Get the free Impound Account Statement

Show details

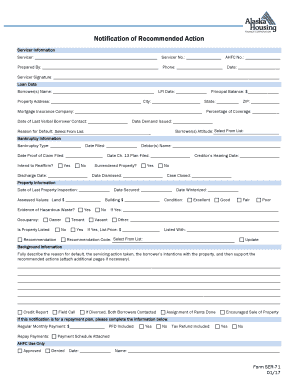

This document serves as a statement regarding the establishment of an impound account for taxes, insurance, or both, particularly in relation to loans with certain Loan-to-Value ratios. It includes

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign impound account statement

Edit your impound account statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your impound account statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit impound account statement online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit impound account statement. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out impound account statement

How to fill out Impound Account Statement

01

Start by gathering all relevant documents related to the impound account.

02

Log into the financial institution's online portal or obtain a physical statement form.

03

Enter your account number and personal identification details as required.

04

Review the sections that require information on deposits and withdrawals.

05

Provide accurate figures for each deposit made into the impound account.

06

Record any withdrawals, including the date and purpose of each transaction.

07

Ensure all information matches your records for accuracy.

08

If there are any discrepancies, make a note to address them.

09

Submit the completed statement as per your institution’s instructions, either online or via mail.

Who needs Impound Account Statement?

01

Homeowners who have an escrow account for property taxes or insurance.

02

Mortgage lenders requiring documentation of impound accounts.

03

Account holders wanting to review their financial allocations for better budgeting.

04

Real estate professionals involved in transactions that include impound accounts.

Fill

form

: Try Risk Free

People Also Ask about

What is the meaning of impound account?

An escrow account, sometimes called an impound account depending on where you live, is set up by your mortgage lender to pay certain property-related expenses. The money that goes into the account comes from a portion of your monthly mortgage payment.

What is the purpose of an escrow account?

The goal of the escrow account is to have enough money to pay taxes and insurance when they become due. To achieve this, the lender adds one-twelfth of the tax and insurance amount to your mortgage payment each month.

What does impound mean in finance?

An escrow account, sometimes called an impound account depending on where you live, is set up by your mortgage lender to pay certain property-related expenses. The money that goes into the account comes from a portion of your monthly mortgage payment.

What is the meaning of impound cash?

Introduction. Impound refers to an escrow account which a mortgage company maintains to collect certain amounts, such as insurance and taxes on a property. These are not part of the agreement, but the collections are for the safekeeping of the home.

What is the initial escrow statement?

The Initial Escrow Disclosure Statement details the specific charges that you will pay into escrow each month as part of a mortgage agreement. PLEASE KEEP THIS STATEMENT TO COMPARE WITH THE ACTUAL ACTIVITY THAT WILL OCCUR IN YOUR ESCROW ACCOUNT DURING THE UPCOMING YEAR.

How do I remove escrow from Mr Cooper?

Requesting Escrow Removal If eligible, you can submit an escrow removal request from your online account. You'll be able to select which eligible escrow items — like home insurance or property taxes — you want reviewed for removal. If you change your mind, you can cancel the request within 7 business days.

What does it mean to impound money?

Impoundment is an act by a president of the United States of not spending money that has been appropriated by the U.S. Congress. Thomas Jefferson was the first president to exercise the power of impoundment in 1801 with Congressional approval.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Impound Account Statement?

An Impound Account Statement is a financial document that provides a detailed report of funds held in an impound account, typically used in real estate transactions for the collection of property taxes and insurance premiums.

Who is required to file Impound Account Statement?

Lenders and financial institutions that manage impound accounts for borrowers are required to file Impound Account Statements, particularly when there are transactions involving escrow accounts.

How to fill out Impound Account Statement?

To fill out an Impound Account Statement, one should gather relevant information such as account balances, transactions, and disbursement details, and then carefully follow the prescribed format, ensuring that all required fields are accurately completed.

What is the purpose of Impound Account Statement?

The purpose of the Impound Account Statement is to provide transparency and accountability regarding the funds collected for property taxes and insurance, ensuring that borrowers are well-informed about their escrow balances and any required payments.

What information must be reported on Impound Account Statement?

An Impound Account Statement must report information such as the total amount collected, balances at the beginning and end of the statement period, itemized disbursements, and any discrepancies or adjustments made during that period.

Fill out your impound account statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Impound Account Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.