MN Application For Homestead Classification - Ramsey County 2015-2026 free printable template

Show details

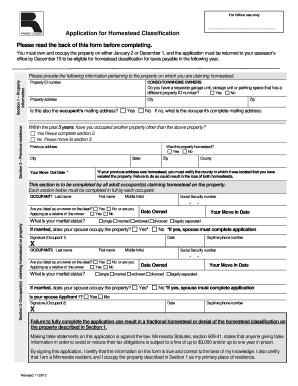

For Office use only Application for Homestead Classification Please read the back of this form before completing. You must own and occupy the property on either January 2 or December 1, and the application

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MN Application For Homestead Classification - Ramsey

Edit your MN Application For Homestead Classification - Ramsey form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MN Application For Homestead Classification - Ramsey form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MN Application For Homestead Classification - Ramsey online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit MN Application For Homestead Classification - Ramsey. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MN Application For Homestead Classification - Ramsey County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MN Application For Homestead Classification - Ramsey

How to fill out MN Application For Homestead Classification - Ramsey County

01

Obtain the MN Application For Homestead Classification form from the Ramsey County website or local government office.

02

Fill out your personal information, including your name, address, and contact information.

03

Provide details about the property for which you are applying, including the property address and parcel number.

04

Indicate your ownership of the property by providing information about your deed and any previous ownership history.

05

Confirm that you occupy the residence as your primary place of abode.

06

If applicable, provide information about any co-owners or spouses.

07

Sign and date the application to certify that the information provided is accurate.

08

Submit the completed application to the Ramsey County Assessor's Office by mail or in person.

Who needs MN Application For Homestead Classification - Ramsey County?

01

Homeowners in Ramsey County who occupy their property as their primary residence and wish to apply for property tax benefits.

02

Individuals who have recently purchased a home or changed their primary residence.

03

Co-owners or spouses living in the same household who wish to apply for homestead classification.

Fill

form

: Try Risk Free

People Also Ask about

Who qualifies for homestead exemption in Minnesota?

Who is eligible to homestead? If you own real estate property and you or a qualifying relative occupies the property by December 31, you may apply for homestead status by December 31. You can only homestead one residential parcel in the State of MN.

Who qualifies for homestead credit in MN?

The Minnesota Homestead Credit Refund can provide relief to homeowners paying property taxes.To qualify, you must: Have a valid Social Security Number. Own and occupy a home. Have your home classified as a homestead with your county. Pay or arrange to pay your property taxes.

How do I Homestead my house in Minnesota?

To qualify for homestead: You must own the property, or be a relative or in-law of the owner (son, daughter, parent, grandchild, grandparent, brother, sister, aunt, uncle, niece or nephew). You or your relative must occupy the property as the primary place of residence. You must be a Minnesota resident.

Who qualifies for a homestead exemption in MN?

Who is eligible to homestead? If you own real estate property and you or a qualifying relative occupies the property by December 31, you may apply for homestead status by December 31. You can only homestead one residential parcel in the State of MN.

Who qualifies for a homestead exemption in MN?

Having a homestead classification may qualify your property for a Homestead Market Value Exclusion or one of the following: Property Tax Refund.To qualify for a homestead, you must: Own a property. Occupy the property as your sole or primary residence. Be a Minnesota resident.

How much is the MN Homestead credit?

What are the maximums? For refund claims filed in 2022, based on property taxes payable in 2022 and 2021 household income, the maximum refund is $2,930. Homeowners whose income exceeds $119,790 are not eligible for a refund. How are claims filed?

What qualifies for homestead in MN?

To qualify for a homestead, you must: Own a property. Occupy the property as your sole or primary residence. Be a Minnesota resident.

Who qualifies for MN property tax refund?

You are a Minnesota resident or spent at least 183 days in the state. You lived in and paid rent on a Minnesota building where the owner was assessed property tax or made payments in lieu of property tax. Your household income for 2022 was less than $69,520.

Does Minnesota have homestead credit?

Do I qualify for the Homestead Credit Refund (for homeowners)? Only owner/occupants of homestead property are eligible for the State Property Tax Refund. Relative Homesteads are not eligible for the refund or the renter's rebate. See the Minnesota Department of Revenue website for eligibility requirements.

How much higher are non homestead taxes in Minnesota?

Non-homesteaded residential property has a rate of 1.25%. Commercial and industrial property has a rate of 1.50% for the first $150,000 in value, and 2% of the value above $150,000. There are other classifications, but this should cover the majority of properties.

How does homestead exemption work in Minnesota?

By decreasing the taxable market value, net property taxes are also decreased. For homesteads valued at $76,000 or less, the exclusion is 40% of the market value, creating a maximum exclusion of $30,400. The exclusion is reduced as property values increase, and phases out for homesteads valued at $413,800 or more.

What is the benefit of homestead exemption in Minnesota?

A homestead classification qualifies your property for a classification rate of 1.00% on up to $500,000 in taxable market value. Homesteads are also eligible for a market value exclusion, which may reduce the property's taxable market value.

What is the benefit of homestead exemption in Minnesota?

This program has two benefits for qualifying homeowners: It reduces the taxable market value of the property (for properties valued under $413,800 only), which in turn may lower taxes. It is one of the qualifying factors for homeowners to receive the State of Minnesota Property Tax Refund.

How much does homestead exemption save you in Minnesota?

By decreasing the taxable market value, net property taxes are also decreased. For homesteads valued at $76,000 or less, the exclusion is 40% of the market value, creating a maximum exclusion of $30,400. The exclusion is reduced as property values increase, and phases out for homesteads valued at $413,800 or more.

How much is the Homestead Credit in Minnesota?

What are the maximums? For refund claims filed in 2022, based on property taxes payable in 2022 and 2021 household income, the maximum refund is $2,930. Homeowners whose income exceeds $119,790 are not eligible for a refund.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit MN Application For Homestead Classification - Ramsey online?

With pdfFiller, it's easy to make changes. Open your MN Application For Homestead Classification - Ramsey in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I make edits in MN Application For Homestead Classification - Ramsey without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit MN Application For Homestead Classification - Ramsey and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I fill out MN Application For Homestead Classification - Ramsey using my mobile device?

Use the pdfFiller mobile app to fill out and sign MN Application For Homestead Classification - Ramsey on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is MN Application For Homestead Classification - Ramsey County?

The MN Application for Homestead Classification in Ramsey County is a form used by property owners to apply for homestead status, which allows them to receive property tax benefits and reductions.

Who is required to file MN Application For Homestead Classification - Ramsey County?

Property owners or eligible individuals who occupy their property as their primary residence are required to file the MN Application for Homestead Classification in Ramsey County.

How to fill out MN Application For Homestead Classification - Ramsey County?

To fill out the application, provide your personal information, property details, and confirm that the property is your primary residence. The form can typically be downloaded from the Ramsey County website or obtained from the local assessor's office.

What is the purpose of MN Application For Homestead Classification - Ramsey County?

The purpose of the MN Application for Homestead Classification is to determine eligibility for homestead tax benefits, which may include lower property tax rates and exemptions for qualifying homeowners.

What information must be reported on MN Application For Homestead Classification - Ramsey County?

The application requires information such as the property address, the owner's name, date of occupancy, and any additional qualifications that may support the claim for homestead status.

Fill out your MN Application For Homestead Classification - Ramsey online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MN Application For Homestead Classification - Ramsey is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.