Get the free Maximum Credit Appeal

Show details

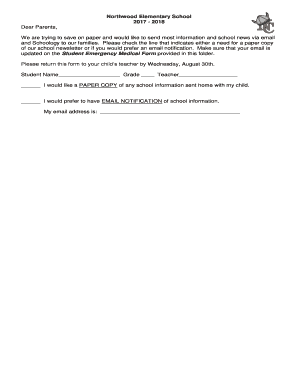

Use this form to appeal the Financial Aid Office for additional time to complete a COCC program based on unusual or extraordinary circumstances.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign maximum credit appeal

Edit your maximum credit appeal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your maximum credit appeal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing maximum credit appeal online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit maximum credit appeal. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out maximum credit appeal

How to fill out Maximum Credit Appeal

01

Gather all necessary documentation that supports your appeal.

02

Fill out the Maximum Credit Appeal form carefully, ensuring all required fields are completed.

03

Include detailed explanations for each item you are disputing.

04

Attach any supporting evidence, such as credit reports or correspondence with creditors.

05

Review your appeal for completeness and accuracy before submission.

06

Submit the appeal to the appropriate credit bureau or agency handling your case.

Who needs Maximum Credit Appeal?

01

Individuals who have been denied credit due to inaccuracies on their credit report.

02

Consumers who believe their credit should be higher based on their payment history.

03

Anyone seeking to correct errors or misreporting related to their credit score.

04

Individuals who have experienced financial hardship that has affected their credit history.

Fill

form

: Try Risk Free

People Also Ask about

What happens if my financial aid appeal is denied?

Independent third-party documentation of the special circumstances may be required, or the appeal will be denied. If your appeal was denied, you can appeal again if you have addressed the issues that caused you to fail to maintain SAP.

What does suspension 150% timeframe mean?

Time frame is evaluated by the number of hours attempted. Students who are unable to graduate within the 150% time frame lose eligibility for financial aid when the hours needed to graduate and the hours attempted exceed the 150% limit.

How many times can you appeal financial aid?

Sure, the financial aid or admissions reps would like for you to believe this! They don't want to encourage multiple appeals from multiple students! The reality is that they cannot stop you from appealing. You can put as many formal appeals in writing as you need.

Can I appeal financial aid after accepting?

This could be before the FAFSA is filed, or after. A student might also experience a change in financial circumstances in the middle of the school year, which would warrant a start of the financial aid appeals process. Essentially, there is no designated timeframe for when an appeal should be made.

What is the success rate of fafsa appeals?

According to March 2025 research by College Aid Pro, 75% of students at private colleges and 25% at public colleges successfully appealed their financial aid. These appeals typically yield an additional $3,000-$5,000 per year, though some result in awards exceeding $50,000.

How often are financial aid appeals approved?

How Often Do Financial Aid Appeals Get Approved? Financial aid appeals are approved or denied at the discretion of your school. Your chances of approval will depend on many factors, like whether or not the school is able to offer more federal aid.

How to write an appeal letter for financial aid maximum time frame?

Provide a detailed account of your circumstances, highlighting how they adversely affected your academic performance. Clearly explain how your situation aligns with the grounds for a SAP appeal, and how your circumstances were affected during the time you were attending school.

What is the maximum attempted credits for financial aid?

What is the maximum timeframe? The federal government defines the maximum timeframe as 150% of your program's published length, as measured in credit hours. For example, a typical degree requires 63 credits which would result in a maximum timeframe of 94.5 credit hours (63 x 150%).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Maximum Credit Appeal?

Maximum Credit Appeal is a process through which individuals or businesses can request a review of their maximum credit limit set by a lender or credit agency. It aims to potentially increase the credit limit based on provided evidence and reasons.

Who is required to file Maximum Credit Appeal?

Individuals or businesses that believe their credit limit is set too low based on their creditworthiness, income, or financial status may file a Maximum Credit Appeal.

How to fill out Maximum Credit Appeal?

To fill out a Maximum Credit Appeal, one typically needs to complete an appeal form provided by the lender or credit agency, including personal information, current credit details, reasons for the appeal, and supporting documentation.

What is the purpose of Maximum Credit Appeal?

The purpose of Maximum Credit Appeal is to allow borrowers to contest and seek adjustment of their credit limits, helping them access more credit based on their financial situation.

What information must be reported on Maximum Credit Appeal?

Information required on a Maximum Credit Appeal typically includes the individual's or business’s name, account number, current credit limit, reasons for the appeal, and any additional proof of creditworthiness such as income statements or credit reports.

Fill out your maximum credit appeal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Maximum Credit Appeal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.