Get the free VATRules for Value Added Tax NUGENIA Contact and

Show details

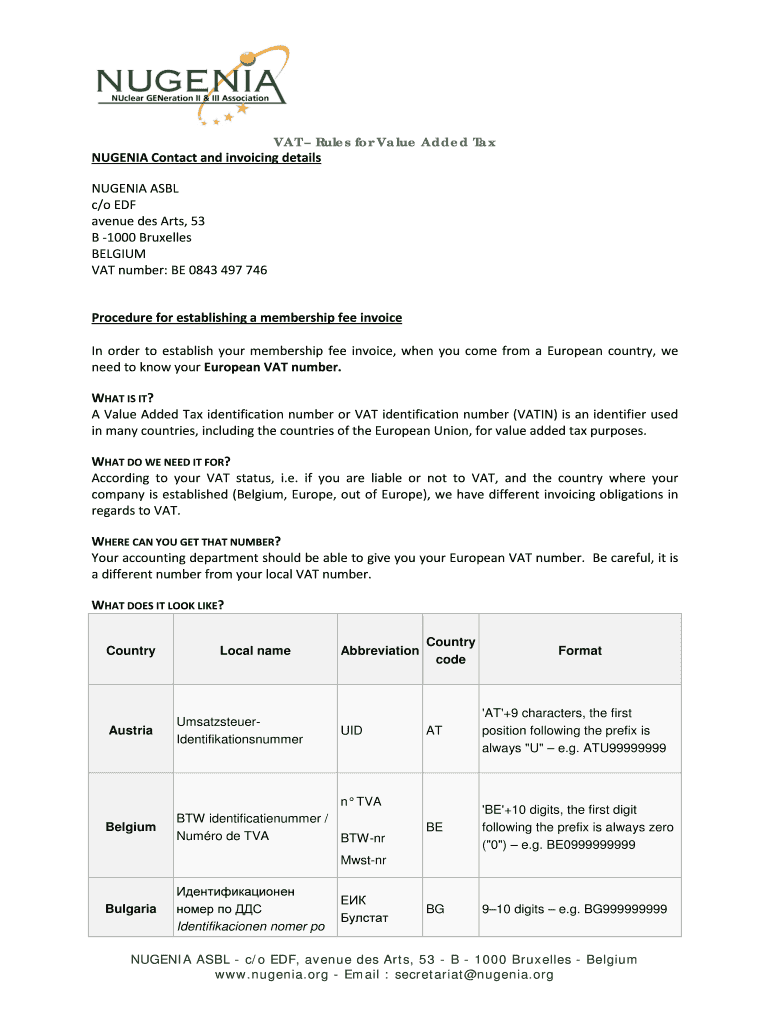

VAT Rules for Value Added Tax EUGENIA Contact and invoicing details EUGENIA ASBL c/o EDF avenue DES Arts, 53 B 1000 Belles BELGIUM VAT number: BE 0843 497 746 Procedure for establishing a membership

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign vatrules for value added

Edit your vatrules for value added form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vatrules for value added form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit vatrules for value added online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit vatrules for value added. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out vatrules for value added

How to fill out vatrules for value added?

01

Start by obtaining the necessary forms and documentation from your local tax authority or revenue agency.

02

Familiarize yourself with the specific regulations and guidelines related to value-added tax (VAT) in your country or jurisdiction.

03

Ensure that you have accurate records of all your business transactions, including invoices, receipts, and relevant financial documents.

04

Calculate the VAT amount applicable to each transaction by multiplying the taxable value by the appropriate VAT rate.

05

Include the VAT amount separately on your invoices or receipts, clearly indicating the VAT rate applied.

06

Keep track of any VAT exemptions or special rates that may apply to certain goods or services, and make sure to comply with any additional reporting requirements.

07

Regularly reconcile your VAT records with your financial statements to ensure accuracy and compliance.

08

File your VAT returns within the prescribed deadlines and make any necessary payments to the tax authority.

Who needs vatrules for value added?

01

Businesses involved in the production, distribution, or sale of goods and services often need to adhere to VAT rules for value added.

02

Individuals or self-employed professionals who surpass a certain income threshold may also be required to register for VAT and comply with the relevant rules.

03

Importers and exporters engaged in international trade are typically subject to VAT rules for value added.

04

Certain industries or sectors, such as hospitality, retail, and construction, may have specific VAT regulations that they need to follow.

05

Additionally, any business or individual that purchases goods or services subject to VAT may need to understand and apply VAT rules.

Note: The specific requirements for filling out VAT rules and the entities obliged to follow them may vary depending on the country or jurisdiction. It is advisable to consult with local tax experts or authorities for accurate and up-to-date information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get vatrules for value added?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific vatrules for value added and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an electronic signature for signing my vatrules for value added in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your vatrules for value added and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Can I edit vatrules for value added on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share vatrules for value added from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is vatrules for value added?

VAT rules for value added are regulations that govern the collection and reporting of taxes on the value added at each stage of production or distribution.

Who is required to file vatrules for value added?

Businesses or individuals engaged in the production or distribution of goods or services are required to file VAT rules for value added.

How to fill out vatrules for value added?

VAT rules for value added can be filled out by providing information on the value added at each stage of production or distribution, along with the corresponding tax amounts.

What is the purpose of vatrules for value added?

The purpose of VAT rules for value added is to ensure that taxes are collected at each stage of production or distribution based on the value added.

What information must be reported on vatrules for value added?

Information such as the value added at each stage, the corresponding tax amounts, and any deductions or exemptions must be reported on VAT rules for value added.

Fill out your vatrules for value added online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Vatrules For Value Added is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.