KY 0506 - Boone County 2014 free printable template

Show details

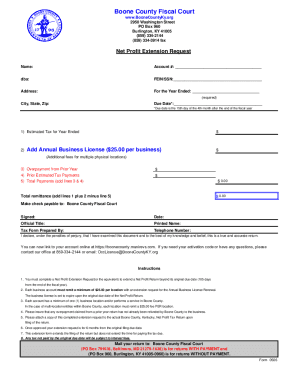

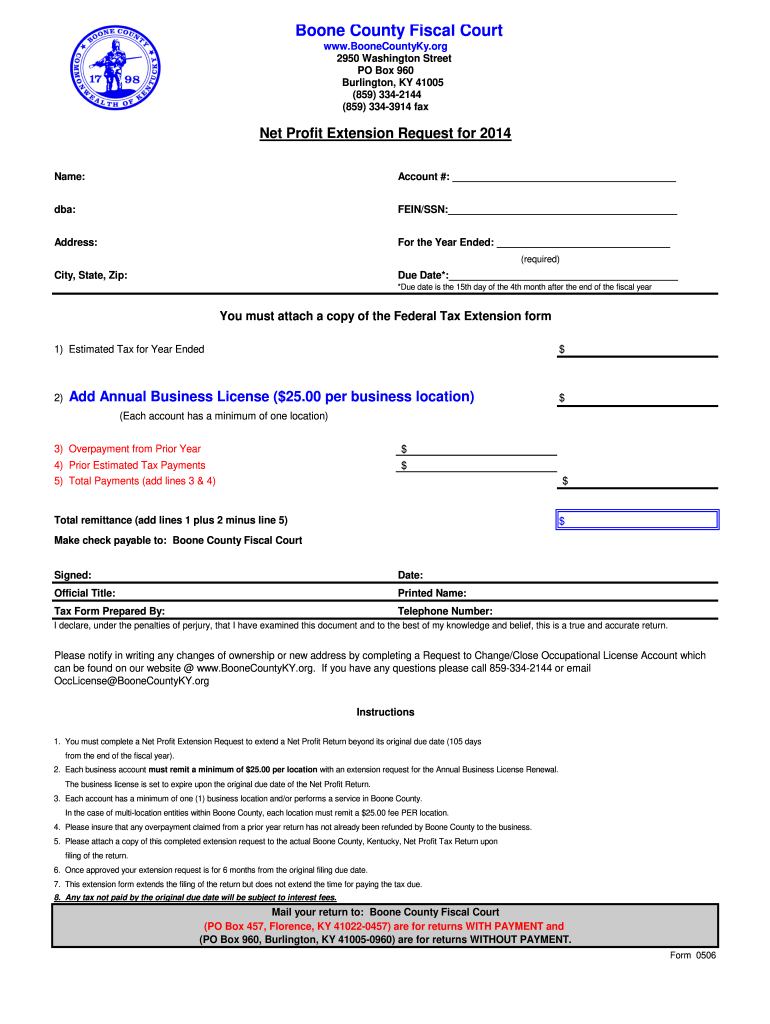

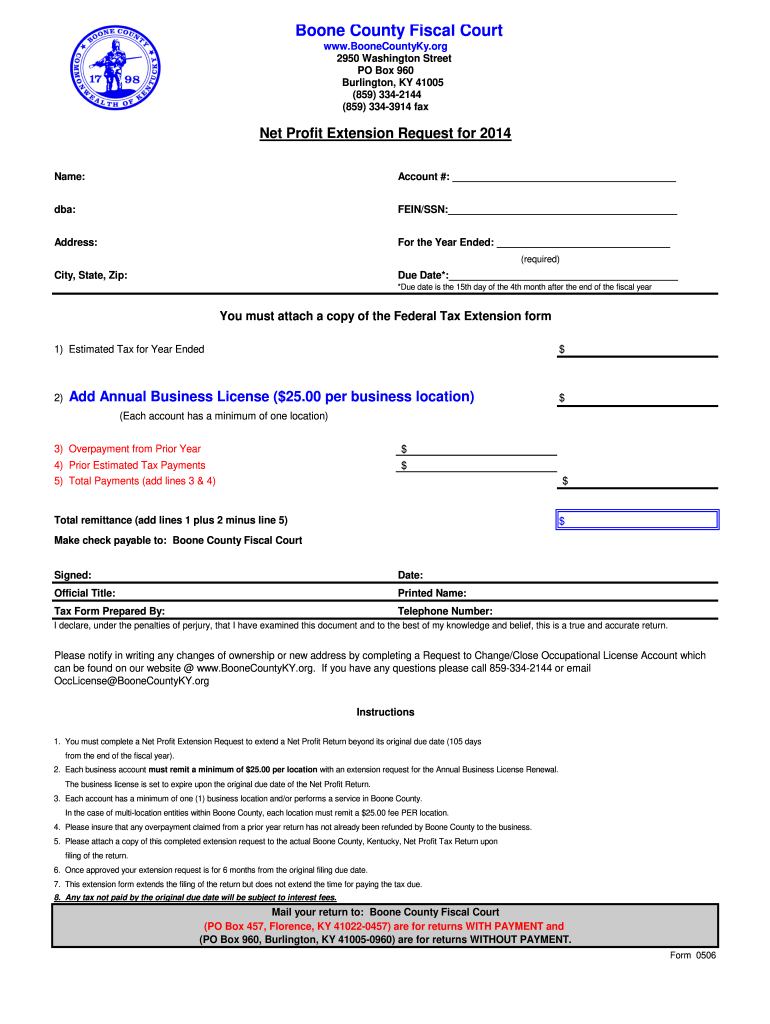

Boone County Fiscal Court www. BooneCountyKy. org 2950 Washington Street PO Box 960 Burlington KY 41005 859 334-2144 859 334-3914 fax Net Profit Extension Request for 2014 Name Account dba FEIN/SSN Address For the Year Ended City State Zip Due Date required Due date is the 15th day of the 4th month after the end of the fiscal year You must attach a copy of the Federal Tax Extension form 1 Estimated Tax for Year Ended Add Annual Business License ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY 0506 - Boone County

Edit your KY 0506 - Boone County form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY 0506 - Boone County form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit KY 0506 - Boone County online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit KY 0506 - Boone County. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY 0506 - Boone County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY 0506 - Boone County

How to fill out KY 0506 - Boone County

01

Obtain the KY 0506 form from the Boone County website or local government office.

02

Read the instructions carefully to understand the requirements.

03

Provide your personal information in the designated fields, including your name, address, and contact details.

04

Fill out the applicable sections related to your specific situation or request.

05

Double-check the information you entered for accuracy.

06

Sign and date the form where indicated.

07

Submit the completed form to the appropriate Boone County department either in person or by mail.

Who needs KY 0506 - Boone County?

01

Residents of Boone County who need to apply for a specific permit or service.

02

Individuals or businesses conducting transactions that require official documentation in Boone County.

03

Anyone who is required to submit information or requests to the Boone County government.

Fill

form

: Try Risk Free

People Also Ask about

Does Kentucky have a state income tax form?

A full-year resident of Kentucky files Form 740 and a person who moves into or out of Kentucky during the year or is a full-year nonresident files Form 740-NP.

What is Kentucky Form k5?

Form K-5. Form K-5 is used to report withholding statement information from Forms W-2, W-2G, and 1099 and is completed online with two filing methods to choose from. It may be filed electronically by clicking the submit button or the completed form may be printed and mailed to the address on the form.

What is the form 720 ext in Kentucky?

Form 720EXT grants an automatic 6-month extension of time to file Form 720. Kentucky State Partnership tax extension Form 720EXT is due within 4 months and 15 days following the end of the partnership reporting period.

Do I need to file an extension for Kentucky state tax return?

If you expect to owe Kentucky income taxes, you must pay at least 75% of your tax payment owed with the Extension Payment Voucher below the KY extension form by April 18, 2023 to avoid interest and late payment penalties.

What is the extension form for Kentucky Dept of Revenue?

To extend a filing date, use Form 41A720SL, Extension of Time to File Kentucky Corporation/ LLET Return. Extensions—Extensions are for filing purposes only; late payment penalties and interest apply to payments made after the original due date.

What is the Kentucky withholding tax?

Compute tax on wages using the 4.5% Kentucky flat tax rate to determine gross annual Kentucky tax. Divide the gross annual Kentucky tax by the number of annual pay periods to determine the Kentucky withholding tax for the pay period.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit KY 0506 - Boone County from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your KY 0506 - Boone County into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I edit KY 0506 - Boone County on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing KY 0506 - Boone County.

How do I fill out the KY 0506 - Boone County form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign KY 0506 - Boone County and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is KY 0506 - Boone County?

KY 0506 - Boone County is a tax form used for reporting local occupational license taxes imposed by Boone County, Kentucky.

Who is required to file KY 0506 - Boone County?

Individuals and businesses that earn income from work performed or services rendered within Boone County are required to file KY 0506.

How to fill out KY 0506 - Boone County?

To fill out KY 0506, provide personal information, income details, deductions, and calculate the total tax liability according to the instructions provided on the form.

What is the purpose of KY 0506 - Boone County?

The purpose of KY 0506 - Boone County is to collect local occupational license taxes to fund municipal services and local government operations.

What information must be reported on KY 0506 - Boone County?

The form requires reporting of gross income, deductions, credit for taxes paid to other jurisdictions, business information, and the calculated tax owed.

Fill out your KY 0506 - Boone County online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY 0506 - Boone County is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.