What is audit report format?

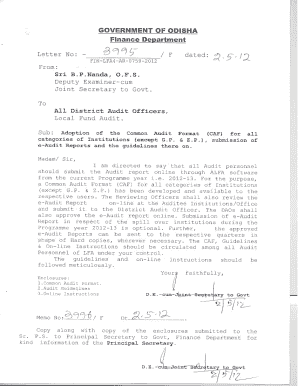

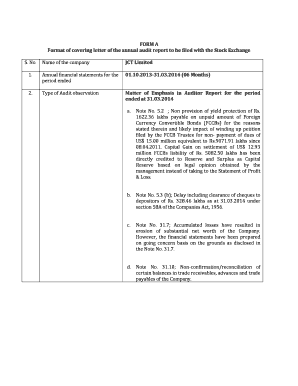

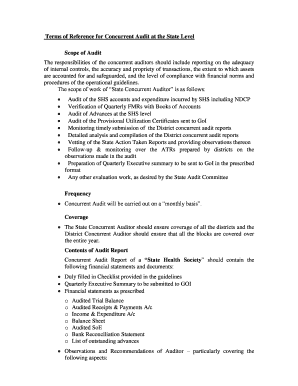

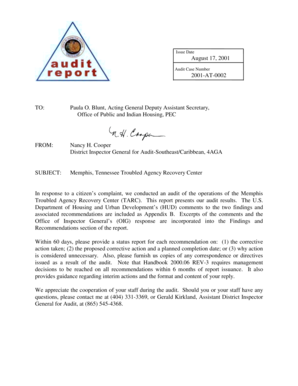

An audit report format refers to the structure and layout in which an audit report is presented. It includes the sections and subheadings that provide a clear and organized representation of the audit findings, conclusions, and recommendations. The format of an audit report ensures that vital information is communicated effectively and facilitates easy understanding and interpretation of the report's content.

What are the types of audit report format?

There are various types of audit report formats used depending on the nature and scope of the audit. Some common types include:

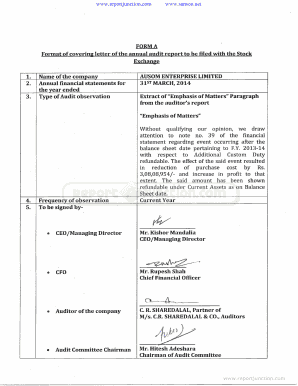

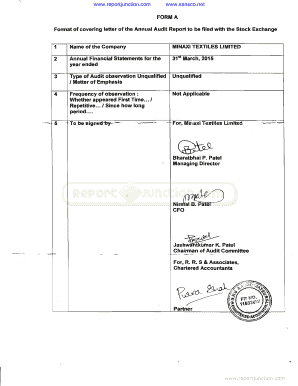

Unqualified opinion report: This type of report is issued when the auditor concludes that the financial statements are free from material misstatements and accurately represent the company's financial position.

Qualified opinion report: This report is issued when the auditor provides an opinion with some reservations, highlighting certain limitations or exceptions found in the financial statements that do not comply with generally accepted accounting principles (GAAP).

Adverse opinion report: An adverse opinion report is issued when the auditor determines that the financial statements are materially misstated and do not provide an accurate representation of the company's financial position.

Disclaimer of opinion report: This type of report is issued when the auditor is unable to express an opinion due to significant limitations or lack of sufficient evidence to support the findings.

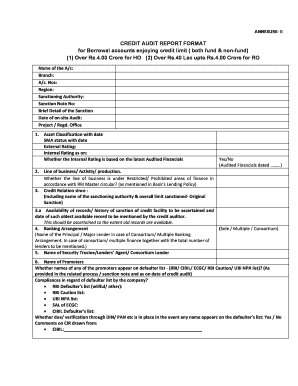

How to complete audit report format

Completing an audit report format requires careful consideration and attention to detail to ensure accurate and comprehensive reporting. Here are some steps to help you complete an audit report format:

01

Gather all relevant audit findings, including financial statements, internal controls, documentation, and supporting evidence.

02

Structure your report by including sections such as introduction, scope, methodology, findings, conclusions, and recommendations.

03

Provide a clear and concise summary of the audit objectives, procedures, and key findings.

04

Present your conclusions and recommendations based on the audit findings, making sure to explain any material misstatements or discrepancies discovered.

05

Include any necessary appendices, supporting documentation, or additional information to provide a comprehensive audit report.

06

Review and proofread your report for accuracy, clarity, and consistency before finalizing it.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.