WA TD-420-044 2012 free printable template

Show details

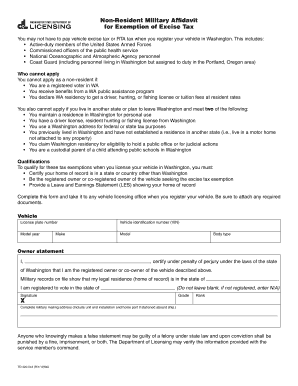

Click here to START or CLEAR, then hit the TAB button Non-Resident Military Affidavit for Exemption of Excise Tax License plate/Registration number Year Make Series/Body type Vehicle/Vessel Identification

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WA TD-420-044

Edit your WA TD-420-044 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WA TD-420-044 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing WA TD-420-044 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit WA TD-420-044. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WA TD-420-044 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WA TD-420-044

How to fill out WA TD-420-044

01

Obtain the WA TD-420-044 form from the Washington State Department of Licensing website or local office.

02

Provide your full name in the designated section.

03

Enter your driver’s license or ID number.

04

Fill in your current address, including city, state, and zip code.

05

Indicate the purpose of the form in the appropriate area.

06

If applicable, include any additional information requested.

07

Sign and date the form at the specified location.

08

Submit the completed form to the relevant department either by mail or in person.

Who needs WA TD-420-044?

01

Individuals applying for a specific type of vehicle title or seeking to make changes to their vehicle registration.

02

Persons needing to report a lost or stolen title in Washington State.

Fill

form

: Try Risk Free

People Also Ask about

Is military exempt from excise tax in Washington state?

Members of the armed forces who purchase vehicles in Washington are required to pay retail sales tax if they intend to remain here more than three months. This is true even if they claim a home of record in a state other than Washington and even if they register the vehicle under the laws of their home state.

Does Washington State tax military pay?

For more information, please call 800-562-2308. What are my Washington State Military and Veterans State Tax Benefits? Washington Income Taxes: There are no individual income taxes in Washington. Distributions received from the Thrift Savings Plan (TSP) are not taxed.

Who is exempt from vehicle excise tax in Washington state?

The motor vehicle excise tax is exempt on passenger vehicles used primarily for commuter ride sharing and transportation of persons with special needs.

Is there a tax exemption for military?

You may know that military allowances like Basic Allowance for Housing are tax-free. You may also know that most VA benefits are also tax-free. Did you know that many states do not charge income tax on active duty or retired military pay? Many others tax only a portion of these pays.

What is tax exempt in Washington state?

Services to individuals and businesses – things like haircuts, medical bills, consultant fees, etc. – are not “personal property,” and most services are not subject to sales tax.

Do active duty military pay taxes on vehicles?

Military members must pay sales tax on purchases, just like everyone else. What gets a little tricky is that the sales tax is based on and paid to the state in which the car is registered, which is often different from the state where the car was purchased.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my WA TD-420-044 in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your WA TD-420-044 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I execute WA TD-420-044 online?

With pdfFiller, you may easily complete and sign WA TD-420-044 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I fill out WA TD-420-044 using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign WA TD-420-044 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is WA TD-420-044?

WA TD-420-044 is a tax exemption application form used in Washington State to request a property tax exemption for certain types of property.

Who is required to file WA TD-420-044?

Entities and individuals who qualify for property tax exemptions in Washington State, such as non-profit organizations or certain business owners, are required to file WA TD-420-044.

How to fill out WA TD-420-044?

To fill out WA TD-420-044, applicants must provide their contact information, describe the property for which the exemption is sought, select the type of exemption applicable, and submit any required supporting documentation.

What is the purpose of WA TD-420-044?

The purpose of WA TD-420-044 is to assess and approve applications for property tax exemptions, ensuring that qualifying properties receive the appropriate tax relief.

What information must be reported on WA TD-420-044?

The information that must be reported on WA TD-420-044 includes the applicant's name, address, a description of the property, the reason for the exemption, and any additional documentation that supports the claim.

Fill out your WA TD-420-044 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WA TD-420-044 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.