MI 4892 2017 free printable template

Show details

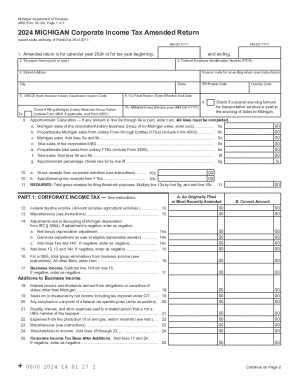

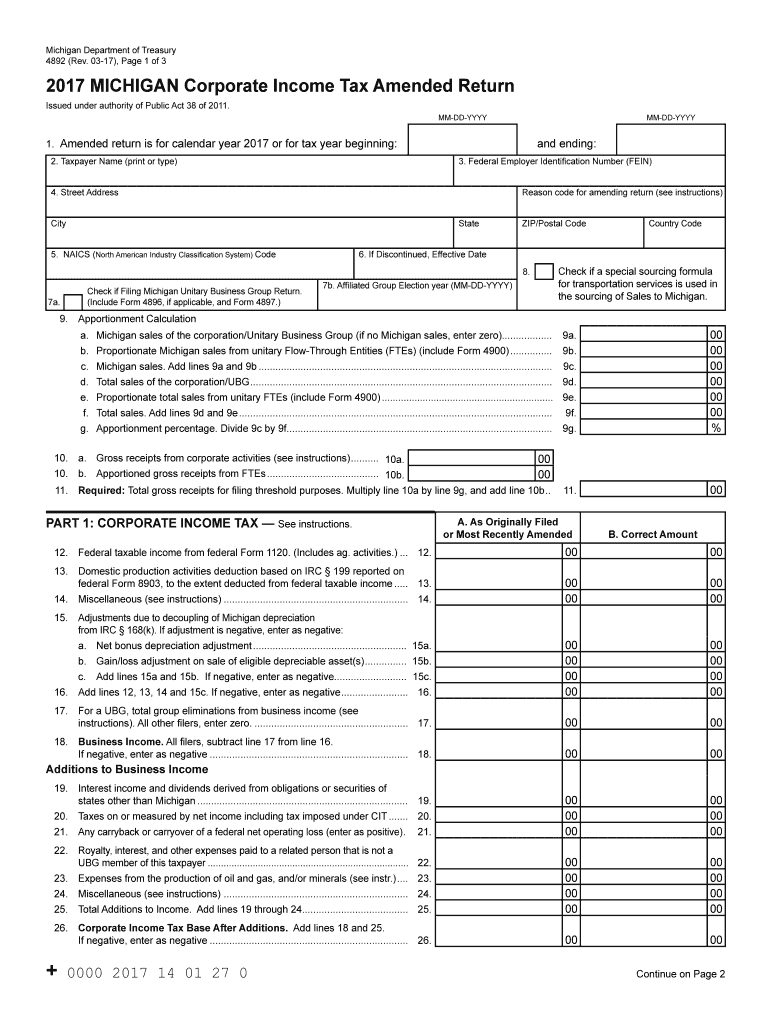

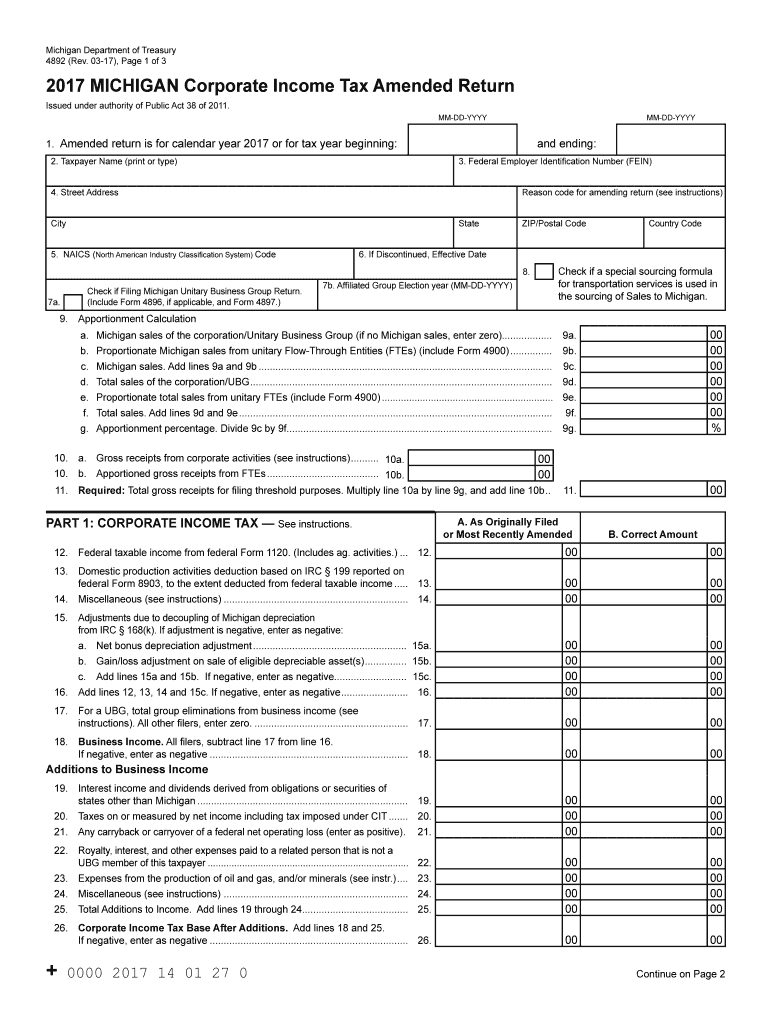

Michigan Department of Treasury 4892 Rev. 03-17 Page 1 of 3 2017 MICHIGAN Corporate Income Tax Amended Return Issued under authority of Public Act 38 of 2011. 25. Total Additions to Income. Add lines 19 through 24. 0000 2017 14 01 27 0 Continue on Page 2 2017 Form 4892 Page 2 of 3 Taxpayer FEIN Subtractions from Business Income 27. Pay amount on line 56. Mail check and return to Make check payable to State of Michigan. Print taxpayer s FEIN the tax year and CIT on the front of the check. Do...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI 4892

Edit your MI 4892 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI 4892 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MI 4892 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MI 4892. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI 4892 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI 4892

How to fill out MI 4892

01

Begin with personal information, including your full name and date of birth.

02

Provide your contact information, ensuring to include your email and phone number.

03

Indicate your immigration status or visa type.

04

Fill out the details of your address, including previous addresses if required.

05

Answer all specific questions regarding your eligibility for the program.

06

Double-check all entries for accuracy before submission.

07

Sign and date the application form where indicated.

Who needs MI 4892?

01

Individuals seeking to apply for a specific immigration program or benefit.

02

Those who are required to provide additional information for their immigration application.

03

People who have been requested to submit this form by the immigration authority.

Fill

form

: Try Risk Free

People Also Ask about

Who has to file an MI-1040?

You must file a Michigan Individual Income Tax Return MI-1040 and pay tax on income you earned, received, or accrued while living in Michigan. Required forms include (not limited to): MI-1040, Schedule 1, Schedule NR and Schedule W. For more information on part-year residency view the MI-1040 instruction booklet .

Where to get Michigan income tax forms?

In addition, current year commonly used forms will continue to be available at Michigan Department of Treasury offices, most public libraries, Northern Michigan post offices, and Michigan Department of Health and Human Services (MDHHS) county offices.

Does Michigan have a state tax ID?

Banks, government entities, and companies can use your Michigan tax ID number to identify your business. A Michigan tax ID number is a requirement for all businesses in the state of Michigan. Before you can request a Michigan tax ID number for your business, you will need to acquire an EIN from the IRS.

Do I need to include W-2 with Michigan tax return?

Any W-2 that indicates Michigan withholding must be filed with Treasury, regardless of residency status. Treasury requires state copies of the following W-2s: W-2, when issued to an employee for work performed in Michigan or to report Michigan income tax withheld.

What needs to be sent with Michigan tax return?

Michigan Schedules and Forms (e.g. Schedule W, Schedule 1, Form 4884, MI-1040CR) Federal amended return and schedules. Copies of the Internal Revenue Service (IRS) audit report, notice, federal transcripts or other supporting documents. Property tax statements/lease agreements.

Where can I find Michigan state tax forms?

In addition, current year commonly used forms will continue to be available at Michigan Department of Treasury offices, most public libraries, Northern Michigan post offices, and Michigan Department of Health and Human Services (MDHHS) county offices.

Does Michigan have a state income tax form?

The most common Michigan income tax form is the MI-1040. This form is used by Michigan residents who file an individual income tax return.

What documents do I need file my taxes?

What documents do I need to file my taxes? Social Security documents. Income statements such as W-2s and MISC-1099s. Tax forms that report other types of income, such as Schedule K-1 for trusts, partnership and S corporations. Tax deduction records. Expense receipts.

How do I file my Michigan state taxes?

The Michigan State Income Taxes for Tax Year 2022 (January 1 - Dec. 31, 2022) can be prepared and e-Filed now along with an IRS or Federal Income Tax Return. Alternatively, you can also only prepare and mail-in a MI state return. The latest deadline for e-filing a Michigan Tax Returns is April 18, 2023.

Can you buy tax forms?

You can order the tax forms, instructions and publications you need to complete your 2021 tax return here. We will process your order and ship it by U.S. mail when the products become available. Most products should be available by the end of January 2022.

What is the difference between a 1040 and 1099?

The key difference between these forms is that Form 1040 calculates your tax or refund. It includes multiple details about your personal tax situation. Forms 1099 report only one source of income.

What are the 3 basic forms used to file income taxes?

About Form 1040, U.S. Individual Income Tax Return Schedule 1 (Form 1040) Additional Income and Adjustments to Income. USE IF Schedule 2 (Form 1040), Additional Taxes. USE IF Schedule 3 (Form 1040), Additional Credits and Payments. USE IF …

Is there a Michigan state tax form?

The most common Michigan income tax form is the MI-1040. This form is used by Michigan residents who file an individual income tax return.

Where can I get Illinois tax forms?

Submit a request to have forms or publications mailed to you. You can also request certain forms and publications by calling our 24-hour forms order hotline at 1 800 356-6302.

What forms do I need to file Michigan taxes?

Required forms include (not limited to): MI-1040, Schedule 1, Schedule NR, and Schedule W.

What is a Michigan 1040 form?

2021 Michigan Individual Income Tax Return MI-1040.

Where can I pick up IRS forms?

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my MI 4892 directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your MI 4892 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I create an electronic signature for the MI 4892 in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your MI 4892.

How do I complete MI 4892 on an Android device?

Use the pdfFiller Android app to finish your MI 4892 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is MI 4892?

MI 4892 is a form used for reporting certain tax information in the state of Michigan.

Who is required to file MI 4892?

Entities or individuals who meet specific criteria related to their income and tax obligations within the state of Michigan are required to file MI 4892.

How to fill out MI 4892?

To fill out MI 4892, taxpayers should provide their personal or business information, report income, deductions, and any relevant tax credits on the form according to the instructions provided by the Michigan Department of Treasury.

What is the purpose of MI 4892?

The purpose of MI 4892 is to collect necessary information for the calculation of tax liabilities for individuals and businesses operating in Michigan.

What information must be reported on MI 4892?

MI 4892 requires the reporting of personal identification information, income figures, applicable deductions, any tax credits, and other relevant financial information.

Fill out your MI 4892 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI 4892 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.