GU GRT-1 2014 free printable template

Show details

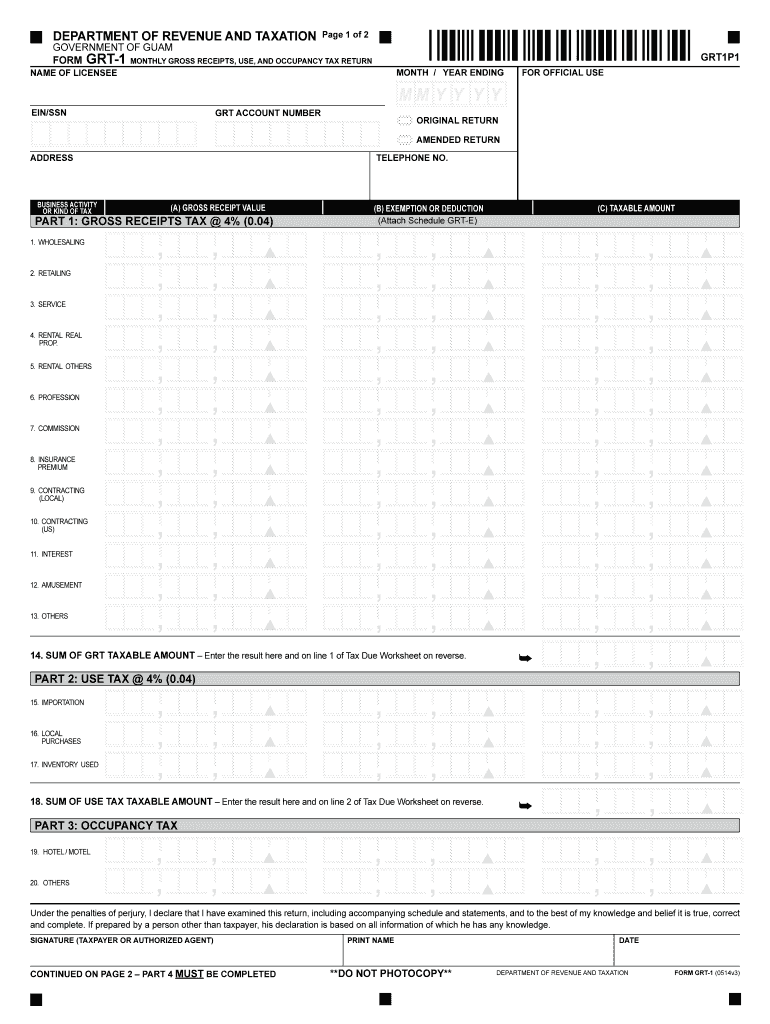

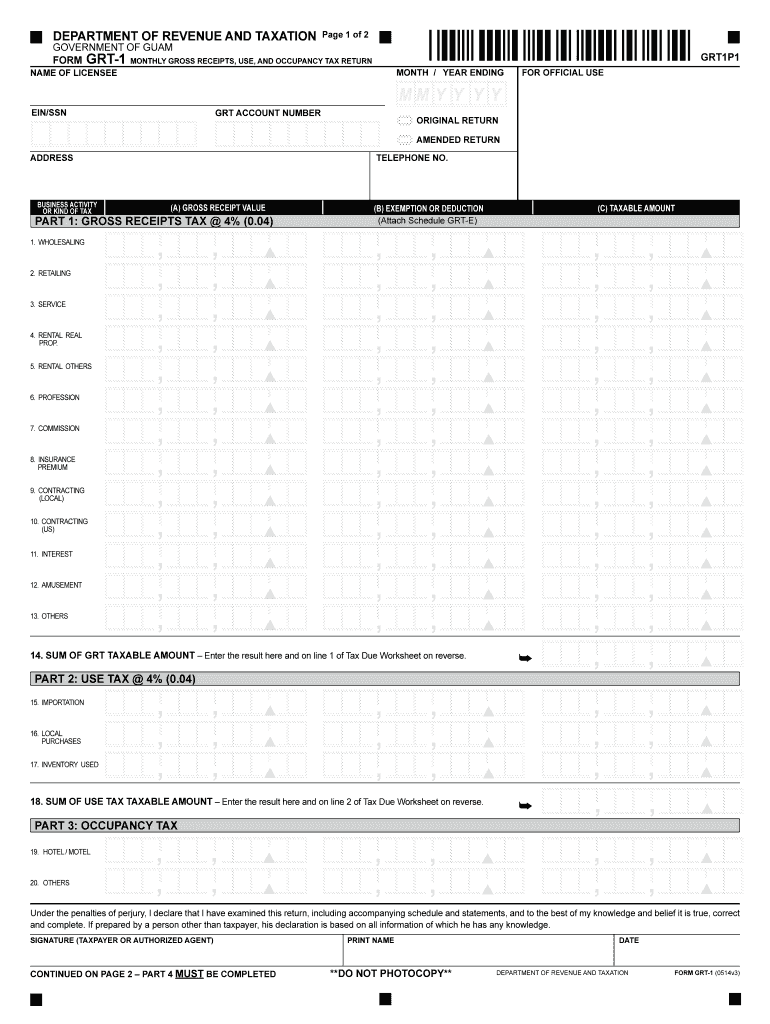

PRINT Clear Form Download DEPARTMENT OF REVENUE AND TAXATION Page 1 of 2 GOVERNMENT OF GUAM FORM GRT-1 MONTHLY GROSS RECEIPTS USE AND OCCUPANCY TAX RETURN NAME OF LICENSEE GRT1P1 MONTH / YEAR ENDING MM Y Y Y Y EIN/SSN GRT ACCOUNT NUMBER ADDRESS BUSINESS ACTIVITY OR KIND OF TAX 2. SIGNATURE TAXPAYER OR AUTHORIZED AGENT PRINT NAME DATE CONTINUED ON PAGE 2 PART 4 MUST BE COMPLETED DO NOT PHOTOCOPY FORM GRT-1 0514v3 M M Y Y Y Y PART 4 TOTALS 42. RETAILING 3. SERVICE 4. RENTAL REAL PROP. 5....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign guam grt 1 2014

Edit your guam grt 1 2014 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your guam grt 1 2014 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit guam grt 1 2014 online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit guam grt 1 2014. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

GU GRT-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out guam grt 1 2014

How to fill out GU GRT-1

01

Obtain a copy of the GU GRT-1 form from the official website or your local government office.

02

Read the instructions carefully before filling out the form.

03

Start by entering your personal information in the designated fields, such as your name, address, and contact details.

04

Provide any relevant identification numbers that may be required, such as your Social Security Number or Tax ID.

05

Fill in the specific details regarding the purpose of the form and any associated transactions.

06

Review all the information for accuracy and completeness before submitting.

07

Sign and date the form as needed.

08

Submit the completed form as per the instructions provided, either online or via mail.

Who needs GU GRT-1?

01

Individuals or businesses who are required to report certain transactions or events to the governing body.

02

Anyone seeking to apply for a permit, license, or other approvals that require this specific form.

03

Taxpayers needing to document certain tax-related activities.

Fill

form

: Try Risk Free

People Also Ask about

How much is tax in Guam?

Sales Tax Rate in Guam averaged 2.80 percent from 2014 until 2023, reaching an all time high of 4.00 percent in 2015 and a record low of 2.00 percent in 2018.

Does Guam have a gross receipts tax?

What is Guam GRT tax rate? All businesses with sales over $500,000 per year must file monthly GRT reports and pay 4% GRT on all sales to the Treasurer of Guam.

What is Guam tax penalty?

Failure to Pay Penalty Section 26111, Chapter 26, Title 11, Guam Code Annotated, provides for a penalty of five percent (5%) of the tax due for each 30-day period, or fraction thereof, not to exceed twenty-five percent (25%) in the aggregate.

Do you pay taxes if you live in Guam?

More In File An individual who has income from American Samoa, the Commonwealth of the Northern Mariana Islands (CNMI), Guam, Puerto Rico or the U.S. Virgin Islands will usually have to file a tax return with the tax department of one of these territories.

Does Guam charge sales tax?

The new 2 percent general sales tax applies to tangible personal property and a number of business services purchased in Guam, “or purchased outside of Guam for delivery to Guam.” The tax doesn't apply to the following: banking services, lending services, foreign currency services, or insurance services.

What taxes do you Pay in Guam?

Guam does not use a state withholding form because there is no personal income tax in Guam.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the guam grt 1 2014 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your guam grt 1 2014 in seconds.

How do I fill out the guam grt 1 2014 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign guam grt 1 2014 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I edit guam grt 1 2014 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share guam grt 1 2014 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is GU GRT-1?

GU GRT-1 is a tax form used in Guam for reporting gross receipts tax.

Who is required to file GU GRT-1?

All businesses and individuals engaged in activities that generate gross receipts in Guam are required to file GU GRT-1.

How to fill out GU GRT-1?

To fill out GU GRT-1, you must provide information about your gross receipts, calculate the tax owed based on the applicable rate, and report it on the form, along with any necessary identification information.

What is the purpose of GU GRT-1?

The purpose of GU GRT-1 is to report and remit the gross receipts tax that businesses collect on their taxable sales and services in Guam.

What information must be reported on GU GRT-1?

GU GRT-1 requires reporting of total gross receipts, deductions (if any), the amount of tax collected, and identification details of the business filing the form.

Fill out your guam grt 1 2014 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Guam Grt 1 2014 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.