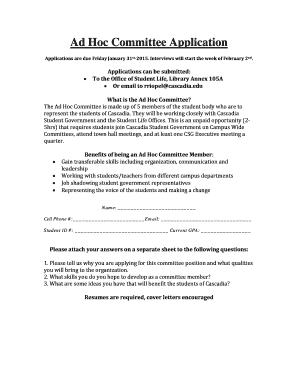

GU GRT-1 2016 free printable template

Show details

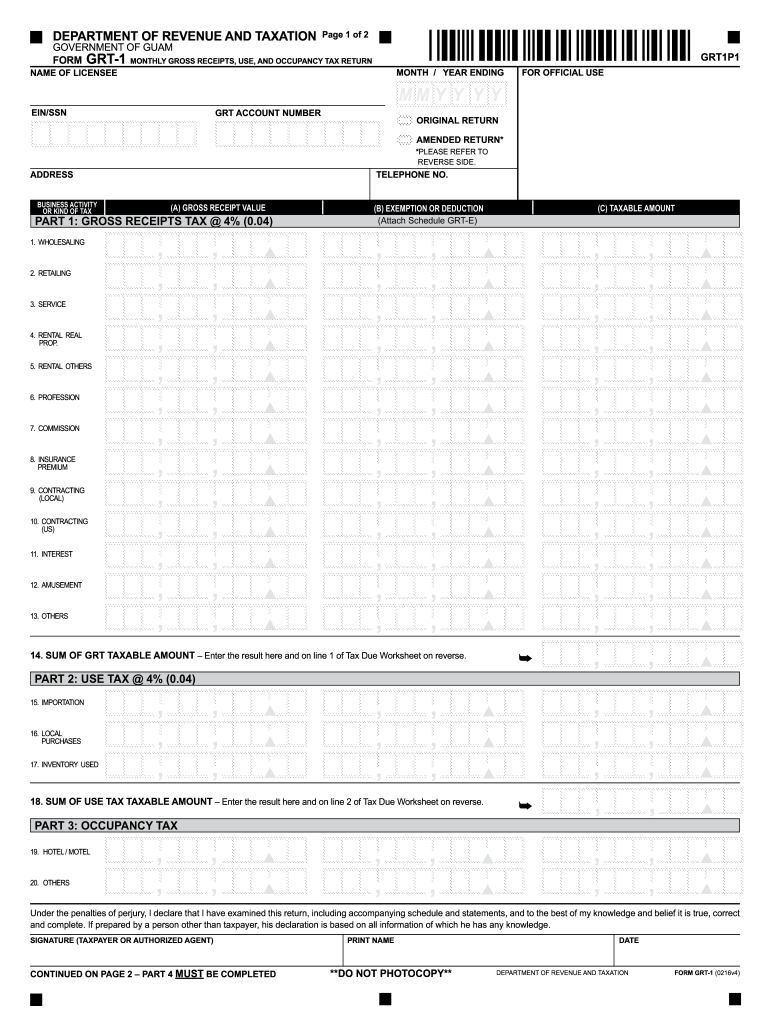

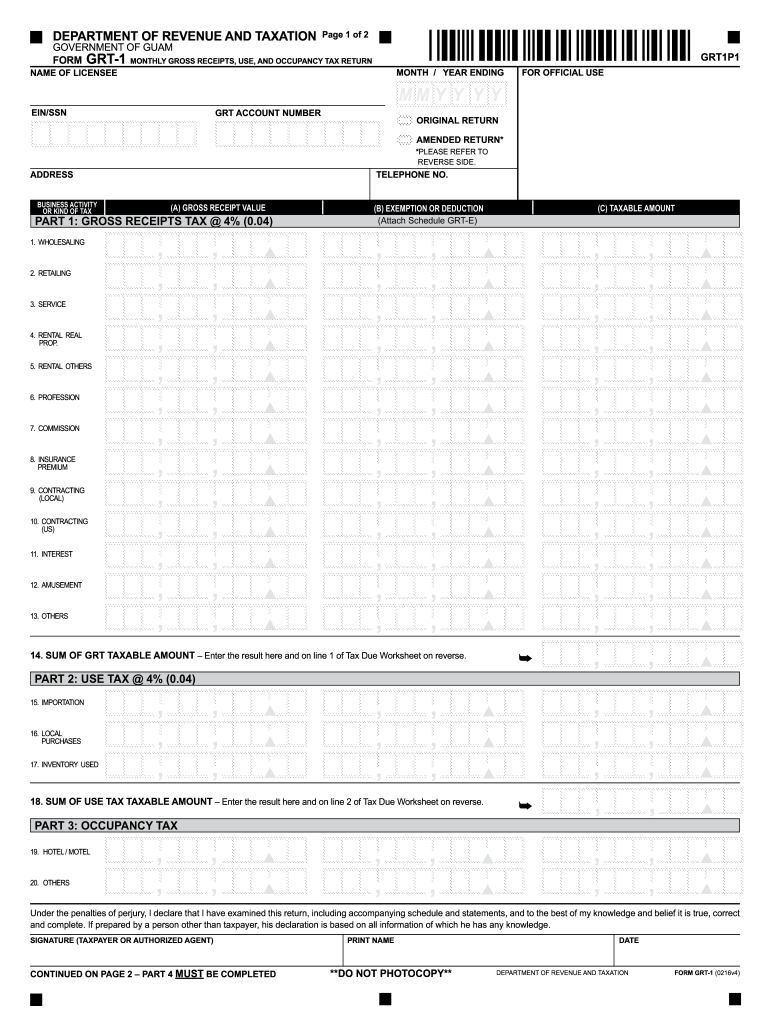

SUM OF GRT TAXABLE AMOUNT Enter the result here and on line 1 of Tax Due Worksheet on reverse. PART 2 USE TAX 4 0. 04 1. WHOLESALING ORIGINAL RETURN FOR OFFICIAL USE B EXEMPTION OR DEDUCTION Attach Schedule GRT-E C TAXABLE AMOUNT s 14. SIGNATURE TAXPAYER OR AUTHORIZED AGENT PRINT NAME DATE CONTINUED ON PAGE 2 PART 4 MUST BE COMPLETED DO NOT PHOTOCOPY FORM GRT-1 0216v4 M M Y Y Y Y PART 4 TOTALS 42. PRINT Clear Form Download DEPARTMENT OF REVENUE AND TAXATION Page 1 of 2 GOVERNMENT OF...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign grt 1 2016 form

Edit your grt 1 2016 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your grt 1 2016 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit grt 1 2016 form online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit grt 1 2016 form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

GU GRT-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out grt 1 2016 form

How to fill out GU GRT-1

01

Obtain the GU GRT-1 form from the appropriate website or office.

02

Fill in your personal information at the top, including name, address, and contact information.

03

Provide any relevant identification numbers as required.

04

Complete the section detailing the purpose of the form and any other requested information.

05

Review the form to ensure all fields are filled out correctly and legibly.

06

Sign and date the form where indicated.

07

Submit the completed form to the designated office or email it as directed.

Who needs GU GRT-1?

01

Individuals applying for certain permits or licenses.

02

Businesses submitting tax-related documents.

03

Any entities required to report financial information as per local regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is GRT tax in Texas?

Texas has a gross receipt tax of 1% on gross income over $1,000,000. You can use the E-Z computation form to get . 575% tax if your sales are under 10 million a year. Wholesalers and retailers are automatically at .

Is GRT a percentage tax?

GRT, or gross receipts tax, is a percentage tax imposed on gross receipts derived from sources within the Philippines by banks and non-bank financial intermediaries, among others.

What does GRT stand for in taxes?

A gross receipts tax is a tax applied to a company's gross sales, without deductions for a firm's business expenses, like costs of goods sold and compensation.

Is sales tax the same as GRT?

But GRT is not the same as sales tax. In most states, sales tax applies only to sales of goods. The main difference from sales tax is that GRT also applies to sales of services. It's important to note that individuals who are independent contractors are considered to be in business.

What is the gross receipts tax on telecommunications in PA?

Telecommunications Gross Receipts Tax includes mobile telecommunications services and interstate landline calls that originate or terminate in Pennsylvania, taxes at 5%.

What is the meaning of GRT in tax?

What Is a Gross Receipts Tax? A gross receipts tax is a tax applied to a company's gross sales, without deductions for a firm's business expenses, like costs of goods sold and compensation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit grt 1 2016 form from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your grt 1 2016 form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an eSignature for the grt 1 2016 form in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your grt 1 2016 form and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit grt 1 2016 form on an Android device?

With the pdfFiller Android app, you can edit, sign, and share grt 1 2016 form on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is GU GRT-1?

GU GRT-1 is a tax form used in Guam for business gross receipts tax reporting.

Who is required to file GU GRT-1?

All businesses operating in Guam that earn gross receipts are required to file GU GRT-1.

How to fill out GU GRT-1?

To fill out GU GRT-1, businesses must report their total gross receipts from sales and services, calculate the tax amount owed, and provide any deductions before submitting the form to the Guam Department of Revenue and Taxation.

What is the purpose of GU GRT-1?

The purpose of GU GRT-1 is to collect information on a business's gross receipts for taxation purposes in Guam.

What information must be reported on GU GRT-1?

On GU GRT-1, businesses must report total gross receipts, applicable deductions, and the total tax calculated based on the gross receipts.

Fill out your grt 1 2016 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Grt 1 2016 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.