Get the free CE-4 Petition for Abatement - Validity of Debt (Rev. 5-13) - Kansas ... - ksrevenue

Show details

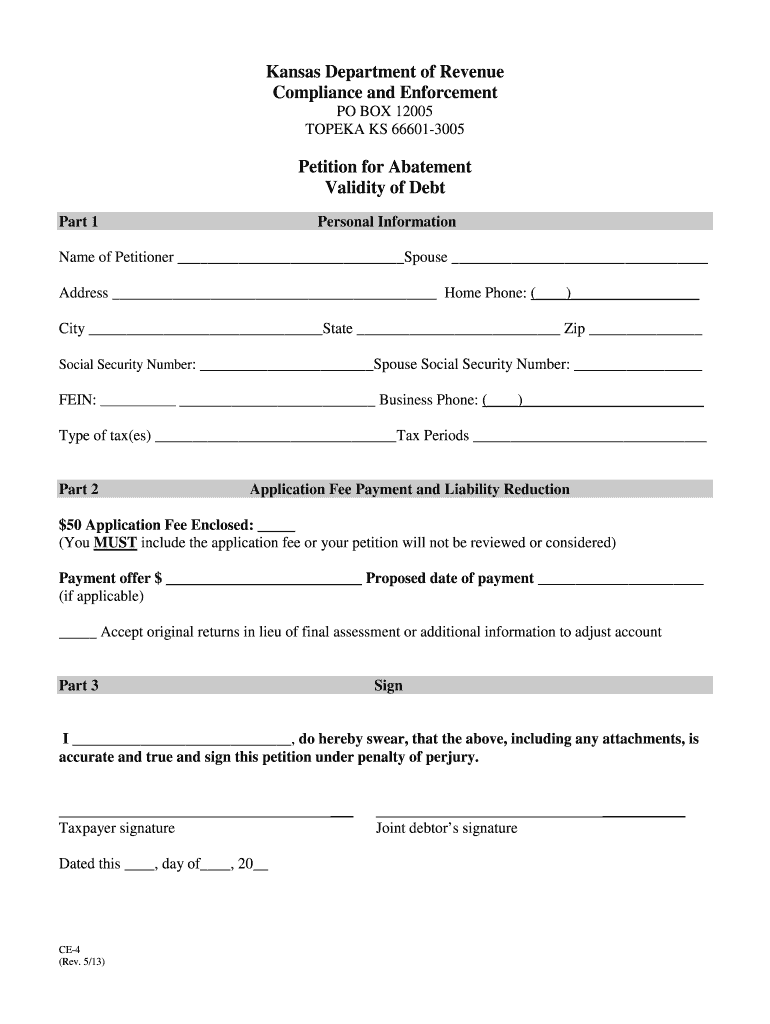

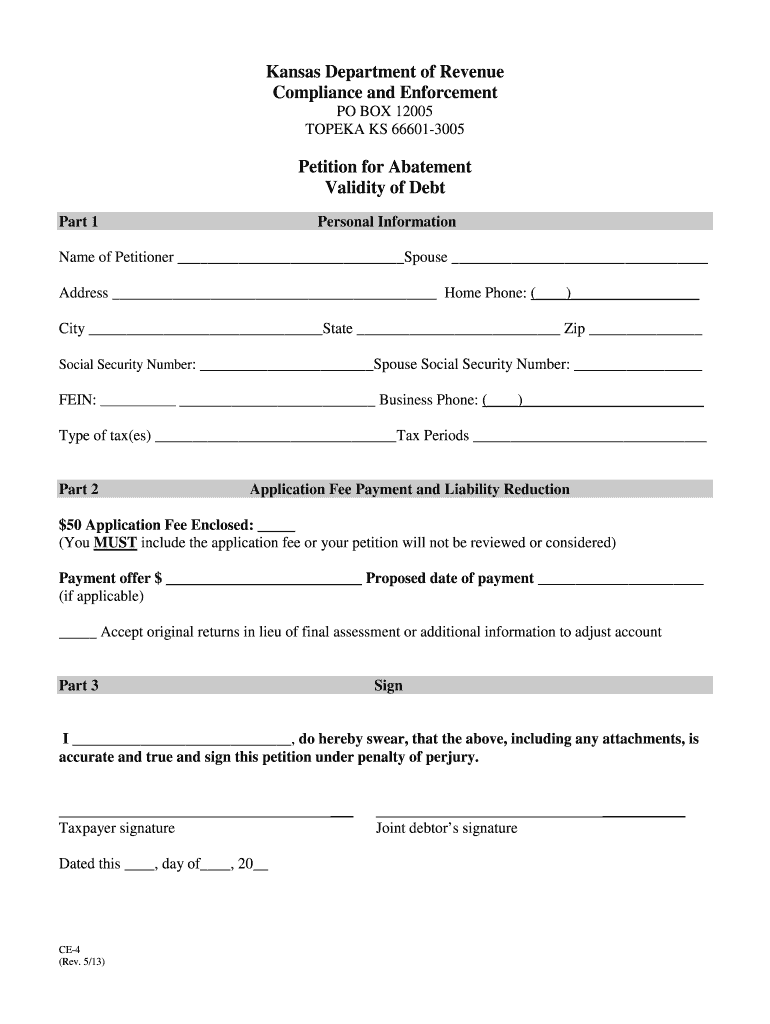

Kansas Department of Revenue Compliance and Enforcement PO BOX 12005 TOPEKA KS 66601-3005 Petition for Abatement Validity of Debt Part 1 Personal Information Name of Petitioner Spouse Address Home

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ce-4 petition for abatement

Edit your ce-4 petition for abatement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ce-4 petition for abatement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ce-4 petition for abatement online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ce-4 petition for abatement. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ce-4 petition for abatement

How to fill out ce-4 petition for abatement:

01

Obtain the necessary forms: The first step in filling out a ce-4 petition for abatement is to obtain the correct forms. These forms can typically be found on your local government's website or by visiting their office in person.

02

Provide personal information: In the ce-4 petition for abatement, you will need to provide your personal information, such as your full name, address, and contact information. This information is essential for the government to accurately process your petition.

03

Explain the reason for the petition: Next, you will need to explain the reason for your petition. This can include the specific violation or issue you are requesting an abatement for. Make sure to provide clear and concise details to strengthen your case.

04

Attach supporting documents: It is crucial to attach any supporting documents that help reinforce your claims. This may include photographs, invoices, receipts, or any other evidence that supports your petition. These documents can provide concrete proof of the violation you are seeking to address.

05

Provide a proposed solution: In your ce-4 petition for abatement, it is essential to propose a solution to the violation. This can include suggesting steps that can be taken to remedy the issue or requesting that the responsible party take specific actions. Providing a proposed solution demonstrates your willingness to resolve the problem.

Who needs ce-4 petition for abatement?

01

Property owners: Property owners who are facing violations or issues that require abatement may need to file a ce-4 petition. This could include situations such as code violations, environmental concerns, or nuisances impacting the property.

02

Tenants: In some cases, tenants may also need to file a ce-4 petition for abatement if they are experiencing issues that are the responsibility of the property owner. This could include problems with maintenance, health hazards, or other violations affecting their living conditions.

03

Businesses: Business owners who encounter violations or concerns that require abatement may also need to file a ce-4 petition. This could relate to issues with their property, such as zoning violations, noise complaints, or environmental hazards.

In conclusion, filling out a ce-4 petition for abatement involves obtaining the necessary forms, providing personal information, explaining the reason for the petition, attaching supporting documents, and proposing a solution. This petition may be needed by property owners, tenants, and businesses facing violations or issues requiring abatement.

Fill

form

: Try Risk Free

People Also Ask about

What is a tax warrant in Kansas?

Tax warrants are filed by the Kansas Department of Revenue for recovery of delinquent tax obligations. If any tax due to the State of Kansas is not paid within 60 days after it becomes due, the Director of Revenue or their designee issues a warrant.

What happens if I can't pay my Kansas state taxes?

If you are not able to pay the full amount due, you should file your Kansas income tax return and pay as much as you can by the filing date. Penalties and interest will accrue on any unpaid balance until fully paid. Contact our department at 1-785-296-6121 to make arrangements to pay the remaining balance.

How long can property taxes go unpaid in Kansas?

Delinquent real estate taxes not paid within 3 years are referred to the Legal Department for foreclosure action, thus putting the property in jeopardy of being sold at auction.

What is a petition for abatement in Kansas?

A petition for abatement (PFA) allows you to reduce your tax debt for less than the full amount you owe or when you dispute the amount of the debt.

Does the IRS issue tax warrants?

The IRS can seize property under a tax warrant to satisfy your unpaid back taxes, either by taking possession of and selling real estate, removing funds from bank accounts, and garnishing your wages.

What is a tax warrant in the state of Kansas?

Tax warrants are filed by the Kansas Department of Revenue for recovery of delinquent tax obligations. If any tax due to the State of Kansas is not paid within 60 days after it becomes due, the Director of Revenue or their designee issues a warrant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find ce-4 petition for abatement?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific ce-4 petition for abatement and other forms. Find the template you need and change it using powerful tools.

How do I edit ce-4 petition for abatement in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your ce-4 petition for abatement, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an electronic signature for signing my ce-4 petition for abatement in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your ce-4 petition for abatement and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is ce-4 petition for abatement?

The CE-4 petition for abatement is a request made to the relevant authority to reduce or eliminate penalties or fines related to a violation or non-compliance.

Who is required to file ce-4 petition for abatement?

Any individual or entity that has been penalized for a violation or non-compliance and wishes to request a reduction or elimination of the penalties.

How to fill out ce-4 petition for abatement?

The CE-4 petition for abatement typically requires providing details of the violation, reasons for requesting abatement, and supporting documentation.

What is the purpose of ce-4 petition for abatement?

The purpose of the CE-4 petition for abatement is to provide a formal process for individuals or entities to request relief from penalties or fines imposed for violations.

What information must be reported on ce-4 petition for abatement?

Information such as the nature of the violation, the amount of penalties assessed, reasons for requesting abatement, and supporting documents should be included in the CE-4 petition for abatement.

Fill out your ce-4 petition for abatement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ce-4 Petition For Abatement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.