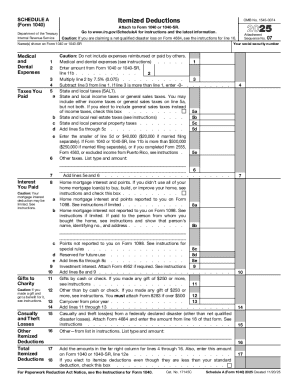

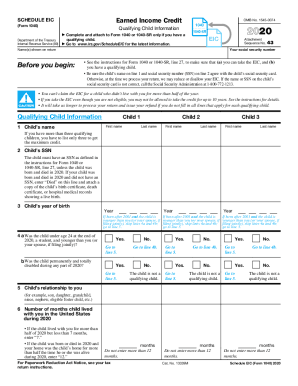

About IRS 1040 - Schedule A 2020 previous version

What is IRS 1040 - Schedule A?

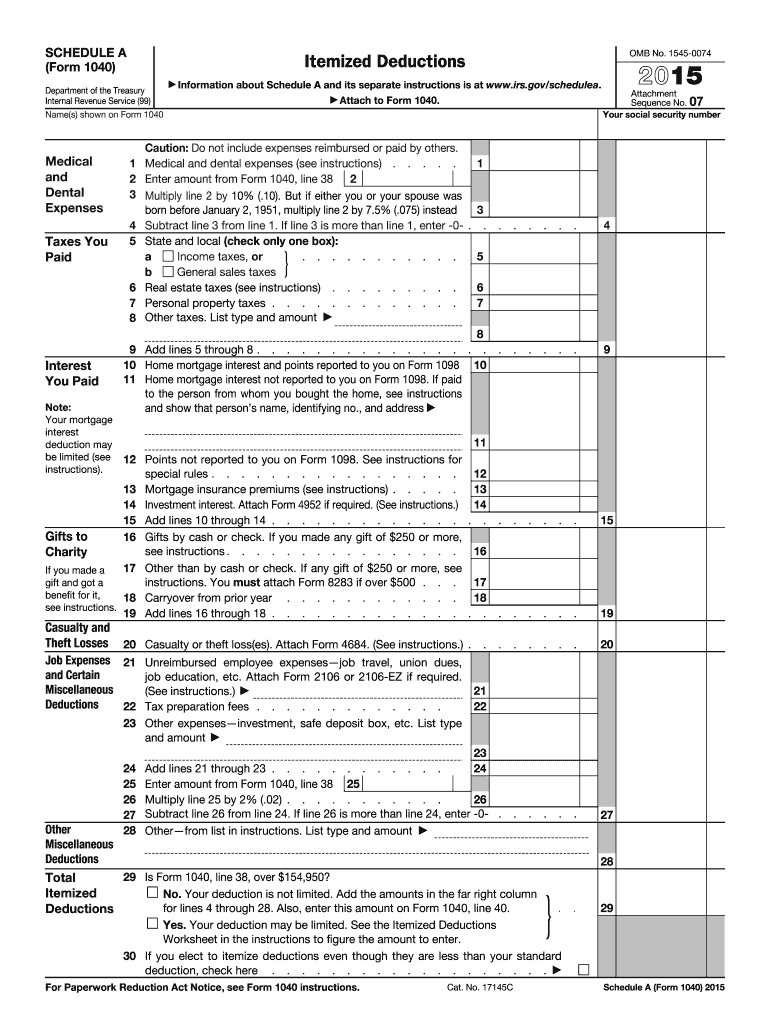

IRS 1040 - Schedule A is a tax form used by U.S. taxpayers to report itemized deductions. Taxpayers can choose between taking the standard deduction or itemizing deductions on this form. The choice depends on which method provides a greater tax benefit. Schedule A must accompany Form 1040 when filing their individual income taxes.

What is the purpose of this form?

The purpose of IRS 1040 - Schedule A is to enable taxpayers to detail their itemized deductions to potentially reduce their taxable income. Common deductions include medical expenses, mortgage interest, and state and local taxes. Proper completion of this form can lead to significant tax savings depending on the individual financial situation.

Who needs the form?

Taxpayers who choose to itemize their deductions need to complete IRS 1040 - Schedule A. This includes individuals whose total deductions exceed the standard deduction amount for their filing status. Additionally, certain taxpayers with specific deductible expenses, such as substantial medical bills or high mortgage interest payments, will benefit from using this schedule.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 1040 - Schedule A if you choose to take the standard deduction instead of itemizing your deductions. Certain categories of taxpayers, such as those with income below a specified threshold or specific filing statuses, may find that itemizing is not beneficial. Always review the latest IRS guidelines to determine eligibility for standard deduction exemptions.

Components of the form

IRS 1040 - Schedule A consists of several sections that capture different types of itemized deductions. The main components include sections for medical expenses, taxes, interest paid, gifts to charity, and miscellaneous deductions. Each section requires specific details, including amounts and types of expenses. Ensure to follow the instructions laid out in each section for accurate reporting.

What payments and purchases are reported?

On IRS 1040 - Schedule A, taxpayers report a variety of payments and purchases that qualify as deductions. This includes unreimbursed medical expenses, state and local taxes, mortgage interest, and charitable contributions. Accurate documentation of each deduction claimed is essential to support your declarations during an audit or verification process.

What are the penalties for not issuing the form?

Failure to complete and submit IRS 1040 - Schedule A when required can result in penalties, including increased tax liabilities due to loss of deductions. Additionally, the IRS may impose fines for late submissions or incorrect information. It is crucial for taxpayers to file the form accurately and on time to avoid such penalties.

What information do you need when you file the form?

When filing IRS 1040 - Schedule A, gather all necessary documentation and information. This includes receipts for deductible expenses, records of medical bills, mortgage interest statements, and proof of charitable contributions. Having this information readily available can streamline the process and ensure accurate completion of the form.

Is the form accompanied by other forms?

IRS 1040 - Schedule A is typically filed alongside Form 1040, the primary tax return for individual taxpayers. Depending on your tax situation, additional forms may be required for specific deductions reported on Schedule A. Review the IRS guidelines for any supplementary forms that may be necessary based on the deductions you claim.

Where do I send the form?

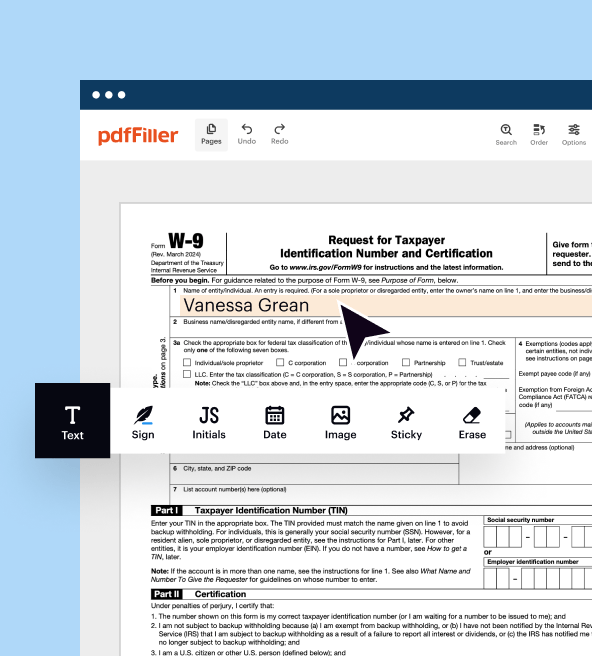

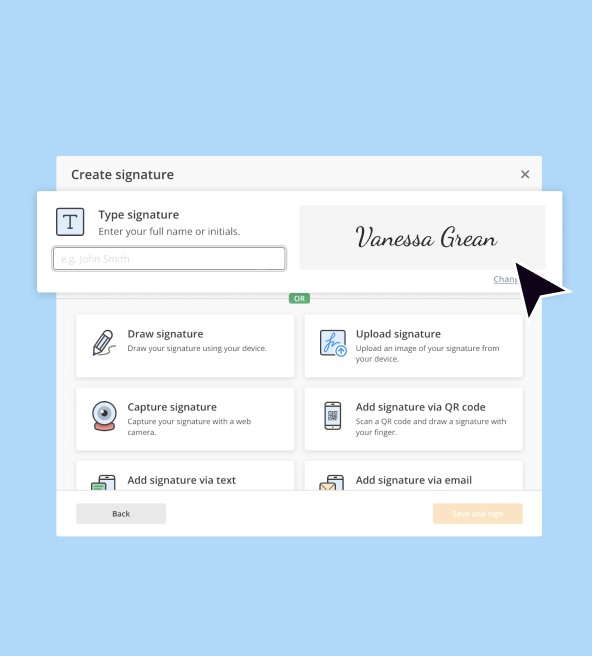

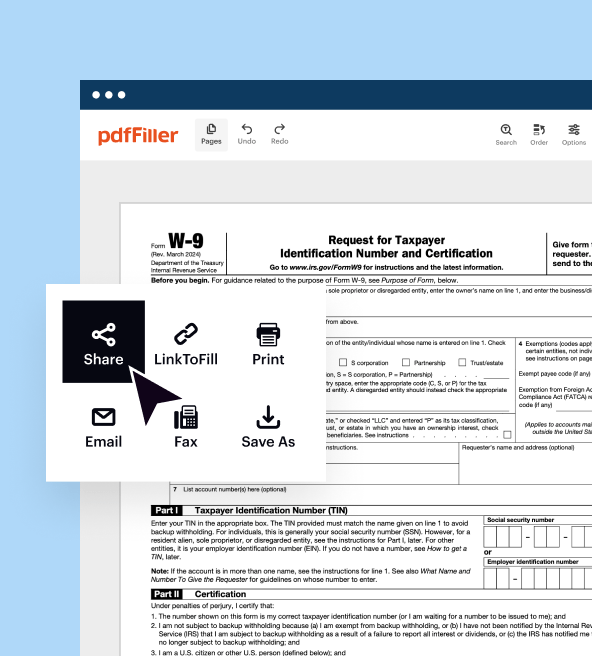

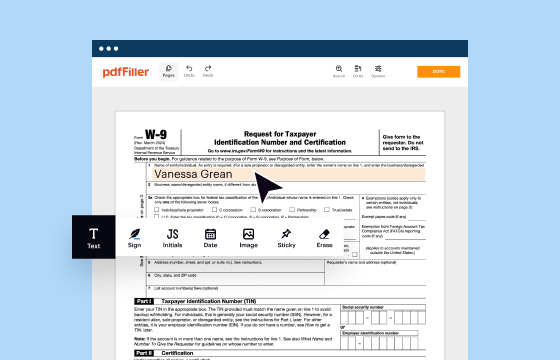

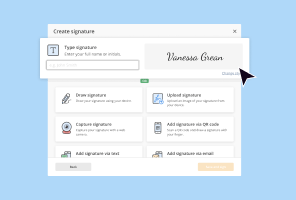

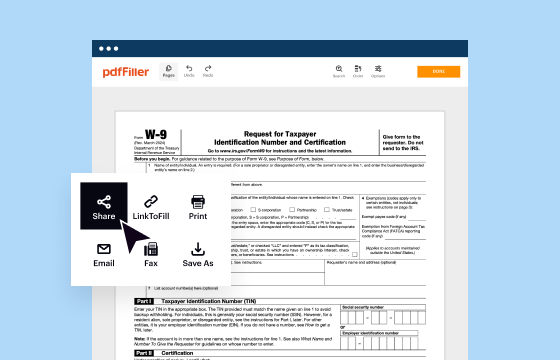

IRS 1040 - Schedule A should be submitted according to the instructions provided for Form 1040 filing. This usually involves sending it to the address specified for your state on the IRS website. Ensure you verify the mailing address and follow up on any additional requirements, such as electronic filing options through tools like pdfFiller, for a more efficient process.