MI 4892 2014 free printable template

Show details

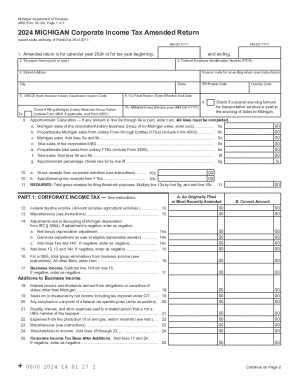

Michigan Department of Treasury 4892 Rev. 05-14 Page 1 2014 MICHIGAN Corporate Income Tax Amended Return Issued under authority of Public Act 38 of 2011. Pay amount on line 56. Mail check and return to Make check payable to State of Michigan. Print taxpayer s FEIN the tax year and CIT on the front of the check. Do not staple the check to the return. Instructions for an amended CIT return Forms 4892 4906 and 4909 Purpose To calculate and file an amended Corporate Income Tax CIT return....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI 4892

Edit your MI 4892 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI 4892 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MI 4892 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MI 4892. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI 4892 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI 4892

How to fill out MI 4892

01

Gather personal information such as your name, date of birth, and contact details.

02

Indicate the reason for filling out the MI 4892 form clearly.

03

Provide detailed information regarding your immigration status and history.

04

Fill out any required financial information, including income sources and amounts.

05

Review the instructions specific to your case type to ensure accurate completion.

06

Sign and date the form at the bottom before submission.

Who needs MI 4892?

01

Individuals applying for specific immigration benefits in Michigan.

02

Those who need to report changes to their immigration status.

03

People providing supporting documentation for immigration matters.

Fill

form

: Try Risk Free

People Also Ask about

Who has to file an MI-1040?

You must file a Michigan Individual Income Tax Return MI-1040 and pay tax on income you earned, received, or accrued while living in Michigan. Required forms include (not limited to): MI-1040, Schedule 1, Schedule NR and Schedule W. For more information on part-year residency view the MI-1040 instruction booklet .

Where to get Michigan income tax forms?

In addition, current year commonly used forms will continue to be available at Michigan Department of Treasury offices, most public libraries, Northern Michigan post offices, and Michigan Department of Health and Human Services (MDHHS) county offices.

Does Michigan have a state tax ID?

Banks, government entities, and companies can use your Michigan tax ID number to identify your business. A Michigan tax ID number is a requirement for all businesses in the state of Michigan. Before you can request a Michigan tax ID number for your business, you will need to acquire an EIN from the IRS.

Do I need to include W-2 with Michigan tax return?

Any W-2 that indicates Michigan withholding must be filed with Treasury, regardless of residency status. Treasury requires state copies of the following W-2s: W-2, when issued to an employee for work performed in Michigan or to report Michigan income tax withheld.

What needs to be sent with Michigan tax return?

Michigan Schedules and Forms (e.g. Schedule W, Schedule 1, Form 4884, MI-1040CR) Federal amended return and schedules. Copies of the Internal Revenue Service (IRS) audit report, notice, federal transcripts or other supporting documents. Property tax statements/lease agreements.

Where can I find Michigan state tax forms?

In addition, current year commonly used forms will continue to be available at Michigan Department of Treasury offices, most public libraries, Northern Michigan post offices, and Michigan Department of Health and Human Services (MDHHS) county offices.

Does Michigan have a state income tax form?

The most common Michigan income tax form is the MI-1040. This form is used by Michigan residents who file an individual income tax return.

What documents do I need file my taxes?

What documents do I need to file my taxes? Social Security documents. Income statements such as W-2s and MISC-1099s. Tax forms that report other types of income, such as Schedule K-1 for trusts, partnership and S corporations. Tax deduction records. Expense receipts.

How do I file my Michigan state taxes?

The Michigan State Income Taxes for Tax Year 2022 (January 1 - Dec. 31, 2022) can be prepared and e-Filed now along with an IRS or Federal Income Tax Return. Alternatively, you can also only prepare and mail-in a MI state return. The latest deadline for e-filing a Michigan Tax Returns is April 18, 2023.

Can you buy tax forms?

You can order the tax forms, instructions and publications you need to complete your 2021 tax return here. We will process your order and ship it by U.S. mail when the products become available. Most products should be available by the end of January 2022.

What is the difference between a 1040 and 1099?

The key difference between these forms is that Form 1040 calculates your tax or refund. It includes multiple details about your personal tax situation. Forms 1099 report only one source of income.

What are the 3 basic forms used to file income taxes?

About Form 1040, U.S. Individual Income Tax Return Schedule 1 (Form 1040) Additional Income and Adjustments to Income. USE IF Schedule 2 (Form 1040), Additional Taxes. USE IF Schedule 3 (Form 1040), Additional Credits and Payments. USE IF …

Is there a Michigan state tax form?

The most common Michigan income tax form is the MI-1040. This form is used by Michigan residents who file an individual income tax return.

Where can I get Illinois tax forms?

Submit a request to have forms or publications mailed to you. You can also request certain forms and publications by calling our 24-hour forms order hotline at 1 800 356-6302.

What forms do I need to file Michigan taxes?

Required forms include (not limited to): MI-1040, Schedule 1, Schedule NR, and Schedule W.

What is a Michigan 1040 form?

2021 Michigan Individual Income Tax Return MI-1040.

Where can I pick up IRS forms?

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my MI 4892 in Gmail?

Create your eSignature using pdfFiller and then eSign your MI 4892 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How can I fill out MI 4892 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your MI 4892, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I fill out MI 4892 on an Android device?

On Android, use the pdfFiller mobile app to finish your MI 4892. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is MI 4892?

MI 4892 is a form used in the state of Michigan for reporting specific tax information.

Who is required to file MI 4892?

Individuals and entities that have tax obligations or specific financial reporting requirements in Michigan are required to file MI 4892.

How to fill out MI 4892?

To fill out MI 4892, one must provide accurate information regarding income, deductions, and any other relevant financial details as instructed on the form.

What is the purpose of MI 4892?

The purpose of MI 4892 is to gather information for tax purposes, ensuring compliance with Michigan tax laws.

What information must be reported on MI 4892?

MI 4892 requires reporting of income, deductions, tax credits, and other pertinent financial details as specific to Michigan tax regulations.

Fill out your MI 4892 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI 4892 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.