Canada Customs Invoice Fedex

What is Canada Customs Invoice FedEx?

A Canada Customs Invoice (CCI) is a document required by FedEx when shipping commercial goods into Canada. It helps Canadian Customs officers assess duties and taxes on imported items.

What are the types of Canada Customs Invoice FedEx?

There are two main types of Canada Customs Invoice FedEx:

Regular CCI - Used for non-duty-free commercial goods

NAFTA CCI - Used for North American Free Trade Agreement eligible goods

How to complete Canada Customs Invoice FedEx

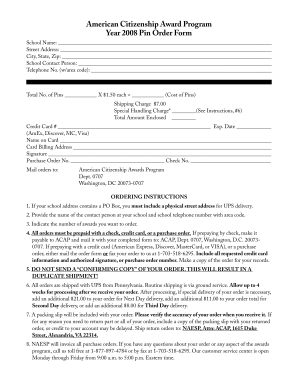

Completing a Canada Customs Invoice FedEx is a straightforward process. Here are the steps:

01

Fill out the shipper's and recipient's information

02

Provide a detailed description of the goods being shipped

03

Indicate the value of the items

04

Include the country of origin for each item

05

Sign and date the document

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you write an invoice for customs?

A customs invoice should include all the information necessary for the shipment to clear customs, including: The type of imported goods. Shipping weight. The value of goods. Import duty and taxes.

Do I need a Commercial Invoice to ship to Canada FedEx?

FedEx International Ground® shipments to Canada require the following: Commercial Invoice. The Commercial Invoice is the official transaction record between an exporter and an importer. In most cases, it's the form that customs officials use to clear your shipment and accurately assess duties and taxes.

What is a US customs invoice?

A commercial invoice is a crucial document that details all the relevant information about the shipment's price, value, and quantity of goods. This will in turn determine the taxes and duties that you'll need to pay for your shipment to clear customs.

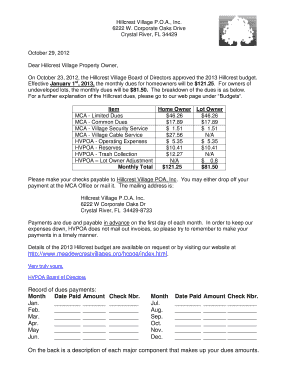

How much does FedEx charge for customs?

UPS / FedEx shipments Customs Clearance Shipment Value$Our Flat Clearance Fee$Courier's average brokerage fee + extra added fees500-750$35.00$73.50750-1000$35.00$80.501000-1250$40.00$91.501250-1600$40.00$96.505 more rows

Does FedEx International charge customs?

Duties and taxes are imposed to generate revenue and protect local industry. almost all shipments crossing international borders are subject to duty and tax assessment by the importing country's government.

Does FedEx charge customs in Canada?

FedEx Express pays the duties and taxes owed to the Canada Border Services Agency on your behalf and charges the Disbursement Fee for this service. The fee is based on the total amount of the duties and taxes advanced, and will be billed to the party designated to pay the duties and taxes.

Related templates