Get the free sample application for family pension after death of pensioner pdf

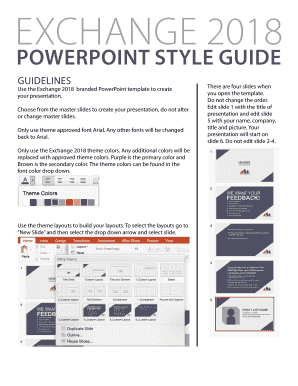

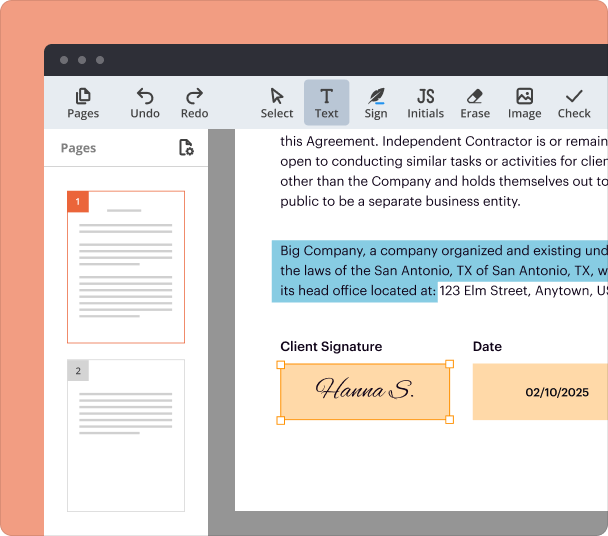

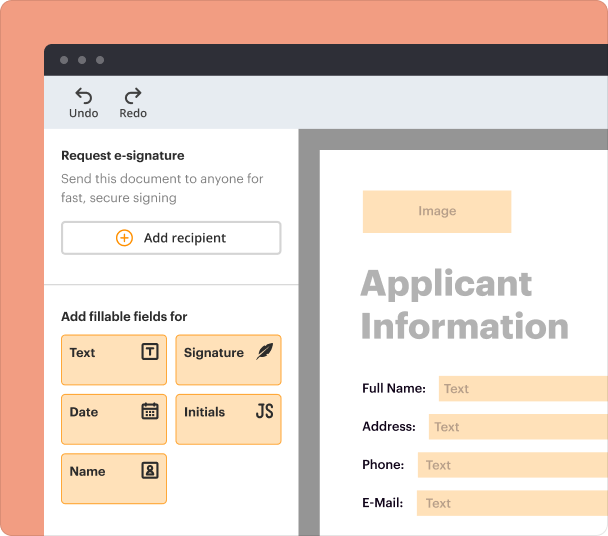

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

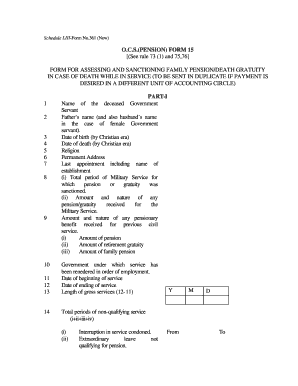

Understanding the Sample Application for Family Pension

What is the sample application for family pension?

The sample application for family pension is a formal request submitted by the eligible family members of a deceased government servant or pensioner. This application is crucial for claiming family pension benefits that are provided under government policies. It typically includes essential personal and financial information to assess eligibility for the pension benefits.

Who needs to complete this application?

This application is primarily intended for the widow, widower, or guardian of the deceased pensioner. If the deceased is survived by children, their guardian may also be responsible for submitting the application to ensure that the family receives the entitled benefits.

Eligibility criteria for the family pension application

To qualify for family pension benefits, applicants must meet specific criteria. Generally, eligibility is confirmed if the applicant is the spouse or a dependent child of the deceased pensioner. Documentation to prove the relationship and the death of the pensioner is a vital component of the application.

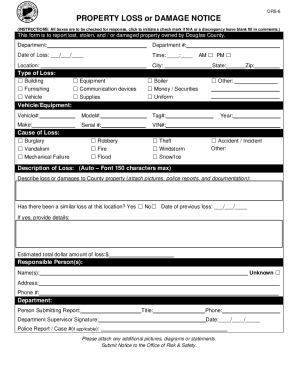

Required documents and information

Completing the sample application for family pension requires several documents. Applicants need to provide: proof of identity, a death certificate of the pensioner, bank details for pension disbursement, and any other supporting documents that establish the relationship with the deceased. Each document plays a critical role in verifying eligibility and processing the application.

How to fill out the family pension application

Filling out the application requires careful attention to detail. Begin by providing personal information, including names, addresses, and specific relationships to the deceased. Ensure that all fields are completed accurately and that supporting documents are attached as required. Any discrepancies can lead to delays or rejection of the application.

Submission methods for the application

The sample application for family pension can typically be submitted in different ways. Applicants may deliver the application in person to the relevant government office, submit it via mail, or, in some cases, use an online platform dedicated to this purpose. Understanding the submission method can help avoid processing delays.

Common errors to avoid while completing the application

Common mistakes include providing incomplete information, failing to include required documents, and errors in personal details. To enhance the likelihood of approval, double-check all entries for accuracy and ensure that all necessary documents are attached before submission.

Frequently Asked Questions about pension to wife after death of husband form

What should I do if my application for family pension is rejected?

If your application is rejected, review the feedback provided by the authority. Common reasons for rejection include incomplete forms or missing documents. Correct any issues and resubmit the application or appeal against the decision if applicable.

How long does it take to process a family pension application?

Processing times can vary based on the specific government office and the completeness of your application. Generally, it may take several weeks to a few months. It is advisable to stay in touch with the office to check the status of your application.

pdfFiller scores top ratings on review platforms