Get the free cir report format

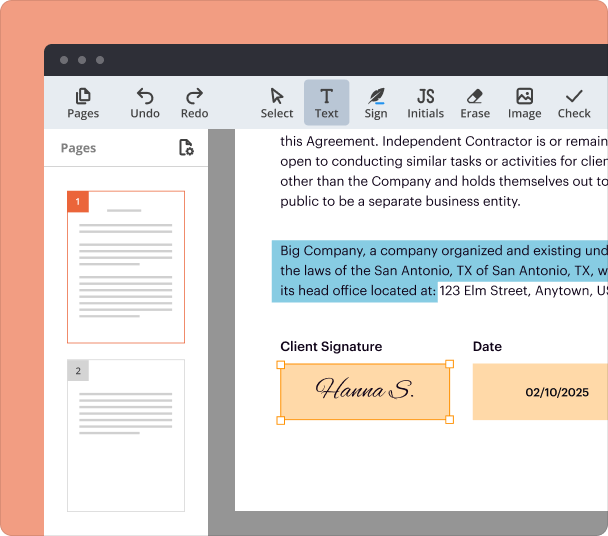

Fill out, sign, and share forms from a single PDF platform

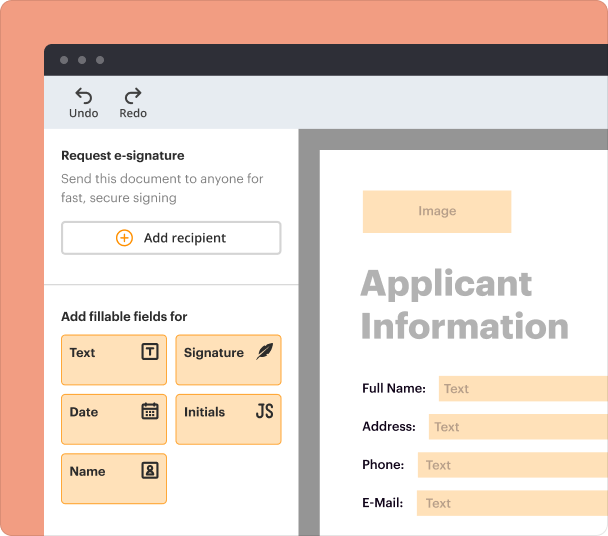

Edit and sign in one place

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Understanding the CIR Report Format Form

What is the CIR report format form?

The Credit Information Report (CIR) report format form is a structured document that provides detailed credit history and financial behavior of an individual or a business. It serves as a crucial tool for lenders, helping them assess creditworthiness before extending credit or loans. The CIR contains essential data, such as payment history, outstanding debts, and any defaults, which are valuable for financial decision-making.

Key Features of the CIR report format form

The CIR report format form includes several key features that enhance its utility and effectiveness for users. These features typically encompass detailed credit history, identification of any missed payments, current outstanding loans, and credit limits. Additionally, it provides an overview of the applicant's financial relationships and interactions with various lending institutions, which creates a comprehensive picture of their credit behavior.

When to Use the CIR report format form

The CIR report format form is essential during the loan application process or when assessing financial trustworthiness. Lenders often require this form to evaluate credit risks when considering personal or business loans. It is also utilized when reviewing existing credit relationships to ensure the accuracy of the data and to monitor ongoing financial health.

Required Documents and Information

Filling out the CIR report format form requires specific documents and information to ensure accuracy. Applicants typically need to provide personal identification, such as a driver's license or Social Security number, along with details of their financial history, including income sources, current debts, and previous loan accounts. This information is crucial for creating a precise and informative CIR.

Best Practices for Accurate Completion

To ensure accurate completion of the CIR report format form, it is advisable to thoroughly review personal financial records before filling out the form. Double-checking figures and ensuring all required documents are accessible will help in minimizing errors. Additionally, providing up-to-date and correct information fosters credibility and assists lenders in making informed decisions.

Common Errors and Troubleshooting

While completing the CIR report format form, applicants may encounter common errors that can delay processing. These include incorrect personal information, missing documentation, or inaccuracies in financial reporting. Identifying and addressing these issues promptly is vital. Keeping a checklist of required fields and verifying entries against official documents can be helpful in avoiding pitfalls.

Frequently Asked Questions about credit information report format in word

What is included in a CIR report?

A CIR report typically includes credit history, payment records, outstanding debts, credit limits, and financial relationships with lenders.

How do I obtain a CIR report?

You can obtain a CIR report by filling out the CIR report format form through your lender or credit reporting agency.

pdfFiller scores top ratings on review platforms