Get the free Credit Risk Modeling Practices in the Insurance Industry Webcast - soa

Show details

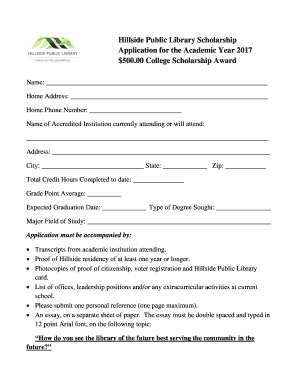

Registration form for the Credit Risk Modeling Practices in the Insurance Industry webcast, detailing fees and participant requirements.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit risk modeling practices

Edit your credit risk modeling practices form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit risk modeling practices form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit risk modeling practices online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit credit risk modeling practices. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit risk modeling practices

How to fill out Credit Risk Modeling Practices in the Insurance Industry Webcast

01

Identify the key objectives for the Credit Risk Modeling Practices Webcast.

02

Gather relevant data and materials related to credit risk modeling in the insurance industry.

03

Create a detailed outline of the topics to be covered in the webcast.

04

Develop engaging presentation slides or other visual aids that enhance understanding.

05

Schedule a date and time for the webcast, considering the availability of key participants.

06

Promote the webcast through various channels to attract attendees.

07

Prepare for potential questions by reviewing common concerns in credit risk modeling.

08

Conduct a tech rehearsal to ensure the webcast platform is functioning properly.

09

Engage with attendees during the webcast, encouraging questions and participation.

10

Follow up with participants after the webcast for feedback and additional resources.

Who needs Credit Risk Modeling Practices in the Insurance Industry Webcast?

01

Insurance companies looking to improve their credit risk assessment methods.

02

Risk management professionals seeking to enhance their understanding of credit risk modeling.

03

Data analysts in the insurance industry wanting to adopt best practices in credit risk analysis.

04

Regulatory officers aiming to stay updated on industry standards for credit risk management.

05

Financial consultants advising insurance firms on credit risk strategies.

Fill

form

: Try Risk Free

People Also Ask about

What is risk modelling in insurance?

A risk model is a model that is used to predict quantifiable amounts of insurance risk. Most commonly used risk factors are claim frequency and claim severity. By calculating a product of the two models one gets the basis for insurance premium, i.e. the actuarial cost.

Is credit risk modelling a good career?

Being a Credit Risk Modeller is undoubtedly a prestigious and rewarding career choice. To evaluate its attractiveness, let's break down various factors: Opportunities for Advancement (Score: 8): The role of Credit Risk Modeller offers significant influence and decision-making authority.

What is credit risk modelling?

Credit risk modeling is the process of quantifying the likelihood that a borrower will default on a loan and estimating the financial losses that may result. Financial institutions use credit risk models to assess and manage exposure, improve lending decisions, and comply with regulatory requirements.

What is the PD model of credit risk?

Development of a Probability of Default (PD) Model It's like a score that helps the bank guess how risky a loan might be. Here's how a borrower might be considered in default (not paying back their loan): The Bank Thinks They Can't Pay: Maybe the borrower goes bankrupt, which means they legally can't pay their debts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Credit Risk Modeling Practices in the Insurance Industry Webcast?

Credit Risk Modeling Practices in the Insurance Industry Webcast is a seminar or online event that discusses methodologies, strategies, and best practices related to assessing and managing credit risk within the insurance sector.

Who is required to file Credit Risk Modeling Practices in the Insurance Industry Webcast?

Entities within the insurance industry, including insurers and reinsurers, who engage in credit risk assessment and management practices are typically required to participate or file relevant information pertaining to these practices.

How to fill out Credit Risk Modeling Practices in the Insurance Industry Webcast?

To fill out the Credit Risk Modeling Practices in the Insurance Industry Webcast, participants should follow provided guidelines, complete necessary forms accurately, and submit required documentation as instructed by the regulatory body overseeing the webcast.

What is the purpose of Credit Risk Modeling Practices in the Insurance Industry Webcast?

The purpose of the Credit Risk Modeling Practices in the Insurance Industry Webcast is to educate insurance professionals on effective credit risk modeling, share insights on regulatory requirements, and promote best practices in risk management to enhance the industry's resilience.

What information must be reported on Credit Risk Modeling Practices in the Insurance Industry Webcast?

Information that must be reported includes methodologies used for credit risk assessment, data inputs, results of modeling practices, compliance with regulatory standards, and any findings or conclusions drawn from the credit risk analysis.

Fill out your credit risk modeling practices online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Risk Modeling Practices is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.