MA DoR M-4422 2016 free printable template

Show details

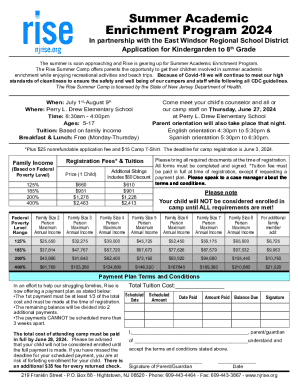

Make check or money order payable to Commonwealth of Massachusetts. Rev. 4/16 FORM M-4422 PAGE 2 Part 1. Massachusetts Department of Revenue Form M-4422 Application for Certificate Releasing Massachusetts Estate Tax Lien Name of decedent Date of death mm/dd/yyyy Social Security number Street address City/Town State Zip County of probate court Case/Docket number Name of executor/personal representative Phone Property being sold transferred or mortgaged Name of purchaser transferee or mortgagee...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form m 4422

Edit your form m 4422 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form m 4422 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form m 4422 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form m 4422. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA DoR M-4422 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form m 4422

How to fill out MA DoR M-4422

01

Obtain the MA DoR M-4422 form from the Massachusetts Department of Revenue website or your local office.

02

Fill in your personal information including your name, address, and Social Security number.

03

Indicate the type of application you are submitting, such as a refund request or an adjustment.

04

Provide details about your income, deductions, and any other relevant financial information.

05

Include any necessary supporting documentation as specified in the form instructions.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the form via mail or electronically, following the submission instructions provided.

Who needs MA DoR M-4422?

01

Individuals or businesses in Massachusetts who need to report income discrepancies, seek tax refunds, or make adjustments to their tax filings.

Fill

form

: Try Risk Free

People Also Ask about

What is the Massachusetts estate tax waiver?

The Massachusetts estate tax exemption is $1 million. This means that if your estate is worth more than $1 million when you die, money will be owed to the state before it's disbursed to your heirs. However, if it's smaller than $1 million, then no state estate taxes will be owed.

What is Form M 4422?

Form M-4422 Application for Certificate Releasing Massachusetts Estate Tax Lien.

What is the best trust to avoid estate taxes?

Charitable remainder trusts (CRTs) are often used for highly appreciated assets, because they help divert capital gains taxes as well as estate taxes. They may be a good choice for real estate, stocks, mutual funds or other assets that have been in a portfolio for some time.

What is the Massachusetts estate tax exemption for 2023?

For calendar years beginning on or after January 1, 2023, the exemption shall be $1,000,000 increased by an amount equal to $1,000,000 multiplied by the percentage, if any, by which the CPI for the preceding calendar year exceeds the CPI for calendar year 2022.

How do I avoid estate tax in Massachusetts?

You can avoid the estate tax in Massachusetts if you do not own any tangible property in the state in your own name. However, as mentioned above, transferring a property in Massachusetts into a revocable living trust does not remove that property from your taxable estate.

How much can you inherit without paying taxes in MA?

The Massachusetts estate tax exemption is $1 million. This means that if your estate is worth more than $1 million when you die, money will be owed to the state before it's disbursed to your heirs. However, if it's smaller than $1 million, then no state estate taxes will be owed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form m 4422 directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your form m 4422 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I make changes in form m 4422?

With pdfFiller, the editing process is straightforward. Open your form m 4422 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I complete form m 4422 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your form m 4422. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is MA DoR M-4422?

MA DoR M-4422 is a form used in Massachusetts for reporting certain income and expenses of residents to ensure compliance with state tax laws.

Who is required to file MA DoR M-4422?

Individuals and businesses in Massachusetts that meet specific income thresholds or engage in certain activities are required to file MA DoR M-4422.

How to fill out MA DoR M-4422?

To fill out MA DoR M-4422, individuals or businesses must provide personal and financial information, including income details and any relevant expenses, following the instructions provided with the form.

What is the purpose of MA DoR M-4422?

The purpose of MA DoR M-4422 is to collect information that helps the Massachusetts Department of Revenue assess and ensure accurate tax filings and compliance with state tax regulations.

What information must be reported on MA DoR M-4422?

MA DoR M-4422 requires reporting of income sources, expenses, tax credits, and any other relevant financial information that contributes to the assessment of tax liabilities.

Fill out your form m 4422 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form M 4422 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.