Get the free Deferred Compensation Plan Participation Application

Show details

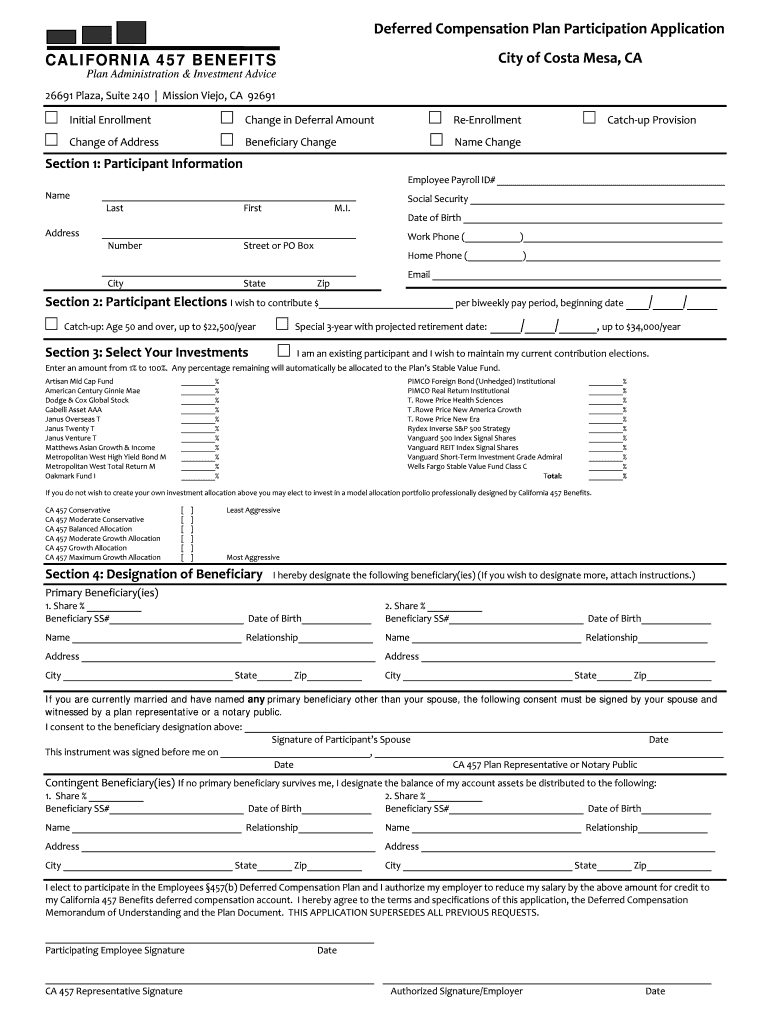

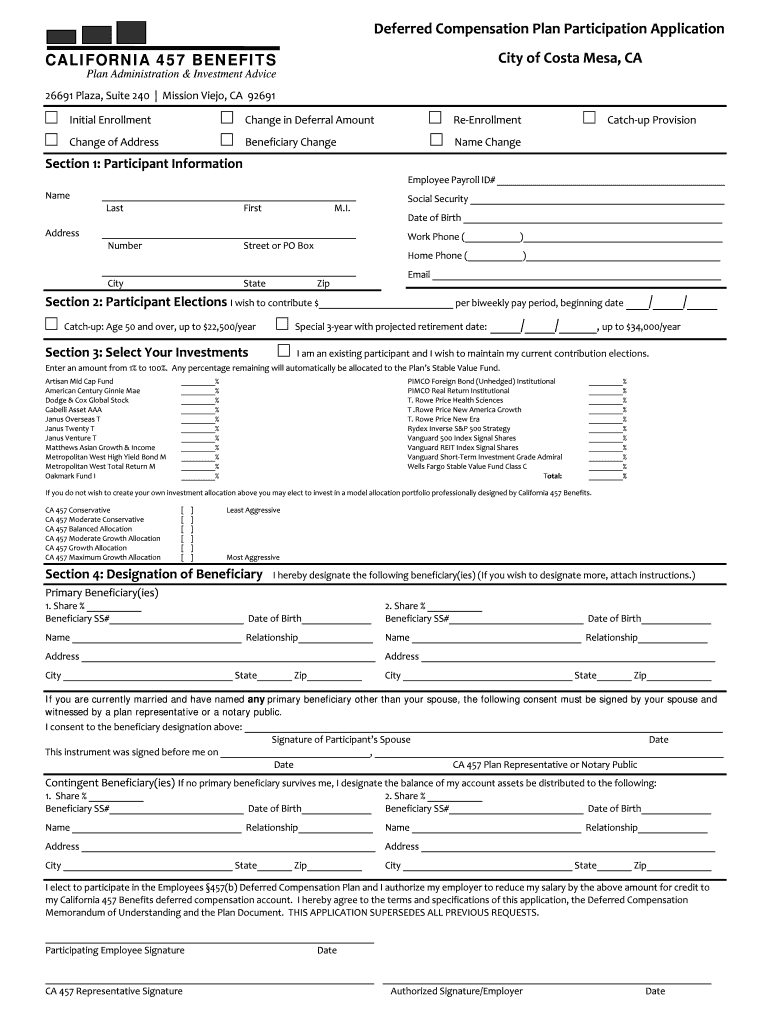

Deferred Compensation Plan Participation Application City of Costa Mesa, CA CALIFORNIA 457 BENEFITS Plan Administration & Investment Advice 26691 Plaza, Suite 240 Mission Viejo, CA 92691 Initial Enrollment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deferred compensation plan participation

Edit your deferred compensation plan participation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deferred compensation plan participation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing deferred compensation plan participation online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit deferred compensation plan participation. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deferred compensation plan participation

How to fill out deferred compensation plan participation:

01

Start by reviewing the information provided by your employer regarding the deferred compensation plan. This may include a summary plan description or an enrollment package that outlines the steps and options available.

02

Determine your eligibility to participate in the deferred compensation plan. Generally, these plans are offered to employees who meet certain criteria, such as length of service, compensation level, or job category. If you are unsure about your eligibility, consult with your employer's human resources department.

03

Understand the contribution options available to you. Deferred compensation plans typically allow participants to contribute a percentage of their salary or a fixed dollar amount. Determine how much you would like to contribute and consider any matching contributions offered by your employer.

04

Complete the necessary enrollment forms provided by your employer. These forms typically require personal information such as your name, address, Social Security number, and beneficiary designations. Also, indicate your contribution amount and any investment options you wish to select.

05

If you have questions or concerns about the investment options available within the deferred compensation plan, consider seeking professional financial advice. Some plans may offer a variety of investment choices, such as mutual funds or company stock, so it's important to understand the potential risks and returns associated with each option.

06

Submit your completed enrollment forms to the designated department or person within your employer's organization. Make sure to keep a copy of all the forms for your records.

Who needs deferred compensation plan participation:

01

Employees who are looking for a tax-deferred method to save for retirement may find deferred compensation plans beneficial. These plans allow employees to contribute a portion of their salary on a pre-tax basis, potentially lowering their current taxable income.

02

Executives and highly compensated individuals may have a particular interest in deferred compensation plans. These individuals often have higher income levels and may face restrictions on participating in traditional retirement plans like 401(k)s. Deferred compensation plans can provide a way for them to save additional funds for retirement.

03

Individuals who anticipate a windfall or large bonus may consider deferred compensation plans as a strategy to defer income into future years. This can help manage tax liability and provide financial flexibility.

In summary, filling out deferred compensation plan participation involves reviewing the provided information, determining eligibility, understanding contribution options, completing enrollment forms, considering investment choices, and submitting the forms. Individuals who could benefit from deferred compensation plans include those seeking tax advantages, executives, and individuals with anticipated significant income.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my deferred compensation plan participation in Gmail?

deferred compensation plan participation and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send deferred compensation plan participation for eSignature?

Once you are ready to share your deferred compensation plan participation, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I edit deferred compensation plan participation on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing deferred compensation plan participation.

What is deferred compensation plan participation?

Deferred compensation plan participation refers to an arrangement where an employee can elect to have a portion of their income set aside to be paid out at a later date, typically upon retirement.

Who is required to file deferred compensation plan participation?

Employees who are enrolled in a deferred compensation plan are required to file participation.

How to fill out deferred compensation plan participation?

Employees can fill out deferred compensation plan participation by completing the necessary forms provided by their employer and specifying the amount to be deferred.

What is the purpose of deferred compensation plan participation?

The purpose of deferred compensation plan participation is to allow employees to save for retirement or other future financial needs in a tax-efficient manner.

What information must be reported on deferred compensation plan participation?

The information that must be reported on deferred compensation plan participation includes the amount deferred, the timing of distributions, and any investment options chosen.

Fill out your deferred compensation plan participation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deferred Compensation Plan Participation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.