Get the free AUTOMOBILE MILEAGE LOG TAX YEAR: NAME: VEHICLE: NAME OF ... - suncoasttaxservice

Show details

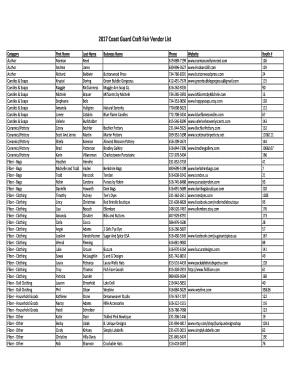

AUTOMOBILE MILEAGE LOG TAX YEAR: NAME: VEHICLE: NAME OF BUSINESS ACTIVITY: January 1 Demeter Reading: December 31 Odometer Reading: Purpose of Trip Totals Date Odometer Start From To Odometer End

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign automobile mileage log tax

Edit your automobile mileage log tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your automobile mileage log tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing automobile mileage log tax online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit automobile mileage log tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out automobile mileage log tax

How to fill out automobile mileage log tax:

01

Determine the purpose of the automobile mileage log tax. Is it for personal or business use? This will help you determine what information to include in the log.

02

Start by recording the date of each trip. This is important for documenting when the mileage occurred.

03

Note the starting and ending odometer readings for each trip. This will allow you to calculate the total miles traveled.

04

Provide a brief description of the purpose of each trip. Was it for business meetings, client visits, or personal errands? This information is useful for tax purposes.

05

Calculate the total miles traveled for each trip by subtracting the starting odometer reading from the ending odometer reading.

06

Multiply the total miles by the applicable mileage rate. The mileage rate is set by the IRS and can vary each year.

07

Keep track of any tolls, parking fees, or other expenses related to the trips. These can be deducted from your taxes as well.

08

Total up the mileage and expenses at the end of the designated time period. This could be monthly, quarterly, or annually, depending on your needs.

09

Make sure to keep all receipts and supporting documentation in case of an audit.

Who needs automobile mileage log tax:

01

Self-employed individuals: If you run your own business or work as a freelancer, keeping an automobile mileage log tax is crucial for documenting deductible expenses.

02

Employees who use their personal vehicles for business purposes: Some employers may reimburse their employees for mileage or allow them to claim it as a business expense on their tax returns.

03

Non-profit organizations: Non-profit organizations often rely on volunteers to perform services using their personal vehicles. Keeping a mileage log can help determine the value of these services.

04

Individuals with multiple streams of income: If you have multiple jobs or side gigs that require you to use your personal vehicle, it's essential to keep track of your mileage for tax purposes.

Remember, it's always a good idea to consult with a tax professional or refer to the IRS guidelines for specific requirements and regulations regarding automobile mileage log tax.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send automobile mileage log tax to be eSigned by others?

Once your automobile mileage log tax is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit automobile mileage log tax online?

The editing procedure is simple with pdfFiller. Open your automobile mileage log tax in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for signing my automobile mileage log tax in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your automobile mileage log tax and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is automobile mileage log tax?

Automobile mileage log tax is a tax based on the number of miles driven for business purposes and is used to calculate deductible expenses for businesses and individuals.

Who is required to file automobile mileage log tax?

Anyone who uses a vehicle for business purposes and wants to claim a deduction for mileage on their taxes is required to file an automobile mileage log tax.

How to fill out automobile mileage log tax?

To fill out the automobile mileage log tax, you need to keep track of the number of miles driven for business purposes, the date of the trip, the starting and ending locations, and the purpose of the trip.

What is the purpose of automobile mileage log tax?

The purpose of automobile mileage log tax is to accurately track and report the number of miles driven for business purposes in order to claim a tax deduction for those expenses.

What information must be reported on automobile mileage log tax?

The information that must be reported on automobile mileage log tax includes the number of miles driven for business purposes, the date of the trip, the starting and ending locations, and the purpose of the trip.

Fill out your automobile mileage log tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Automobile Mileage Log Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.