Get the free Payroll Set Up Training

Show details

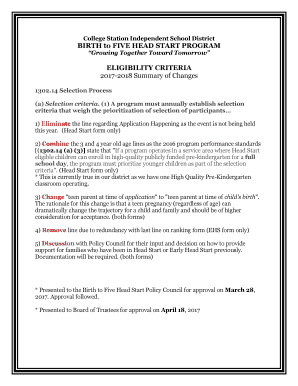

This Learning Guide provides instructions on how to set up payroll directories, the Employee Master, and standard payroll reports for the Central Susquehanna Intermediate Unit.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payroll set up training

Edit your payroll set up training form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payroll set up training form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit payroll set up training online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit payroll set up training. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payroll set up training

How to fill out Payroll Set Up Training

01

Gather all necessary employee information, including names, social security numbers, and tax withholding details.

02

Choose the frequency of payroll (weekly, bi-weekly, monthly).

03

Determine the pay rates for each employee.

04

Set up deductions for taxes, benefits, and other withholdings as applicable.

05

Select a payroll software or system for processing payroll.

06

Input all employee data and settings into the payroll system.

07

Verify the accuracy of data entries by cross-referencing with HR records.

08

Conduct a test run of the payroll system to ensure it functions correctly.

09

Implement a process for ongoing payroll updates (e.g., new hires, terminations, pay raises).

10

Train team members on how to use the payroll system effectively.

Who needs Payroll Set Up Training?

01

HR personnel responsible for employee management.

02

Payroll administrators managing payroll processes.

03

Finance team members involved in budgeting and financial reporting.

04

Business owners overseeing operational functions.

05

Any staff involved in the hiring process or employee onboarding.

Fill

form

: Try Risk Free

People Also Ask about

Can you teach yourself how to do payroll?

Honestly it's something easy that you can do yourself. I used to work at an accounting firm doing payroll. If you don't want to waste the time doing it, since most of it is administrative and data entry, you could have someone close to you do it inside your company.

How to train someone in payroll?

Make sure this includes information like local minimum wages, time off, and benefits. Construct lessons that will walk your employees through completing payroll in compliance with all these local regulations. Give employees the chance to practice their new skills by providing hands-on learning opportunities.

What are the 5 basic steps of using the payroll system?

5 Simple Steps for the Payroll Process in a Small Business Step 1: Collect Employee Information. Step 2: Calculate Gross Pay. Step 3: Deduct Taxes and Other Withholdings. Step 4: Process Payments. Step 5: Maintain Accurate Records. The Importance of Efficient Payroll Processing in Small Businesses.

What is the best way to learn payroll?

Attending a class is an excellent way to learn about payroll, but the course providers usually charge fees. Employers on a tight budget may resort to online articles and videos published by independent authors.

How to get trained in payroll?

Entry-level career training can be obtained through the ADP Learning Academy. More advanced courses and payroll certification programs are offered by PayrollOrg (PAYO), the National Payroll Institute and other organizations.

How to train someone at work effectively?

Payroll for beginners: a step-by-step process Step 1: Register with authorities. Step 2: Collect necessary information. Step 3: Determine employee pay. Step 4: Calculate deductions. Step 5: Pay employees. Step 6: Pay and report taxes. Step 7: Maintain accurate records.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Payroll Set Up Training?

Payroll Set Up Training is a program designed to educate individuals on how to properly establish and manage payroll systems within an organization. It typically includes instruction on compliance, software usage, and best practices for payroll management.

Who is required to file Payroll Set Up Training?

Typically, HR personnel, payroll administrators, and finance teams within an organization are required to complete Payroll Set Up Training to ensure accurate payroll processing and compliance with regulations.

How to fill out Payroll Set Up Training?

To fill out Payroll Set Up Training, participants should follow specific guidelines provided in the training materials, which usually include entering employee information, compensation details, tax withholding preferences, and any other necessary payroll-related data.

What is the purpose of Payroll Set Up Training?

The purpose of Payroll Set Up Training is to equip employees responsible for payroll with the knowledge and skills needed to effectively manage payroll processes, ensuring compliance with labor laws and regulations while also maintaining accurate and timely payroll for employees.

What information must be reported on Payroll Set Up Training?

Information that must be reported on Payroll Set Up Training typically includes employee identification details, salary or hourly rates, tax withholding information, benefits selections, and any deductions applicable to payroll.

Fill out your payroll set up training online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payroll Set Up Training is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.