Get the free IRS Is Contact Representative Jobs, EmploymentIndeed.com

Show details

-- Form Department of the Treasury Internal Revenue Service (77) r 0, and ending Amended return 0 Final return or type. IF. O. BOX 1460 See Specific Instructions City or town, state, and ZIP code

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irs is contact representative

Edit your irs is contact representative form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs is contact representative form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irs is contact representative online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit irs is contact representative. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

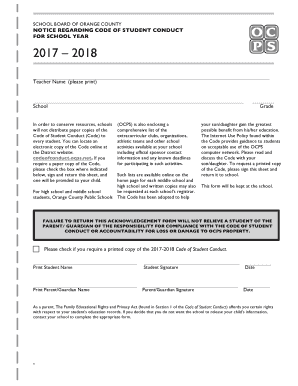

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs is contact representative

How to Fill Out IRS is Contact Representative?

01

Start by logging into your IRS online account using your username and password. If you don't have an account, you can create one easily on the IRS website.

02

Once logged in, navigate to the "Contact Us" or "Help" section of the website to find information related to contacting a representative.

03

Review the available options for contacting the IRS representative. It could be via phone, email, or in-person appointment. Choose the method that suits you best.

04

If you decide to contact the representative over the phone, ensure you have all the necessary documents and information readily available. This may include your Social Security number, tax return details, and any correspondence you have received from the IRS.

05

Follow the instructions provided by the IRS to connect with a representative. It may involve dialing a specific phone number or scheduling an appointment online.

06

If you prefer contacting the representative through email, locate the relevant email address and compose a comprehensive message detailing your issue or inquiry. Make sure to provide all the required information and attach any supporting documents if necessary.

07

If an in-person appointment is your preferred method, search for the nearest IRS office and schedule a meeting using the provided online booking system or by calling the office directly. Prepare all the required documents and arrive at the scheduled time.

08

During your interaction with the IRS contact representative, be prepared to answer their questions and provide any requested information accurately and truthfully. It may be helpful to take notes during the conversation for future reference.

09

After the communication is complete, make sure to document the details of the conversation, including the representative's name, date, and time of the call or meeting. This record can be useful in case any follow-up is required.

10

Remember to thank the IRS contact representative for their assistance and professionalism.

Who Needs IRS is Contact Representative?

01

Individuals with questions or inquiries regarding their tax returns may need to contact an IRS representative. This could include issues related to deductions, credits, payments, or any other tax-related matter.

02

Taxpayers who have received notices or letters from the IRS requiring immediate action or further explanation may need to reach out to a contact representative for clarification and guidance.

03

Businesses, self-employed individuals, and organizations filing taxes may require assistance from an IRS contact representative to ensure accurate reporting and compliance with tax laws.

04

Tax professionals, such as accountants or tax advisors, who act on behalf of clients, may need to communicate with IRS representatives to resolve client-related tax matters.

05

Individuals or organizations facing tax audits or investigations may need to contact an IRS representative for guidance and assistance throughout the process.

06

Taxpayers experiencing difficulty in understanding or navigating the IRS website, tools, or online services may seek the help of a contact representative for technical support.

In summary, anyone who has questions or specific tax-related issues can benefit from contacting an IRS representative, as they are trained to provide guidance, answer inquiries, and help resolve various tax matters.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is irs is contact representative?

The IRS Contact Representative is a person designated by the Internal Revenue Service to assist with tax-related queries and provide guidance.

Who is required to file irs is contact representative?

Anyone who needs assistance with tax-related issues or has questions about their tax obligations may contact the IRS Contact Representative.

How to fill out irs is contact representative?

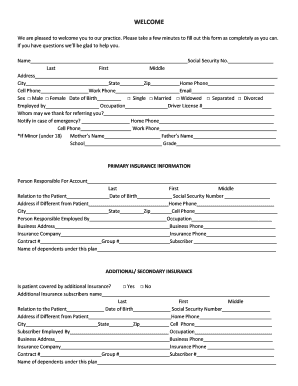

To fill out the IRS Contact Representative form, individuals need to provide their personal information, details of the tax issue or question, and any relevant documentation.

What is the purpose of irs is contact representative?

The purpose of the IRS Contact Representative is to help taxpayers navigate the complexities of the tax system and provide accurate information and guidance.

What information must be reported on irs is contact representative?

Taxpayers should report their personal information, details of the tax issue or question, and any relevant documentation to the IRS Contact Representative.

How can I send irs is contact representative to be eSigned by others?

irs is contact representative is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I execute irs is contact representative online?

pdfFiller has made filling out and eSigning irs is contact representative easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I sign the irs is contact representative electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your irs is contact representative.

Fill out your irs is contact representative online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Is Contact Representative is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.