Get the free Comparative Failure Experience in the U.S. and Canadian Banking & Life Insurance Ind...

Show details

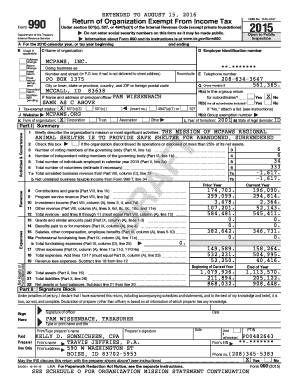

This document serves as a registration form for a webcast discussing comparative failure experiences in the U.S. and Canadian banking and life insurance industries from 1980 to 2010, including registration

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign comparative failure experience in

Edit your comparative failure experience in form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your comparative failure experience in form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit comparative failure experience in online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit comparative failure experience in. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out comparative failure experience in

How to fill out Comparative Failure Experience in the U.S. and Canadian Banking & Life Insurance Industries: 1980-2010

01

Gather relevant data on failures in the U.S. and Canadian banking and life insurance sectors from 1980 to 2010.

02

Categorize the types of failures, such as insolvencies, mismanagement, or regulatory non-compliance.

03

Analyze the causes of these failures and their impacts on the industries.

04

Create a comparison framework to juxtapose U.S. and Canadian experiences.

05

Document lessons learned and best practices that emerged from these failures.

06

Format the findings into a clear report, ensuring to include any quantitative and qualitative data.

07

Review and revise the document for accuracy and comprehensiveness.

Who needs Comparative Failure Experience in the U.S. and Canadian Banking & Life Insurance Industries: 1980-2010?

01

Regulators looking to improve oversight and risk management practices.

02

Industry professionals and stakeholders seeking to understand historical trends and prevent future failures.

03

Academic researchers studying financial crises and their impacts on economies.

04

Investment analysts evaluating the stability and reliability of financial institutions.

05

Policy makers aiming to develop better regulatory frameworks.

Fill

form

: Try Risk Free

People Also Ask about

Why was Canada exempt from the financial crisis?

From its beginning, Canada's banking system was struc- tured to be less vulnerable to shocks and thus did not give rise to the need for a central bank to achieve stability. By contrast, the Fed was created to offset vulnerabilities in the American banking system.

What was the banking crisis in 2008?

Lack of investor confidence in bank solvency and declines in credit availability led to plummeting stock and commodity prices in late 2008 and early 2009. The crisis rapidly spread into a global economic shock, resulting in several bank failures.

How many banks failed in 2010?

There were 157 bank failures in 2010.

Why did banks fail in 1930?

Explanations. Illiquidity coupled with a contagion of fear is seen as the major factor in precipitating the financial crisis. A contagion of fear led to higher short-term demand for currency and further strained the liquidity of banks and as a result made them cash flow insolvent.

What countries were not affected by the 2008 financial crisis?

By contrast, China, Japan, Brazil, India, Iran, Peru and Australia were "among the least affected."

Why didn't Canada have a banking crisis in 2008 or in 1930 or 1907 or?

The Canadian concentrated banking system that had evolved by the end of the twentieth century had absorbed the key sources of systemic risk -- the mortgage market and investment banking -- and was tightly regulated by one overarching regulator.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Comparative Failure Experience in the U.S. and Canadian Banking & Life Insurance Industries: 1980-2010?

Comparative Failure Experience refers to the analysis and documentation of failure rates and trends in the U.S. and Canadian banking and life insurance sectors over the period from 1980 to 2010. It includes examining the factors that lead to failures, the consequences of those failures, and the overall performance of institutions during this timeframe.

Who is required to file Comparative Failure Experience in the U.S. and Canadian Banking & Life Insurance Industries: 1980-2010?

Typically, financial institutions, including banks and insurance companies operating in the U.S. and Canada, are required to file Comparative Failure Experience. This requirement may extend to regulatory bodies and auditors involved in assessing the risk and reliability of these institutions.

How to fill out Comparative Failure Experience in the U.S. and Canadian Banking & Life Insurance Industries: 1980-2010?

To fill out the Comparative Failure Experience, institutions must gather relevant data on failures, including the number of institutions that failed, the reasons for failures, financial metrics, and changes in regulatory compliance. The information is then compiled into a standardized format as required by regulatory authorities.

What is the purpose of Comparative Failure Experience in the U.S. and Canadian Banking & Life Insurance Industries: 1980-2010?

The purpose of Comparative Failure Experience is to enhance understanding of the risk factors associated with financial institution failures, to inform regulatory policies, and to improve risk management practices. It helps stakeholders identify trends and triggers that lead to failures, enabling preemptive measures.

What information must be reported on Comparative Failure Experience in the U.S. and Canadian Banking & Life Insurance Industries: 1980-2010?

The information that must be reported includes the number of institutions that failed, duration of operation prior to failure, financial indicators such as asset size and capital ratios, the geographical distribution of failures, and the underlying causes of each failure. Additionally, comparative statistics may be required for benchmarking purposes.

Fill out your comparative failure experience in online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Comparative Failure Experience In is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.