Canada RC96 E 2013 free printable template

Show details

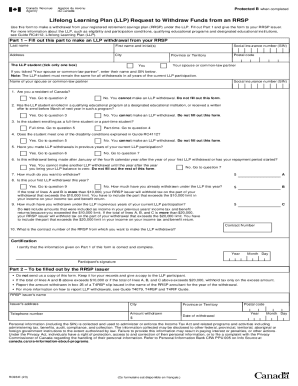

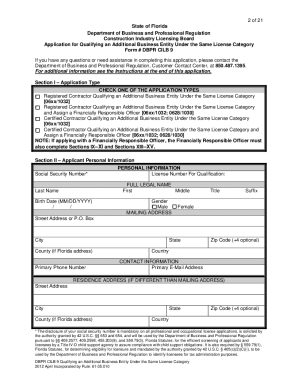

Protected B Lifelong Learning Plan (LLP) Request to withdraw funds from an RESP when completed ? Use this form to make a withdrawal from your registered retirement savings plan (RESP) under the LLP.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada RC96 E

Edit your Canada RC96 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada RC96 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada RC96 E online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Canada RC96 E. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada RC96 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada RC96 E

How to fill out Canada RC96 E

01

Start by obtaining the Canada RC96 E form from the official Canada Border Services Agency (CBSA) website.

02

Carefully read the instructions provided with the form to understand the requirements.

03

Fill in your personal information in the designated fields, including your name, address, and contact details.

04

Provide information about the goods you are importing, including descriptions, quantities, and values.

05

Indicate whether the goods are new or used, and if they are meant for personal use or for commercial purposes.

06

If applicable, include details about any exemptions or special conditions that apply to your goods.

07

Review the completed form for accuracy and completeness to ensure all required information is provided.

08

Sign and date the form at the bottom to verify the information is true and correct.

09

Submit the form either electronically or by mail, as instructed, to the appropriate CBSA office.

Who needs Canada RC96 E?

01

Individuals or businesses who are importing goods into Canada.

02

Canadian residents returning to Canada with personal belongings after traveling abroad.

03

People moving to Canada with household goods as part of their relocation.

04

Anyone requiring an exemption on certain goods being brought into the country.

Fill

form

: Try Risk Free

People Also Ask about

How do I cash out my RRSP?

To withdraw funds from your RRSPs under the HBP, fill out Form T1036, Home Buyers' Plan (HBP) Request to Withdraw Funds from an RRSP. You have to fill out this form for each withdrawal you make. After filling out Area 1 of Form T1036, give it to your RRSP issuer. The issuer must fill out Area 2.

What is your lifelong learning plan?

A lifelong learning plan is a written, well-thought of strategy to continuously gain, absorb, and build skills and knowledge and apply these throughout the life of an individual.

What are examples of lifelong learning?

Examples of lifelong learning Developing a new skill (eg. Self-taught study (eg. Learning a new sport or activity (eg. Learning to use a new technology (smart devices, new software applications, etc) Acquiring new knowledge (taking a self-interest course via online education or classroom-based course)

When can you withdraw from RRSP?

When can I withdraw from my RRSP? You can make a withdrawal from your RRSP any time1 as long as your funds are not in a locked-in plan. The withdrawal, however, is subject to withholding tax and the amount also needs to be included as income when filing your taxes.

How do I withdraw my lifelong learning plan?

To make an LLP withdrawal, use Form RC96, Lifelong Learning Plan (LLP) Request to Withdraw Funds from an RRSP. You have to fill out Form RC96 for each withdrawal you make. To get Form RC96, go to Forms and publications.

What is the maximum amount that a person can take out of their RRSPs for the lifelong learning plan?

The LLP allows you to withdraw up to $10,000 in a calendar year from your RRSPs to finance full-time training or education for you or your spouse or common-law partner.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find Canada RC96 E?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the Canada RC96 E in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How can I edit Canada RC96 E on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing Canada RC96 E.

How do I complete Canada RC96 E on an Android device?

On Android, use the pdfFiller mobile app to finish your Canada RC96 E. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is Canada RC96 E?

Canada RC96 E is a form used by certain businesses to report their sales tax collected and input tax credits for the purpose of filing Goods and Services Tax (GST) or Harmonized Sales Tax (HST) returns.

Who is required to file Canada RC96 E?

Businesses that are registered for GST/HST and have taxable sales above a certain threshold are required to file Canada RC96 E.

How to fill out Canada RC96 E?

To fill out Canada RC96 E, businesses must provide details on their sales and purchases, calculate the total GST/HST collected, and input tax credits claimed by completing all sections of the form accurately.

What is the purpose of Canada RC96 E?

The purpose of Canada RC96 E is to facilitate the accurate reporting of sales tax information to the Canada Revenue Agency (CRA) and ensure compliance with GST/HST regulations.

What information must be reported on Canada RC96 E?

The information that must be reported on Canada RC96 E includes total sales subject to GST/HST, GST/HST collected, input tax credits, and any other relevant financial data that reflects the business's taxable activities.

Fill out your Canada RC96 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada rc96 E is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.