Get the free CREDIT APPLICATION FOR COMMERCIAL ACCOUNT ...

Show details

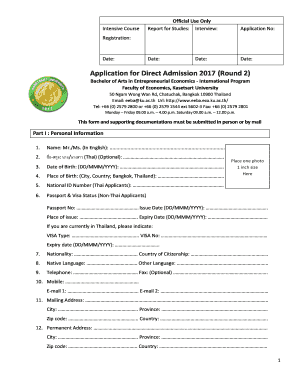

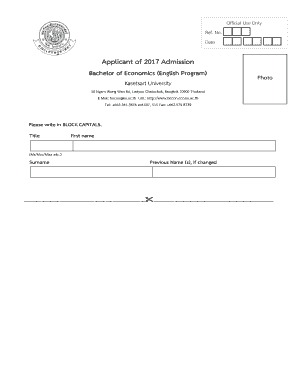

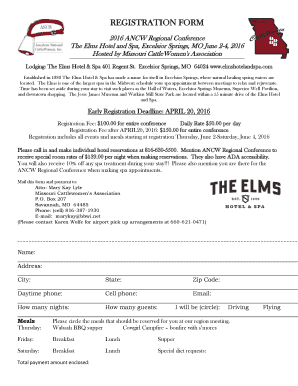

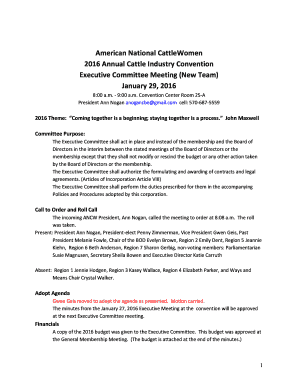

P.O. Box 361189 Strongsville, OH 44136 Office: (800) 7757299 Fax: (440) 2383639 CREDIT APPLICATION FOR COMMERCIAL ACCOUNT Name of Business: Date: Address: Phone: City: State: Zip Code: Please check

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit application for commercial

Edit your credit application for commercial form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit application for commercial form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit application for commercial online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit credit application for commercial. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit application for commercial

How to fill out a credit application for commercial:

01

Begin by gathering all necessary information and documentation. This typically includes your company's legal name, address, contact information, tax identification number, and any financial statements or reports required.

02

Provide detailed information about your company's history, including the date of establishment, any previous legal issues or bankruptcies, and a brief overview of your business operations.

03

Specify the purpose of the credit application, whether it's for purchasing inventory, funding expansion, or leasing equipment.

04

Fill out the financial section, providing accurate information about the company's revenues, expenses, and profitability. Include details about existing loans or credit lines, as well as any collateral or assets that can support the credit application.

05

Provide references from suppliers, customers, or business partners who can vouch for your company's reliability and creditworthiness.

06

Attach any required supporting documents, such as financial statements, bank statements, or tax returns.

07

Review the completed application thoroughly, ensuring all information is accurate and no fields are left blank.

08

Sign and date the application, confirming your understanding of the terms and conditions associated with the credit application.

09

Submit the completed application to the appropriate party, whether it's a bank, financial institution, or specific creditor.

Who needs a credit application for commercial?

01

Any business or organization that requires additional funding, credit lines, or financing options may need a credit application for commercial purposes.

02

Startups or newly established companies seeking financial support to initiate their operations or expand their business may need to fill out a credit application.

03

Established businesses that aim to optimize their cash flow or invest in new assets, such as equipment or inventory, may benefit from completing a credit application for commercial purposes.

04

Companies looking to lease or finance large purchases, including real estate properties or expensive machinery, often need to submit a credit application to demonstrate their creditworthiness.

05

Suppliers or vendors who offer credit terms or trade credit may require potential buyers to complete a credit application before extending credit.

Remember, it is crucial to consult with a financial advisor or credit specialist to ensure the accuracy and completeness of your credit application for commercial purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is credit application for commercial?

Credit application for commercial is a formal request made by a business to a financial institution seeking credit or a loan for commercial purposes.

Who is required to file credit application for commercial?

Any business or commercial entity that requires credit or a loan for their operations is required to file a credit application for commercial.

How to fill out credit application for commercial?

To fill out a credit application for commercial, you need to provide detailed information about your business, financial history, credit needs, and any other relevant details requested by the financial institution.

What is the purpose of credit application for commercial?

The purpose of a credit application for commercial is to assess the creditworthiness and financial stability of a business seeking credit or a loan, and to determine the terms and conditions under which the credit will be extended.

What information must be reported on credit application for commercial?

The information that must be reported on a credit application for commercial typically includes details about the business, its ownership and management, financial statements, credit history, collateral, and any other relevant information requested by the financial institution.

How can I edit credit application for commercial from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including credit application for commercial. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit credit application for commercial online?

The editing procedure is simple with pdfFiller. Open your credit application for commercial in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I fill out credit application for commercial on an Android device?

Complete your credit application for commercial and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your credit application for commercial online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Application For Commercial is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.