Get the free Workers39 Compensation Payroll Audit bFormb - Diocese of Owensboro - owensborodiocese

Show details

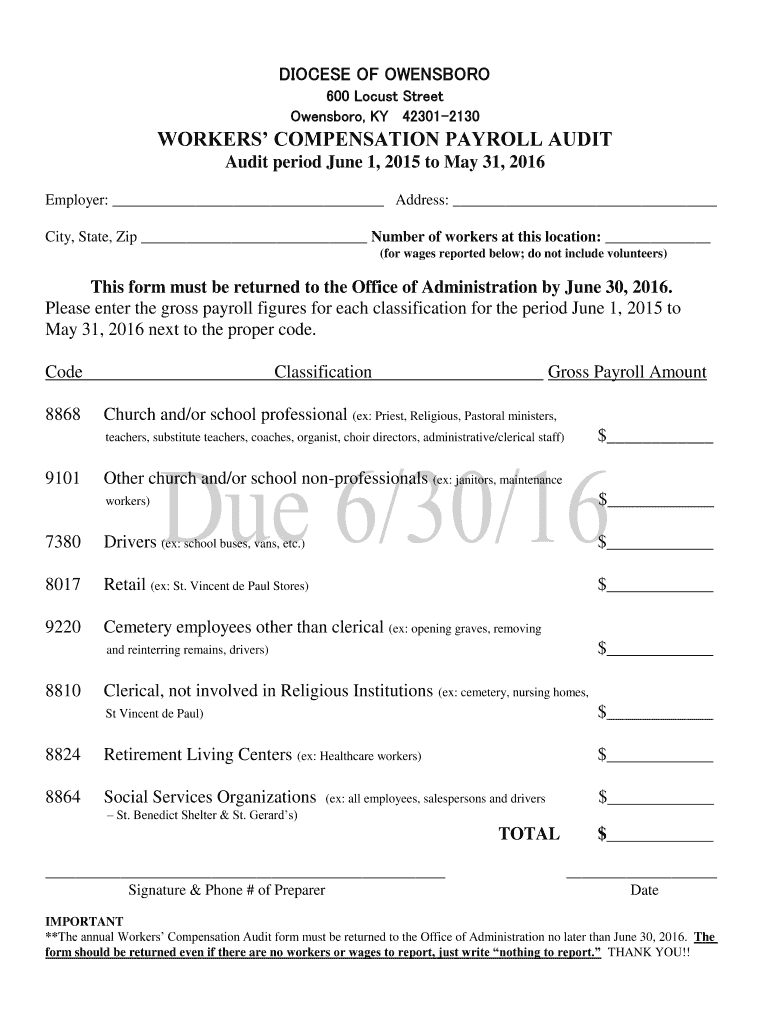

DIOCESE OF OWENSBORO 600 Locust Street Owensboro, KY 423012130 WORKERS COMPENSATION PAYROLL AUDIT period June 1, 2015, to May 31, 2016, Employer: Address: City, State, Zip Number of workers at this

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign workers39 compensation payroll audit

Edit your workers39 compensation payroll audit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your workers39 compensation payroll audit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing workers39 compensation payroll audit online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit workers39 compensation payroll audit. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out workers39 compensation payroll audit

How to fill out a workers' compensation payroll audit:

01

Collect all required documentation: Gather all necessary payroll information such as employee records, payroll records, and any other relevant financial documents.

02

Review the audit form: Familiarize yourself with the specific form provided by your workers' compensation insurance carrier. Read through the instructions carefully to understand what information needs to be provided.

03

Enter employer details: Fill in the necessary information about your business, including the name, address, and contact information.

04

Provide employee details: Enter the names, job titles, and employment dates of all your employees. Include both full-time and part-time workers.

05

Calculate payroll figures: Calculate the total amount paid to each employee during the audit period. This includes wages, salaries, bonuses, commissions, and any other compensation.

06

Classify employee types: Different jobs may have different workers' compensation rates. Classify your employees based on their job duties into appropriate categories specified by the carrier.

07

Indicate payroll categories: Break down the payroll figures into specific categories that are relevant to the audit. These categories may include regular wages, overtime wages, sick pay, holiday pay, and any other types of compensation.

08

Provide payroll records: Attach any supporting documentation requested by the carriers, such as payroll registers, payroll tax forms, W-2 forms, or 1099 forms.

09

Double-check accuracy: Review all the information you have provided for accuracy and ensure that all calculations are correct.

10

Submit the audit: Once you are confident that all the information is accurate, submit the completed audit form and any supporting documents to your workers' compensation insurance carrier.

Who needs workers' compensation payroll audit?

01

Employers with workers' compensation insurance: Any business that is required by law to carry workers' compensation insurance will likely need to undergo a workers' compensation payroll audit. This usually includes businesses with employees.

02

Organizations with fluctuating payrolls: Companies that experience significant changes in their workforce or payroll throughout the year are more likely to be subject to frequent audits to accurately reflect the fluctuations.

03

Businesses in high-risk industries: Certain industries, such as construction, manufacturing, and healthcare, are considered higher risk for workplace injuries. As a result, companies operating in these industries may be required to provide a workers' compensation payroll audit to ensure appropriate coverage and premiums are determined.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in workers39 compensation payroll audit?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your workers39 compensation payroll audit to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I fill out the workers39 compensation payroll audit form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign workers39 compensation payroll audit and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I complete workers39 compensation payroll audit on an Android device?

Complete workers39 compensation payroll audit and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is workers' compensation payroll audit?

Workers' compensation payroll audit is a review of an employer's payroll records to determine the accuracy of the premium paid for workers' compensation insurance.

Who is required to file workers' compensation payroll audit?

Employers who have workers' compensation insurance coverage are required to file workers' compensation payroll audit.

How to fill out workers' compensation payroll audit?

Employers can fill out workers' compensation payroll audit by providing detailed payroll records, employee information, and other requested data to the insurance carrier or auditor.

What is the purpose of workers' compensation payroll audit?

The purpose of workers' compensation payroll audit is to ensure that employers are paying the correct premium for workers' compensation insurance based on their actual payroll.

What information must be reported on workers' compensation payroll audit?

Information such as payroll records, employee classifications, hours worked, and wages paid must be reported on workers' compensation payroll audit.

Fill out your workers39 compensation payroll audit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

workers39 Compensation Payroll Audit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.