Fidelity Investments Instructions for Completing IRS Section 83(b) Form 2021 free printable template

Show details

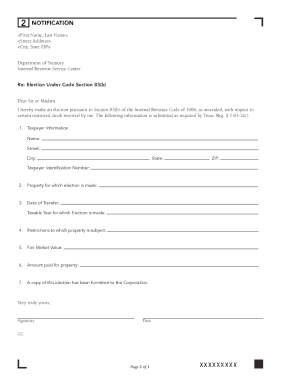

Instructions for Completing IRS Section 83(b) Form1INSTRUCTIONSTo make an 83(b) election, you must complete the following steps within 30 days of your Award Date:

Complete the IRS 83(b) form that

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Fidelity Investments Instructions for Completing IRS Section

Edit your Fidelity Investments Instructions for Completing IRS Section form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Fidelity Investments Instructions for Completing IRS Section form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Fidelity Investments Instructions for Completing IRS Section online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit Fidelity Investments Instructions for Completing IRS Section. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fidelity Investments Instructions for Completing IRS Section 83(b) Form Form Versions

Version

Form Popularity

Fillable & printabley

4.5 Satisfied (37 Votes)

4.8 Satisfied (185 Votes)

4.7 Satisfied (55 Votes)

How to fill out Fidelity Investments Instructions for Completing IRS Section

How to fill out Fidelity Investments Instructions for Completing IRS Section 83(b)

01

Obtain the IRS Section 83(b) election form.

02

Fill in your name, address, and Social Security number in the designated fields.

03

Indicate the property you are receiving (typically stock options or shares).

04

Specify the date you received the property.

05

State the fair market value of the property at the time of transfer.

06

Include the amount you paid for the property, if any.

07

Sign and date the form.

08

Make copies of the completed form for your records.

09

File the form with the IRS within 30 days of receiving the property.

Who needs Fidelity Investments Instructions for Completing IRS Section 83(b)?

01

Anyone who receives restricted stock or stock options as part of their compensation package should fill out the Fidelity Investments Instructions for Completing IRS Section 83(b).

02

Individuals who want to elect immediate taxation on the value of their equity compensation instead of waiting until the restriction lapses.

03

Taxpayers seeking to maximize the potential tax benefits associated with early tax election on equity compensation.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to file 83b?

To qualify for preferential tax treatment, your 83(b) election form must be postmarked and mailed to the appropriate IRS office within 30 days of purchasing your stock grant or the date of your early exercise.

How does 83b affect tax?

An 83(b) election allows the employee to pay income taxes earlier, often before the company shares have climbed in value. Thus, when you sell shares for a gain later on (at least a year), you will pay capital gains tax instead of ordinary income tax, which is taxed at a higher rate.

How do I know if IRS received my 83b?

The certified mail with the return receipt will help you confirm that the IRS received the 83(b) form. Keep a copy of the completed form, the return receipt, and the mailing envelope with the 83(b) filing address for your records.

How do I know if the IRS got my 83b?

The certified mail with the return receipt will help you confirm that the IRS received the 83(b) form. Keep a copy of the completed form, the return receipt, and the mailing envelope with the 83(b) filing address for your records.

How to file 83b election electronically?

Sign your 83(b) election form electronically Choose shares that are eligible for early exercise in Carta. Access the digital 83(b) election form. Fill out the form and provide a digital signature. Submit your form for Carta to mail on your behalf. Track the form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute Fidelity Investments Instructions for Completing IRS Section online?

pdfFiller has made filling out and eSigning Fidelity Investments Instructions for Completing IRS Section easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How can I edit Fidelity Investments Instructions for Completing IRS Section on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing Fidelity Investments Instructions for Completing IRS Section, you need to install and log in to the app.

How do I fill out the Fidelity Investments Instructions for Completing IRS Section form on my smartphone?

Use the pdfFiller mobile app to fill out and sign Fidelity Investments Instructions for Completing IRS Section. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is Fidelity Investments Instructions for Completing IRS Section 83(b)?

Fidelity Investments Instructions for Completing IRS Section 83(b) provide guidance on how to report income from property transferred in connection with the performance of services, specifically for stock options or restricted stock grants that vest over time.

Who is required to file Fidelity Investments Instructions for Completing IRS Section 83(b)?

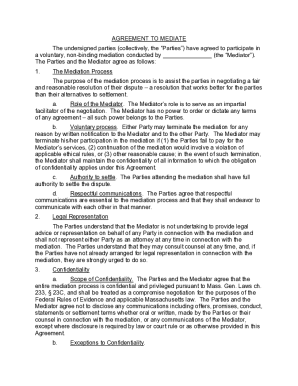

Employees or service providers who receive property (like stock) as compensation that is subject to vesting requirements are required to file IRS Section 83(b) elections.

How to fill out Fidelity Investments Instructions for Completing IRS Section 83(b)?

To fill out the instructions, individuals must complete a Section 83(b) election form, including their name, address, social security number, the description of property, date of transfer, and the fair market value of the property at the time of transfer.

What is the purpose of Fidelity Investments Instructions for Completing IRS Section 83(b)?

The purpose is to allow taxpayers to elect to include the fair market value of property received as income at the time of transfer, rather than when the property vests, potentially minimizing future tax liabilities.

What information must be reported on Fidelity Investments Instructions for Completing IRS Section 83(b)?

The information that must be reported includes the taxpayer's details, a description of the property received, the date of transfer, the market value at the time of transfer, and the amount paid for the property, if any.

Fill out your Fidelity Investments Instructions for Completing IRS Section online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fidelity Investments Instructions For Completing IRS Section is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.