Get the free Credit Authorization

Show details

This document authorizes the release of information related to bank accounts, employment, credit, or mortgage verification to 4Trust Mortgage for the purpose of processing a mortgage loan application.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit authorization

Edit your credit authorization form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit authorization form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit authorization online

Follow the steps below to benefit from a competent PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit credit authorization. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

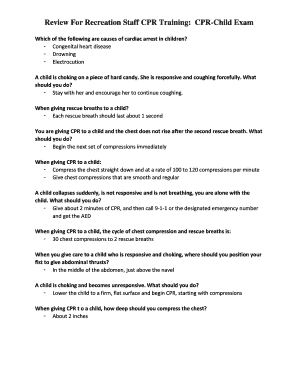

How to fill out credit authorization

How to fill out Credit Authorization

01

Obtain the Credit Authorization form from your financial institution or lender.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide the necessary financial details, such as your account number and the amount of credit you are requesting.

04

Review any terms and conditions associated with the credit authorization.

05

Sign and date the form to authorize the institution to check your credit.

06

Submit the completed form to the appropriate department as instructed.

Who needs Credit Authorization?

01

Individuals applying for loans or credit cards.

02

Businesses seeking to establish credit lines or loans.

03

Landlords or rental companies checking tenant creditworthiness.

04

Employers conducting background checks with financial implications.

Fill

form

: Try Risk Free

People Also Ask about

What is the meaning of credit authorization?

Credit card authorisation is a crucial step in the payment transaction process, where the card issuer validates the cardholder's details and verifies whether the transaction can be approved or declined.

How does credit authorization work?

A credit card authorization form is a document that customers (or cardholders) fill out to grant businesses the permission to charge their credit card. Credit card authorization forms are more often used for larger purchases (think cars, computers, etc.) than they are for smaller, everyday items.

How do you write an authorization for a credit card?

Typically it contains: The cardholder's credit card information: Card type, Name on card, Card number, Expiration date. The merchant's business information. Cardholder's billing address. Language authorizing the merchant to charge the customer's card on file. Name and signature of the cardholder. Date.

What is credit authorisation?

Credit card authorisation is the process of verifying that a cardholder has enough funds or credit to cover the cost of a card transaction. Card authorisation is required for both in-person and online card transactions.

How long does credit authorization last?

A preauthorization charge on a credit or debit card typically lasts for about five to seven days, but this duration can vary depending on the card issuer's policies and the type of transaction. Some banks may keep the hold for up to 14 days.

What is a credit authorization?

**Definition:**Credit card authorization is an approval from a card issuer, usually through a credit card processor, that the customer has sufficient funds to cover the cost of the transaction.

What is a credit authorization agreement?

What is a credit card authorization form? A credit card authorization form is a document, signed by a cardholder, that grants a merchant permission to charge their credit card for recurring payments during a period of time as written in that document.

Is authorization English or American?

The distinction extends to all derivative words. North Americans use authorized, authorizing, authorizes, and authorization, while English speakers from outside the U.S. and Canada use authorised, authorising, authorises, and authorisation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Credit Authorization?

Credit Authorization is a process used by lenders to verify a borrower's creditworthiness before approving a loan or credit application.

Who is required to file Credit Authorization?

Typically, individuals or businesses applying for credit, loans, or other financial products are required to file Credit Authorization.

How to fill out Credit Authorization?

To fill out a Credit Authorization, provide personal information such as name, address, Social Security number, employment details, and any necessary financial information required by the lender.

What is the purpose of Credit Authorization?

The purpose of Credit Authorization is to allow lenders to assess the credit risk associated with a borrower, ensuring they have the ability to repay the loan or credit extended.

What information must be reported on Credit Authorization?

Information that must be reported on Credit Authorization includes identifying personal details, credit history, payment history, outstanding debts, and any bankruptcies or delinquencies.

Fill out your credit authorization online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Authorization is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.