Canada Pacific Customs Brokers Canada Customs Invoice 2009-2025 free printable template

Show details

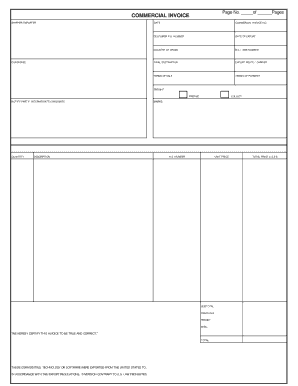

This document is used for customs clearance for goods being exported to Canada, providing details such as vendor and consignee information, shipment details, and terms of sale.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada Pacific Customs Brokers Canada Customs

Edit your Canada Pacific Customs Brokers Canada Customs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada Pacific Customs Brokers Canada Customs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada Pacific Customs Brokers Canada Customs online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Canada Pacific Customs Brokers Canada Customs. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Canada Pacific Customs Brokers Canada Customs

How to fill out Canada Pacific Customs Brokers Canada Customs Invoice

01

Obtain the Canada Customs Invoice (CCI) form from the Canada Border Services Agency (CBSA) website or your customs broker.

02

Fill in your name and address in the 'Exporter's Information' section.

03

Provide the recipient's name and address in the 'Consignee's Information' section.

04

Enter the detailed description of the goods in the 'Description of Goods' section, including quantity, value, and unit of measure.

05

Indicate the country of origin for each item listed.

06

Complete the 'Value for Duty' section by stating the price paid or payable for the goods.

07

Fill out the 'Terms of Sale' information, specifying the terms under which the goods are sold.

08

Sign and date the invoice at the bottom to certify that the information provided is accurate.

Who needs Canada Pacific Customs Brokers Canada Customs Invoice?

01

Businesses or individuals importing goods into Canada are required to fill out the Canada Customs Invoice.

02

Customs brokers assist their clients in completing the CCI to ensure compliance with Canadian customs regulations.

03

Importers need the CCI for customs clearance and assessment of import duties and taxes.

Fill

form

: Try Risk Free

People Also Ask about

What is a customs invoice form?

Customs forms and commercial invoices are crucial international documents that provide details about international transactions and help your packages get through customs. Properly completed forms for export helps customs authorities quickly decide which taxes and import duties apply to your package.

How do I fill out a Canadian customs invoice?

Indicate the name and address of: (a) the person selling the goods to the purchaser; or (b) the person consigning the goods to Canada. Indicate the date the goods began their continuous journey to Canada. Use to record other useful information (e.g., the commercial invoice number, the purchaser's order number).

How do I fill out a customs invoice?

1:06 2:21 How to fill in a commercial invoice - YouTube YouTube Start of suggested clip End of suggested clip Model number as well as the description. And don't just rely on the company's. Product code toMoreModel number as well as the description. And don't just rely on the company's. Product code to describe the goods. Remember to state the quantity.

Who fills out Canada customs invoice?

The CCI can be filled out by the exporter, importer or their agents (so long as the exporter provides all of the information required). Make sure you're using the right export documents.

Who provides the customs invoice?

The commercial invoice is one of the most important documents in international trade and ocean freight shipping. It is a legal document issued by the seller (exporter) to the buyer (importer) in an international transaction and serves as a contract and a proof of sale between the buyer and seller.

Do you need a customs invoice for documents?

The Commercial Invoice is required for all international commodity shipments and serves as the foundation for all other international shipping documents. It's the primary document used by most foreign customs agencies for import control, valuation and duty determination.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find Canada Pacific Customs Brokers Canada Customs?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the Canada Pacific Customs Brokers Canada Customs. Open it immediately and start altering it with sophisticated capabilities.

How do I edit Canada Pacific Customs Brokers Canada Customs online?

With pdfFiller, the editing process is straightforward. Open your Canada Pacific Customs Brokers Canada Customs in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I complete Canada Pacific Customs Brokers Canada Customs on an Android device?

On an Android device, use the pdfFiller mobile app to finish your Canada Pacific Customs Brokers Canada Customs. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is Canada Pacific Customs Brokers Canada Customs Invoice?

The Canada Customs Invoice (CCI) is a document used to provide detailed information about goods being imported into Canada, facilitating the assessment of duties and taxes.

Who is required to file Canada Pacific Customs Brokers Canada Customs Invoice?

Any individual or business that is importing goods into Canada must file the Canada Customs Invoice to properly declare the value and nature of the goods.

How to fill out Canada Pacific Customs Brokers Canada Customs Invoice?

To fill out the CCI, importers must provide details such as the seller and purchaser's information, description of goods, value, origin, and applicable duties. Accurate and complete information is necessary to avoid delays.

What is the purpose of Canada Pacific Customs Brokers Canada Customs Invoice?

The purpose of the CCI is to ensure accurate declaration of goods being imported for customs clearance, enabling the assessment of applicable customs duties and taxes.

What information must be reported on Canada Pacific Customs Brokers Canada Customs Invoice?

The CCI must include information such as the seller's name and address, purchaser's details, a detailed description of the goods, value for duty, currency, and details of any applicable freight or insurance costs.

Fill out your Canada Pacific Customs Brokers Canada Customs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada Pacific Customs Brokers Canada Customs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.