IRS SS-4 2000 free printable template

Show details

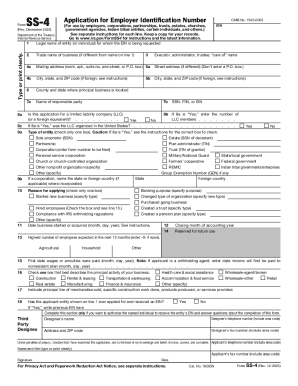

For Privacy Act and Paperwork Reduction Act Notice see page 4. Class Size Cat. No. 16055N Rev. 4-2000 Form SS-4 Rev. 4-2000 General Instructions Section references are to the Internal Revenue Code unless otherwise noted. Purpose of Form Use Form SS-4 to apply for an employer identification number EIN. The correct Tele-TIN number for the Holtsville IRS Service Center is 631-447-4955. Also the Tele-TIN number for the Kansas City Service Center has changed to 816-823-7777 Form SS-4 Rev. April 2000...Application for Employer Identification Number For use by employers corporations partnerships trusts estates churches government agencies certain individuals and others. Attention Caution On page 2 of Form SS-4 the area code for the Tele-TIN number at the IRS Service Center in Holtsville NY is incorrect. See instructions. Please type or print clearly. Department of the Treasury Internal Revenue Service 8a EIN OMB No* 1545-0003 Keep a copy for your records. Name of applicant legal name see...instructions Trade name of business if different from name on line 1 Executor trustee care of name 4a Mailing address street address room apt. or suite no. 5a Business address if different from address on lines 4a and 4b 4b City state and ZIP code County and state where principal business is located Name of principal officer general partner grantor owner or trustor SSN or ITIN may be required see instructions Type of entity Check only one box. see instructions Caution If applicant is a limited...liability company see the instructions for line 8a* Sole proprietor SSN Estate SSN of decedent Partnership 8b Personal service corp* Plan administrator SSN REMIC National Guard Farmers cooperative State/local government Church or church-controlled organization Other nonprofit organization specify Other specify If a corporation name the state or foreign country State if applicable where incorporated Other corporation specify Trust Reason for applying Check only one box. see instructions Banking...purpose specify purpose Started new business specify type Federal government/military enter GEN if applicable Foreign country Changed type of organization specify new type Purchased going business Hired employees Check the box and see line 12. Created a trust specify type Created a pension plan specify type Date business started or acquired month day year see instructions 11 Closing month of accounting year see instructions First date wages or annuities were paid or will be paid month day year....Note If applicant is a withholding agent enter date income will first be paid to nonresident alien* month day year Highest number of employees expected in the next 12 months. Note If the applicant does not expect to have any employees during the period enter -0-. see instructions Principal activity see instructions Is the principal business activity manufacturing If Yes principal product and raw material used Nonagricultural Household Yes No To whom are most of the products or services sold...Please check one box.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS SS-4

How to edit IRS SS-4

How to fill out IRS SS-4

Instructions and Help about IRS SS-4

How to edit IRS SS-4

To edit an IRS SS-4 form, leverage editing tools that allow you to fill in, modify, and amend any incorrect information. Using services like pdfFiller can facilitate direct changes online, ensuring that the most recent information is accurately presented. After editing, ensure to double-check the information before finalizing the form, as errors can lead to processing delays.

How to fill out IRS SS-4

Filling out the IRS SS-4 requires careful attention to detail. Follow these steps:

01

Gather necessary data, including the entity's legal name, trade name, and address.

02

Provide the name and Social Security Number (SSN) of the responsible party.

03

Indicate the type of entity applying for an Employer Identification Number (EIN).

Accuracy is paramount. Verify that all names and numbers are correct to avoid delays in processing your application.

About IRS SS-4 2000 previous version

What is IRS SS-4?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS SS-4 2000 previous version

What is IRS SS-4?

The IRS SS-4 form is the "Application for Employer Identification Number" used to apply for an EIN. This number is essential for various business operations, including tax reporting and compliance with federal regulations. The SS-4 form can be completed by individuals, partnerships, corporations, and various other entities.

What is the purpose of this form?

The primary purpose of the IRS SS-4 form is to obtain an Employer Identification Number, which is a unique identifier used by the IRS to track tax obligations associated with an entity. Businesses and organizations require an EIN for various tax applications, including employee wage reports and banking purposes.

Who needs the form?

Filing the IRS SS-4 is necessary for all businesses that pay employees or operate as a corporation or partnership. Non-profit organizations, estates, trusts, and certain government entities also need to complete this form to receive an EIN. If unsure about eligibility, consulting a tax professional can provide clarity.

When am I exempt from filling out this form?

Individuals operating sole proprietorships without employees typically do not need to file the IRS SS-4 for an EIN, as they may use their SSN for tax reporting purposes. However, once a business hires employees or operates as a partnership or corporation, obtaining an EIN via SS-4 becomes mandatory.

Components of the form

The IRS SS-4 includes fields for the following components:

01

Legal name of the entity.

02

Trade name, if applicable.

03

The responsible party's information including SSN.

04

Entity type and reason for applying.

05

Business address and the date the entity was established.

Providing complete and accurate details in every section is crucial for the timely processing of the application.

Due date

The IRS SS-4 form does not have a strict due date as it is an application for obtaining an EIN. However, it is important to file it promptly when forming a new business or hiring employees to avoid complications with tax reporting and compliance.

What are the penalties for not issuing the form?

Failing to obtain an EIN when required can result in penalties, including the inability to report and pay taxes correctly. Additionally, businesses may face difficulties in opening bank accounts or hiring employees, impacting operational capacity. It is advisable to file the IRS SS-4 as soon as applicable to avoid these issues.

What information do you need when you file the form?

When filing the IRS SS-4, you will need specific information, including:

01

Legal name and address of the entity applying.

02

Responsible party’s SSN and contact details.

03

Type of business entity and its purpose.

Having this information ready will streamline the process and ensure that all necessary fields are filled accurately.

Is the form accompanied by other forms?

The IRS SS-4 does not typically require accompanying forms at the time of filing. However, businesses may need to complete additional forms related to their specific tax obligations after obtaining the EIN based on their operational needs.

Where do I send the form?

The completed IRS SS-4 form can be submitted electronically, via fax, or by mail. If filing by mail, send it to the appropriate address based on your business location, as indicated in the instructions provided with the form. Ensure to check the latest guidelines from the IRS to confirm the correct submission method.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.