of birth is entered, and accurately input their Social Security number.

05

Determine the type of beneficiary designation you want to make. Cal STRS offers different options, such as primary and contingent beneficiaries, and different percentages for the distribution of benefits. Carefully read through the instructions and select the option that aligns with your preferences.

06

Indicate the relationship between you and the designated recipient. This may include spouse, child, sibling, domestic partner, or another valid relationship as recognized by Cal STRS.

07

Review the completed form thoroughly to ensure accuracy. Check for any errors or missing information before submitting the form to Cal STRS.

Who Needs Cal STRS Recipient Designation:

01

Cal STRS recipient designation is required for all plan members who want to designate a specific individual or individuals as beneficiaries to receive their pension benefits after their death.

02

This is particularly important for plan members who want to ensure that their retirement benefits go to a specific person or people instead of being determined by the default rules or laws of succession.

03

It is recommended for every Cal STRS plan member to review and update their recipient designation periodically to ensure it reflects their current intentions and desires. This helps to avoid potential conflicts or confusion in the distribution of benefits.

Remember, it is crucial to consult with a financial advisor or legal professional if you have any questions or concerns about filling out the Cal STRS recipient designation form. Their expertise can provide you with personalized guidance and ensure that your wishes are properly documented.

Fill

form

: Try Risk Free

People Also Ask about

How do I get an award letter from CalSTRS?

Your letter will be accessible only through your secure online myCalSTRS account. It will not be mailed or faxed by us to you or a third party.

What are the beneficiary options for CalSTRS?

You can elect: 100% Beneficiary Option Your beneficiary will receive 100% of the monthly amount you received, or would have received, during retirement. 75% Beneficiary Option Your beneficiary will receive 75% of the monthly amount you received, or would have received, during retirement.

Does CalSTRS have survivor benefits?

As a member of the CalSTRS Defined Benefit Program, your spouse, children or other loved ones may be eligible for survivor benefits after your death.

Who is the beneficiary of CalSTRS death benefit?

If you die after retirement, the one-time death benefit is the same under both Coverage A and Coverage B. CalSTRS pays a one-time death benefit payment of $6,903 to your named recipient or recipients if you're a retired member. The amount of the payment may be adjusted periodically by the Teachers' Retirement Board.

How long does it take to get CalPERS death benefits?

If the member contributed dollar amounts to CalPERS, or was vested and separated within four months of death, our regular death benefits are paid.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit cal strs recipient designation from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including cal strs recipient designation, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Where do I find cal strs recipient designation?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the cal strs recipient designation. Open it immediately and start altering it with sophisticated capabilities.

Can I edit cal strs recipient designation on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute cal strs recipient designation from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is cal strs recipient designation?

The Cal STRS recipient designation is a form that allows California State Teachers' Retirement System (Cal STRS) members to designate their beneficiaries to receive certain benefits upon their death.

Who is required to file cal strs recipient designation?

All Cal STRS members are required to file the recipient designation form to designate their beneficiaries.

How to fill out cal strs recipient designation?

To fill out the Cal STRS recipient designation form, members need to provide their personal information, such as name, address, and contact details. They also need to specify the name(s) and relationship(s) of their designated beneficiary/beneficiaries.

What is the purpose of cal strs recipient designation?

The purpose of the Cal STRS recipient designation form is to ensure that the member's chosen beneficiaries receive the benefits (such as death benefits) they are entitled to upon the member's death.

What information must be reported on cal strs recipient designation?

The Cal STRS recipient designation form requires members to report their personal information, including their name, address, and contact details. They also need to specify the name(s) and relationship(s) of their designated beneficiary/beneficiaries.

Fill out your cal strs recipient designation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cal Strs Recipient Designation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.