KY 0506 - Boone County 2021 free printable template

Show details

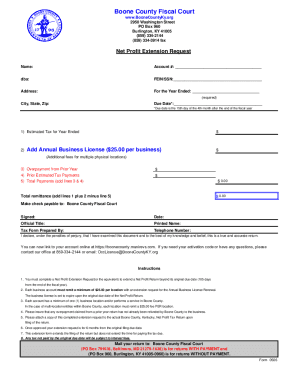

Boone County Fiscal Court www. BooneCountyKy. org 2950 Washington Street PO Box 960 Burlington KY 41005 859 334-2144 859 334-3914 fax Net Profit Extension Request for 2018 Name Account dba FEIN/SSN Address For the Year Ended City State Zip Due Date required Due date is the 15th day of the 4th month after the end of the fiscal year 1 Estimated Tax for Year Ended Add Annual Business License 25. 5. Please attach a copy of this completed extension request to the actual Boone County Kentucky Net...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY 0506 - Boone County

Edit your KY 0506 - Boone County form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY 0506 - Boone County form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit KY 0506 - Boone County online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit KY 0506 - Boone County. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY 0506 - Boone County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY 0506 - Boone County

How to fill out KY 0506 - Boone County

01

Obtain the KY 0506 form from the Boone County official website or local government office.

02

Begin filling out the top section of the form with your name, address, and contact information.

03

Provide the required identification details such as social security number or taxpayer ID.

04

Complete the relevant sections regarding your income sources and any deductions you wish to claim.

05

Ensure you provide supporting documents where necessary, such as proof of income or residency.

06

Review the completed form for accuracy to avoid any errors.

07

Sign and date the form at the designated area to validate your submission.

08

Submit the KY 0506 form to the appropriate Boone County office as instructed.

Who needs KY 0506 - Boone County?

01

Residents of Boone County who are filing for local taxes.

02

Individuals seeking to claim deductions or credits at the county level.

03

Property owners in Boone County who need to report property information for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

Does Kentucky have a state income tax form?

A full-year resident of Kentucky files Form 740 and a person who moves into or out of Kentucky during the year or is a full-year nonresident files Form 740-NP.

What is Kentucky Form k5?

Form K-5. Form K-5 is used to report withholding statement information from Forms W-2, W-2G, and 1099 and is completed online with two filing methods to choose from. It may be filed electronically by clicking the submit button or the completed form may be printed and mailed to the address on the form.

What is the form 720 ext in Kentucky?

Form 720EXT grants an automatic 6-month extension of time to file Form 720. Kentucky State Partnership tax extension Form 720EXT is due within 4 months and 15 days following the end of the partnership reporting period.

Do I need to file an extension for Kentucky state tax return?

If you expect to owe Kentucky income taxes, you must pay at least 75% of your tax payment owed with the Extension Payment Voucher below the KY extension form by April 18, 2023 to avoid interest and late payment penalties.

What is the extension form for Kentucky Dept of Revenue?

To extend a filing date, use Form 41A720SL, Extension of Time to File Kentucky Corporation/ LLET Return. Extensions—Extensions are for filing purposes only; late payment penalties and interest apply to payments made after the original due date.

What is the Kentucky withholding tax?

Compute tax on wages using the 4.5% Kentucky flat tax rate to determine gross annual Kentucky tax. Divide the gross annual Kentucky tax by the number of annual pay periods to determine the Kentucky withholding tax for the pay period.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in KY 0506 - Boone County?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your KY 0506 - Boone County to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit KY 0506 - Boone County straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing KY 0506 - Boone County.

How do I edit KY 0506 - Boone County on an Android device?

You can make any changes to PDF files, such as KY 0506 - Boone County, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is KY 0506 - Boone County?

KY 0506 - Boone County is a form used for local tax reporting by businesses operating in Boone County, Kentucky.

Who is required to file KY 0506 - Boone County?

Businesses that generate taxable income or have payroll in Boone County are required to file KY 0506 - Boone County.

How to fill out KY 0506 - Boone County?

To fill out KY 0506 - Boone County, provide business information, report income or payroll figures, calculate local tax owed, and sign the form before submission.

What is the purpose of KY 0506 - Boone County?

The purpose of KY 0506 - Boone County is to collect local taxes from businesses to fund community services and infrastructure in Boone County.

What information must be reported on KY 0506 - Boone County?

KY 0506 - Boone County requires reporting of gross receipts, payroll information, business identification, and any applicable tax credits.

Fill out your KY 0506 - Boone County online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY 0506 - Boone County is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.