Get the free COMPANY VALUATION MODELING - leoron.com

Show details

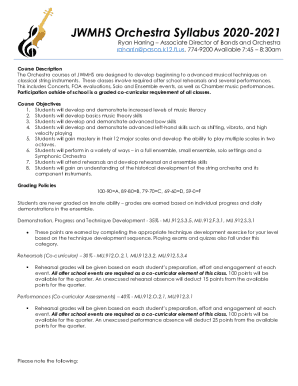

COURSE OVERVIEW In real life, the main challenge in valuing different entities is the ability to understand and quantify the various inputs. If the.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign company valuation modeling

Edit your company valuation modeling form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your company valuation modeling form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing company valuation modeling online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit company valuation modeling. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out company valuation modeling

How to fill out company valuation modeling:

01

Start by gathering all relevant financial information about the company, including its financial statements, historical performance, and projections for future growth.

02

Analyze the company's industry and market conditions to understand the potential risks and opportunities that may impact its valuation.

03

Identify the appropriate valuation methods to use, such as the discounted cash flow (DCF) analysis, comparable company analysis, or asset-based approach.

04

Calculate the company's intrinsic value by applying the selected valuation methods and considering factors such as future cash flows, risk-adjusted discount rates, and comparable company multiples.

05

Consider any unique factors or circumstances that may affect the company's valuation, such as pending legal issues, regulatory changes, or market trends.

06

Validate the valuation results by conducting sensitivity analysis and scenario planning to assess how changes in key assumptions or variables can impact the company's value.

07

Document the entire valuation process, including the methodologies used, assumptions made, and supporting data and analysis.

08

Present the company valuation modeling results and findings in a clear and concise manner, highlighting the key drivers of value and any potential risks or uncertainties.

Who needs company valuation modeling:

01

Entrepreneurs and business owners who are considering selling their company or attracting investors may need company valuation modeling to determine a fair asking price or negotiate investment terms.

02

Investors, such as private equity firms, venture capitalists, or angel investors, who are looking to allocate capital to different companies need company valuation modeling to evaluate potential investment opportunities.

03

Financial analysts and investment bankers who are involved in mergers and acquisitions (M&A) transactions or initial public offerings (IPOs) rely on company valuation modeling to assess the value of target companies and advise clients on investment decisions.

04

Lenders and creditors who are considering extending credit or loans to a company may use company valuation modeling to assess its ability to repay the debt based on its overall value.

05

Corporate finance departments within companies may utilize company valuation modeling for various purposes, including strategic planning, financial reporting, or evaluating potential acquisition targets.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the company valuation modeling electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your company valuation modeling in seconds.

Can I create an eSignature for the company valuation modeling in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your company valuation modeling and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

Can I edit company valuation modeling on an iOS device?

Create, edit, and share company valuation modeling from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is company valuation modeling?

Company valuation modeling is a process used to estimate the economic value of a business or company.

Who is required to file company valuation modeling?

Companies, investors, and financial analysts may be required to file company valuation modeling.

How to fill out company valuation modeling?

Company valuation modeling can be filled out by using various valuation methods such as discounted cash flow analysis, comparable company analysis, or precedent transactions analysis.

What is the purpose of company valuation modeling?

The purpose of company valuation modeling is to determine the worth of a business or company for various reasons such as investment decisions, M&A transactions, or financial reporting.

What information must be reported on company valuation modeling?

Company valuation modeling typically includes financial data, industry analysis, market trends, and assumptions used in the valuation process.

Fill out your company valuation modeling online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Company Valuation Modeling is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.