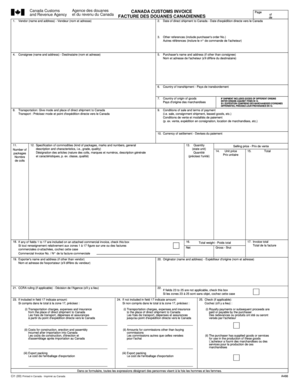

Canada Customs Invoice

What is Canada Customs Invoice?

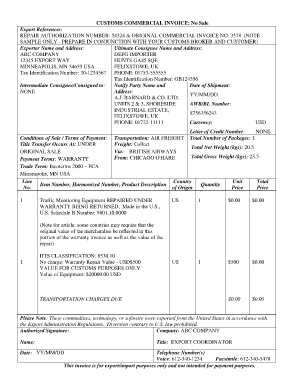

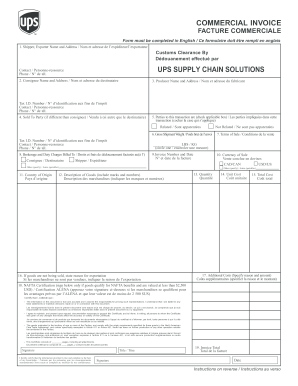

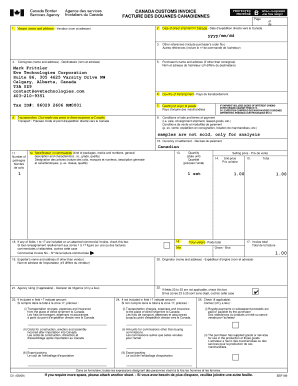

A Canada Customs Invoice is an official document that must be completed when importing goods into Canada. It is used to provide detailed information about the goods being imported, including their value, origin, and other important details.

What are the types of Canada Customs Invoice?

There are two types of Canada Customs Invoice: 1. Commercial Invoice: This type of invoice is used when the imported goods are intended for commercial purposes. 2. Pro Forma Invoice: This type of invoice is used when the imported goods are intended for personal use or are being sent as samples.

How to complete Canada Customs Invoice

To complete a Canada Customs Invoice, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.