What is a qualified audit report?

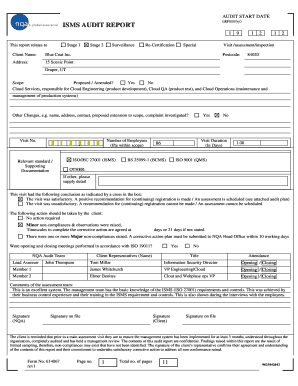

A qualified audit report is a type of report issued by auditors when they encounter certain issues or limitations during the audit process that prevent them from expressing an unqualified opinion on the financial statements of a company or organization. It indicates that the auditor has identified and disclosed specific concerns that need to be addressed and resolved.

What are the types of qualified audit reports?

There are several types of qualified audit reports that can be issued based on the nature and extent of the auditor's concerns. These include:

Qualified Opinion: It is issued when the auditor concludes that the financial statements are fairly presented except for a specific matter that is adequately disclosed in the report.

Adverse Opinion: It is issued when the auditor determines that the financial statements are materially misstated and do not accurately reflect the financial position or results of operations. This is a serious finding.

Disclaimer of Opinion: It is issued when the auditor is unable to form an opinion on the financial statements due to significant limitations or insufficient evidence to evaluate their accuracy and completeness.

How to complete a qualified audit report?

Completing a qualified audit report requires attention to detail and thorough analysis of the financial statements and supporting documents. Here are the steps involved:

01

Conduct a comprehensive audit of the company's financial records.

02

Identify any issues or limitations that may impact the auditor's ability to provide an unqualified opinion.

03

Clearly describe the specific concerns or findings in the audit report.

04

Include all necessary disclosures and explanations related to the qualified opinion being issued.

05

Provide recommendations or suggestions for resolving the identified issues.

06

Review and validate the overall accuracy and consistency of the report.

07

Ensure compliance with applicable auditing standards and regulations.

08

Obtain necessary approvals and signatures for the finalized report.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.