Fidelity Investments Instructions for Completing IRS Section 83(b) Form 2010 free printable template

Show details

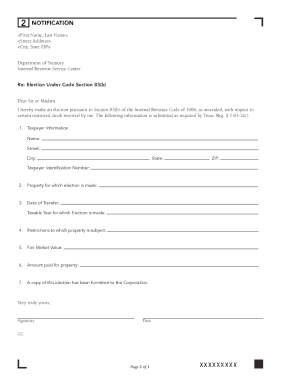

Instructions for Completing IRS Section 83(b) Form 1 INSTRUCTIONS To make an 83(b) election you must complete the following steps within 30 days of your Award Date: Complete the IRS 83(b) form that

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Fidelity Investments Instructions for Completing IRS Section

Edit your Fidelity Investments Instructions for Completing IRS Section form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Fidelity Investments Instructions for Completing IRS Section form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Fidelity Investments Instructions for Completing IRS Section online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Fidelity Investments Instructions for Completing IRS Section. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fidelity Investments Instructions for Completing IRS Section 83(b) Form Form Versions

Version

Form Popularity

Fillable & printabley

4.5 Satisfied (37 Votes)

4.8 Satisfied (185 Votes)

4.7 Satisfied (55 Votes)

How to fill out Fidelity Investments Instructions for Completing IRS Section

How to fill out Fidelity Investments Instructions for Completing IRS Section 83(b)

01

Start by downloading the Fidelity Investments Instructions for Completing IRS Section 83(b) from the Fidelity website.

02

Carefully read the instructions to understand what Section 83(b) is and when it should be filed.

03

Gather necessary information including your name, address, and the date of the granting of the stock or property.

04

Determine the fair market value (FMV) of the property at the time it was granted.

05

Fill out the form with your personal details, the details of the property received, and the FMV.

06

Make sure to sign and date the form at the bottom, confirming the accuracy of the information provided.

07

Submit the completed form to the IRS within 30 days of receiving the stock or property.

08

Keep a copy of the form for your records.

Who needs Fidelity Investments Instructions for Completing IRS Section 83(b)?

01

Individuals who have received stock or property as part of their compensation package and are considering electing to include the value as income under Section 83(b).

02

Employees and contractors who want to avoid paying taxes on the stock appreciation until they sell the shares.

03

Taxpayers who want to ensure compliance with IRS regulations regarding the tax treatment of restricted stock.

Fill

form

: Try Risk Free

People Also Ask about

Does 83b need to be attached to tax return?

Your 83(b) election form no longer needs to be attached to your form 1040.

How do I confirm my 83b filing?

Call the IRS at 800-829-1040.

How do I confirm the IRS received the 83b?

The certified mail with the return receipt will help you confirm that the IRS received the 83(b) form. Keep a copy of the completed form, the return receipt, and the mailing envelope with the 83(b) filing address for your records.

What is the 83b response from the IRS?

The 83(b) election is a provision under the Internal Revenue Code (IRC) that gives an employee, or startup founder, the option to pay taxes on the total fair market value of restricted stock at the time of granting. The 83(b) election applies to equity that is subject to vesting.

What is an example of an 83b election?

Example of an 83(b) Election If, in year 2, the stock value increases further to $500,000, then the co-founder's taxes will be ($500,000 - $10,000) x 10% x 20% = $9,800. By year 3, the value goes up to $1 million and the tax liability will be assessed from ($1 million - $10,000) x 10% x 20% = $19,800.

How to complete 83 b election with the IRS?

What are the steps to filing an 83(b) election? Complete a Section 83(b) election letter. Mail the completed letter to the IRS within 30 days of your grant date: Mail a copy of the completed letter to your employer. Retain one copy of the completed and filed letter for your records and retain proof of mailing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit Fidelity Investments Instructions for Completing IRS Section online?

The editing procedure is simple with pdfFiller. Open your Fidelity Investments Instructions for Completing IRS Section in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I make edits in Fidelity Investments Instructions for Completing IRS Section without leaving Chrome?

Fidelity Investments Instructions for Completing IRS Section can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an eSignature for the Fidelity Investments Instructions for Completing IRS Section in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your Fidelity Investments Instructions for Completing IRS Section and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is Fidelity Investments Instructions for Completing IRS Section 83(b)?

Fidelity Investments Instructions for Completing IRS Section 83(b) provides guidelines for individuals who receive property in connection with the performance of services, allowing them to elect to include the value of the property in their income for the year it is granted rather than when it vests.

Who is required to file Fidelity Investments Instructions for Completing IRS Section 83(b)?

Individuals who receive restricted stock or stock options as part of their compensation may choose to file the Section 83(b) election. It is particularly useful for employees and non-employees receiving equity in a company.

How to fill out Fidelity Investments Instructions for Completing IRS Section 83(b)?

To fill out the form, individuals must provide information such as their name, address, the date of property transfer, the description of the property, the fair market value at the time of transfer, the amount paid for the property, and a statement that they are making the Section 83(b) election.

What is the purpose of Fidelity Investments Instructions for Completing IRS Section 83(b)?

The purpose is to allow taxpayers to recognize income earlier, potentially at a lower tax rate if the value of the property appreciates significantly by the time it vests.

What information must be reported on Fidelity Investments Instructions for Completing IRS Section 83(b)?

The report must include the taxpayer's name, address, date of property transfer, description of the property, fair market value of the property at the date of transfer, the amount paid for the property, and an election statement to invoke Section 83(b).

Fill out your Fidelity Investments Instructions for Completing IRS Section online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fidelity Investments Instructions For Completing IRS Section is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.