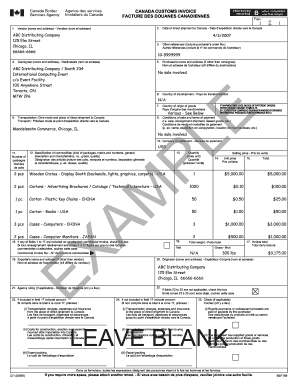

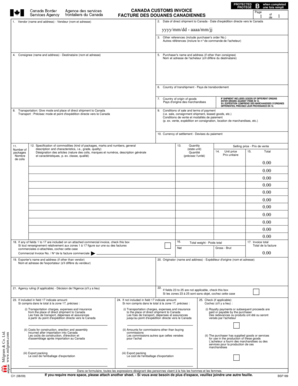

Canada Customs Invoice 2016

What is canada customs invoice 2016?

Canada Customs Invoice 2016 is a document used in international trade to provide official information about the imported goods. It includes details such as the description of the goods, their value, origin, and other relevant information. This invoice is required by the Canada Border Services Agency (CBSA) for customs clearance purposes.

What are the types of canada customs invoice 2016?

There are two main types of Canada Customs Invoice 2016:

Commercial Invoice: This type of invoice is used for regular commercial transactions and includes information about the buyer, seller, and goods being imported. It serves as proof of the transaction and provides the necessary details for customs clearance.

Pro Forma Invoice: This type of invoice is used for pre-shipment planning and includes a description and estimated value of the goods as well as the terms of the sale. It is often used for customs purposes when the final commercial invoice is not yet available.

How to complete canada customs invoice 2016

Completing Canada Customs Invoice 2016 requires attention to detail and accurate information. Here are the steps to fill out the invoice:

01

Start by entering the name and contact information of the exporter and importer.

02

Provide a detailed description of the goods being imported, including their quantity, unit price, and total value.

03

Indicate the terms of sale, such as the payment method, currency, and any additional charges or discounts.

04

Specify the country of origin for the goods.

05

Include any applicable Harmonized System (HS) codes for the goods.

06

Sign and date the invoice to certify its accuracy and completeness.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out canada customs invoice 2016

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What are 5 things that should be included in an invoice?

What should be included in an invoice? 1. ' Invoice' A unique invoice number. Your company name and address. The company name and address of the customer. A description of the goods/services. The date of supply. The date of the invoice. The amount of the individual goods or services to be paid.

What is a US customs invoice?

A commercial invoice is a crucial document that details all the relevant information about the shipment's price, value, and quantity of goods. This will in turn determine the taxes and duties that you'll need to pay for your shipment to clear customs.

What is required on a customs invoice?

The customs invoice must have the purchase price or value of all goods in the currency of the sale. The invoice must include and itemize additional charges such as insurance, freight, packing costs and commissions as well as any discounts from rebates, drawbacks and production assists.

How do you write an invoice for customs?

A customs invoice should include all the information necessary for the shipment to clear customs, including: The type of imported goods. Shipping weight. The value of goods. Import duty and taxes.

Do I need a commercial invoice for Canada?

Any commercial import into Canada requires a commercial invoice, as per the Canada Border Services Agency (CBSA). Your CCI can be in English or French, and it can be handwritten or typed (make sure it's legible either way). As an alternative to preparing your own, you can fill out Form CI1.

Do I need an invoice at customs?

Customs authorities will look at a commercial invoice to determine if a shipment can be allowed in the country and if you have to pay any duties on it. Courier services such as UPS or DHL also require a commercial invoice for international shipping, as it helps them transport the goods to the end customer.

Related templates