MN Application For Homestead Classification - Ramsey County 2012 free printable template

Show details

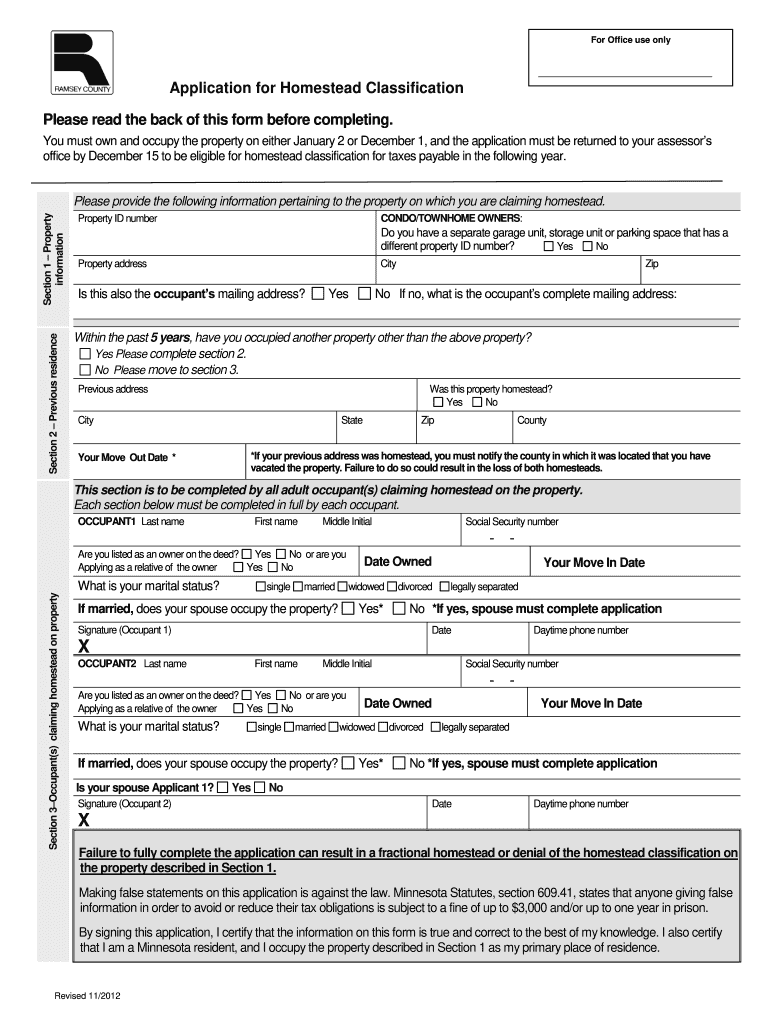

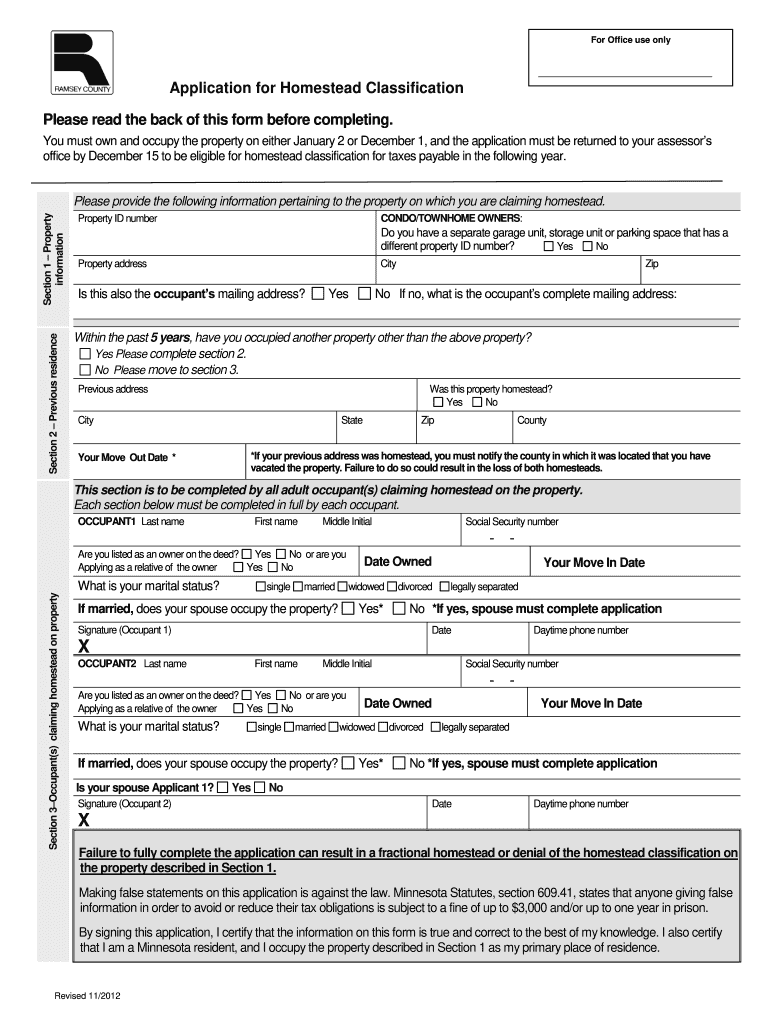

For Office use only Application for Homestead Classification Please read the back of this form before completing. You must own and occupy the property on either January 2 or December 1, and the application

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MN Application For Homestead Classification - Ramsey

Edit your MN Application For Homestead Classification - Ramsey form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MN Application For Homestead Classification - Ramsey form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MN Application For Homestead Classification - Ramsey online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MN Application For Homestead Classification - Ramsey. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MN Application For Homestead Classification - Ramsey County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MN Application For Homestead Classification - Ramsey

How to fill out MN Application For Homestead Classification - Ramsey County

01

Obtain the MN Application For Homestead Classification form from the Ramsey County website or local government office.

02

Fill out your personal information in the designated sections, including your name, address, and contact information.

03

Indicate the type of ownership (e.g., individual, married couple, etc.) in the appropriate section.

04

Provide information about the property for which you are applying, such as the property address and parcel number.

05

Describe the use of the property, confirming that it is your primary residence.

06

Attach supporting documentation if required, such as proof of residency or ownership.

07

Review the completed application for accuracy.

08

Submit the application, either electronically or by mail, to the Ramsey County Assessor's Office by the deadline.

Who needs MN Application For Homestead Classification - Ramsey County?

01

Homeowners who occupy their property as their primary residence in Ramsey County.

02

Individuals or couples looking to benefit from homestead property tax benefits.

03

Those who have recently moved into a property and wish to apply for homestead classification.

Fill

form

: Try Risk Free

People Also Ask about

Who qualifies for homestead exemption in Minnesota?

Who is eligible to homestead? If you own real estate property and you or a qualifying relative occupies the property by December 31, you may apply for homestead status by December 31. You can only homestead one residential parcel in the State of MN.

Who qualifies for homestead credit in MN?

The Minnesota Homestead Credit Refund can provide relief to homeowners paying property taxes.To qualify, you must: Have a valid Social Security Number. Own and occupy a home. Have your home classified as a homestead with your county. Pay or arrange to pay your property taxes.

How do I Homestead my house in Minnesota?

To qualify for homestead: You must own the property, or be a relative or in-law of the owner (son, daughter, parent, grandchild, grandparent, brother, sister, aunt, uncle, niece or nephew). You or your relative must occupy the property as the primary place of residence. You must be a Minnesota resident.

Who qualifies for a homestead exemption in MN?

Who is eligible to homestead? If you own real estate property and you or a qualifying relative occupies the property by December 31, you may apply for homestead status by December 31. You can only homestead one residential parcel in the State of MN.

Who qualifies for a homestead exemption in MN?

Having a homestead classification may qualify your property for a Homestead Market Value Exclusion or one of the following: Property Tax Refund.To qualify for a homestead, you must: Own a property. Occupy the property as your sole or primary residence. Be a Minnesota resident.

How much is the MN Homestead credit?

What are the maximums? For refund claims filed in 2022, based on property taxes payable in 2022 and 2021 household income, the maximum refund is $2,930. Homeowners whose income exceeds $119,790 are not eligible for a refund. How are claims filed?

What qualifies for homestead in MN?

To qualify for a homestead, you must: Own a property. Occupy the property as your sole or primary residence. Be a Minnesota resident.

Who qualifies for MN property tax refund?

You are a Minnesota resident or spent at least 183 days in the state. You lived in and paid rent on a Minnesota building where the owner was assessed property tax or made payments in lieu of property tax. Your household income for 2022 was less than $69,520.

Does Minnesota have homestead credit?

Do I qualify for the Homestead Credit Refund (for homeowners)? Only owner/occupants of homestead property are eligible for the State Property Tax Refund. Relative Homesteads are not eligible for the refund or the renter's rebate. See the Minnesota Department of Revenue website for eligibility requirements.

How much higher are non homestead taxes in Minnesota?

Non-homesteaded residential property has a rate of 1.25%. Commercial and industrial property has a rate of 1.50% for the first $150,000 in value, and 2% of the value above $150,000. There are other classifications, but this should cover the majority of properties.

How does homestead exemption work in Minnesota?

By decreasing the taxable market value, net property taxes are also decreased. For homesteads valued at $76,000 or less, the exclusion is 40% of the market value, creating a maximum exclusion of $30,400. The exclusion is reduced as property values increase, and phases out for homesteads valued at $413,800 or more.

What is the benefit of homestead exemption in Minnesota?

A homestead classification qualifies your property for a classification rate of 1.00% on up to $500,000 in taxable market value. Homesteads are also eligible for a market value exclusion, which may reduce the property's taxable market value.

What is the benefit of homestead exemption in Minnesota?

This program has two benefits for qualifying homeowners: It reduces the taxable market value of the property (for properties valued under $413,800 only), which in turn may lower taxes. It is one of the qualifying factors for homeowners to receive the State of Minnesota Property Tax Refund.

How much does homestead exemption save you in Minnesota?

By decreasing the taxable market value, net property taxes are also decreased. For homesteads valued at $76,000 or less, the exclusion is 40% of the market value, creating a maximum exclusion of $30,400. The exclusion is reduced as property values increase, and phases out for homesteads valued at $413,800 or more.

How much is the Homestead Credit in Minnesota?

What are the maximums? For refund claims filed in 2022, based on property taxes payable in 2022 and 2021 household income, the maximum refund is $2,930. Homeowners whose income exceeds $119,790 are not eligible for a refund.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send MN Application For Homestead Classification - Ramsey to be eSigned by others?

MN Application For Homestead Classification - Ramsey is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I complete MN Application For Homestead Classification - Ramsey online?

pdfFiller makes it easy to finish and sign MN Application For Homestead Classification - Ramsey online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I make edits in MN Application For Homestead Classification - Ramsey without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit MN Application For Homestead Classification - Ramsey and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

What is MN Application For Homestead Classification - Ramsey County?

The MN Application For Homestead Classification is a form used by property owners in Ramsey County, Minnesota, to apply for property tax benefits associated with homestead classification. Homestead classification generally offers tax reductions for properties used as the owner's primary residence.

Who is required to file MN Application For Homestead Classification - Ramsey County?

Property owners who occupy their property as their primary residence and wish to qualify for the homestead tax benefits are required to file the MN Application For Homestead Classification in Ramsey County.

How to fill out MN Application For Homestead Classification - Ramsey County?

To fill out the MN Application For Homestead Classification, property owners must provide personal information, property details, and confirmation of occupancy as the primary residence. It is advisable to follow instructions provided with the form and ensure all required documentation is attached.

What is the purpose of MN Application For Homestead Classification - Ramsey County?

The purpose of the MN Application For Homestead Classification is to formally declare a property as a homestead in order to qualify for reduced property taxes. This classification helps ensure that owners receive tax benefits that may not be available otherwise.

What information must be reported on MN Application For Homestead Classification - Ramsey County?

The information that must be reported includes the property owner’s name, property address, description of the property, evidence of occupancy as the primary residence, and any other relevant personal information as required by Ramsey County.

Fill out your MN Application For Homestead Classification - Ramsey online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MN Application For Homestead Classification - Ramsey is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.