WA TD-420-044 2019-2025 free printable template

Show details

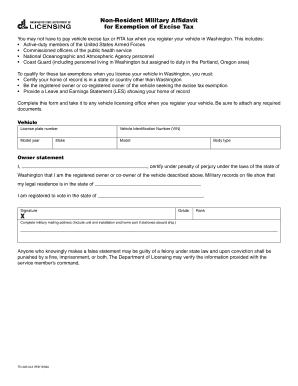

Click here to START or CLEAR, then hit the TAB buttonNonResident Military Affidavit for Exemption of Excise Tax You may not have to pay vehicle excise tax or RTA tax when you register your vehicle

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign washington non resident exemption excise form search

Edit your dol non resident military affidavit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your washington non resident exemption tax form online form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing washington non resident exemption tax form blank online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit washington non resident exemption tax form search. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WA TD-420-044 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out wa dol non resident form

How to fill out WA TD-420-044

01

Obtain the WA TD-420-044 form from the Washington Department of Licensing website or your local Department of Licensing office.

02

Fill in the owner's name and contact information at the top of the form.

03

Provide details about the vehicle, including the make, model, year, VIN, and license plate number.

04

Indicate the reason for filing the form in the specified section.

05

If applicable, include details about any co-owners and their information.

06

Sign and date the form to certify the information provided.

07

Submit the completed form at your local Department of Licensing office or via the specified method outlined on the form.

Who needs WA TD-420-044?

01

Individuals who are registering a vehicle in Washington State.

02

Owners who need to report a change in vehicle ownership or status.

03

Anyone applying for a title transfer for a vehicle.

Fill

td420 non resident military exemption excise form

: Try Risk Free

People Also Ask about washington 044 non resident exemption tax online

Do military pay sales tax on cars in Colorado?

SCHRIEVER AIR FORCE BASE, Colo. -- Military members who are non-Colorado residents, yet are serving under orders in the State of Colorado are exempt from paying specific ownership tax when registering their vehicle here in ance with Colorado law CRS 42-3-104(9).

How do I avoid paying sales tax on a used car in Texas?

How can I avoid paying sales tax on a used car? You will register the vehicle in a state with no sales tax because you live or have a business there. You plan to move to a state without sales tax within 90 days of the vehicle purchase. The vehicle was made before 1973. You are disabled.

What is the vehicle ownership tax in Colorado?

Ownership Tax: Passenger Vehicle = 85% of M.S.R.P. (Sticker Price) Light Truck = 75% of M.S.R.P.

Do veterans pay vehicle tax in Texas?

The military person must have previously registered the motor vehicle in their name in another state or foreign country. U.S. military registration is qualified registration. If the registration requirement is not met, 6.25 percent motor vehicle use tax is due and SPV procedures may apply.

Who pays RTA tax in Washington state?

The RTA MVET is calculated and consumers pay the RTA MVET when licensing a vehicle with the Washington Department of Licensing.

Do active duty military pay taxes on vehicles?

Military personnel, stationed in California are exempt from payment of the vehicle license fee (VLF) on any vehicle owned or leased and registered in California provided: The nonresident military owner is shown as a lessee or registered owner of the vehicle.

Does Washington state have vehicle property tax?

If you are a Washington resident and purchase a vehicle outside this state that you then bring into Washington, you owe use tax on the value of that vehicle. Use tax is the same rate as sales tax and is due when property is brought into Washington if sales tax was not paid.

Is Colorado tax exempt for military?

Active duty pay earned in a combat zone that qualifies for the federal tax exemption is not subject to Colorado income tax. However, to the extent income is included in federal taxable income, Colorado tax will also be due on the income.

Who is subject to Washington excise tax?

The seller of the property typically pays the real estate excise tax, although the buyer is liable for the tax if it is not paid. Unpaid tax can become a lien on the transferred property. REET also applies to transfers of controlling interest (50% or more) in entities that own real property in the state.

How do I avoid paying sales tax on a car in Colorado?

When Sales Tax Is Exempt in Colorado. You can avoid paying sales tax on a car sale if you purchase the vehicle in a state with no sales tax and register it in Colorado. Also, if the vehicle is sold in the state of Colorado but is going to be moved out of the state within 30 days.

Do 100% disabled veterans pay sales tax on vehicles in Texas?

Specific items purchased by people with disabilities are exempt from Texas sales and use tax and motor vehicle sales and use tax.

Are disabled veterans exempt from vehicle sales tax in Texas?

A disabled veteran is not automatically exempt from motor vehicle tax. To receive this exemption, a disabled veteran must be an orthopedically handicapped person, as defined above, and all other requirements for the orthopedically handicapped exemption must be met.

Is Washington State RTA excise tax deductible?

Excise taxes are deductible if they are based on the value of property; are imposed on an annual basis; and are imposed on personal property. The MVET meets all three of these criteria. Other flat fees on the renewal bill do not meet these criteria. Please consult your tax advisor before claiming this exemption.

How are vehicle taxes calculated in Colorado?

State Sales Tax When a vehicle is purchased in Colorado, state sales must be collected. All buyers must pay 2.9% of the purchase price for state sales tax. If the vehicle is purchased from a dealer in Colorado, the dealer will collect the state sales tax and remit it to the state.

Can you deduct RTA tax in Snohomish County?

On the Washington State vehicle registration, there is RTA and Other taxes. RTA can be deducted.

How much does it cost to title a car in Colorado?

The state of Colorado charges a title fee of $7.20. There is a fee of $45 for passenger vehicles and $90 for light truck vehicles and an additional fee of $50 for specialty fees.

Is military Auto sales tax free?

Motor vehicles purchased by U.S. military personnel and most foreign military personnel are subject to motor vehicle sales and use tax.

What is the cost of vehicle registration in Colorado?

Vehicle Registration Motor Vehicle FeeFee AmountRegistration Fee● $3.00 for motorcycles ● $6.00 for passenger vehicles up to 2,000 pounds, plus $0.20 extra per 100 pounds up to 4,500 pounds; and ● $12.50 for passenger vehicles 4,500 pounds or more, plus $0.60 each additional 100 pounds14 more rows

Who is exempt from Texas motor vehicle tax?

A motor vehicle purchased in Texas for use exclusively outside Texas is exempt from motor vehicle sales tax. To claim the exemption, a purchaser must not use the motor vehicle in Texas, except for transportation directly out of state, and must not register the motor vehicle in Texas.

Does Colorado have a personal property tax on vehicles?

It determines the fee by multiplying a vehicle's fair market value by a statutory tax rate that incorporates local property tax rates for commercial and industrial personal property. Colorado imposes an annual ownership tax on most types of motor vehicles. Vehicle AgeValue Base12 model years or older$50.002 more rows • Feb 6, 2012

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send washington dol td420 non resident tax form to be eSigned by others?

Once your non resident military exemption excise is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit washington td420 non resident military excise make online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your td420 non resident military exemption tax form to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit wa 044 non resident excise tax form sample on an Android device?

The pdfFiller app for Android allows you to edit PDF files like washington 044 non resident military make. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is WA TD-420-044?

WA TD-420-044 is a form required by the Washington State Department of Revenue for reporting certain tax-related information.

Who is required to file WA TD-420-044?

Individuals and businesses that are subject to specific tax requirements in Washington State must file WA TD-420-044.

How to fill out WA TD-420-044?

To fill out WA TD-420-044, complete all required fields with accurate information, including identification details, financial information, and any other pertinent data as guided in the form instructions.

What is the purpose of WA TD-420-044?

The purpose of WA TD-420-044 is to collect necessary tax information to ensure compliance with state tax laws and regulations.

What information must be reported on WA TD-420-044?

The information that must be reported on WA TD-420-044 includes taxpayer identification, income details, deductions, and any other relevant financial information as required by the form.

Fill out your washington non resident exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non Resident Military Exemption Excise Tax Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.