MA DoR M-4422 2004 free printable template

Show details

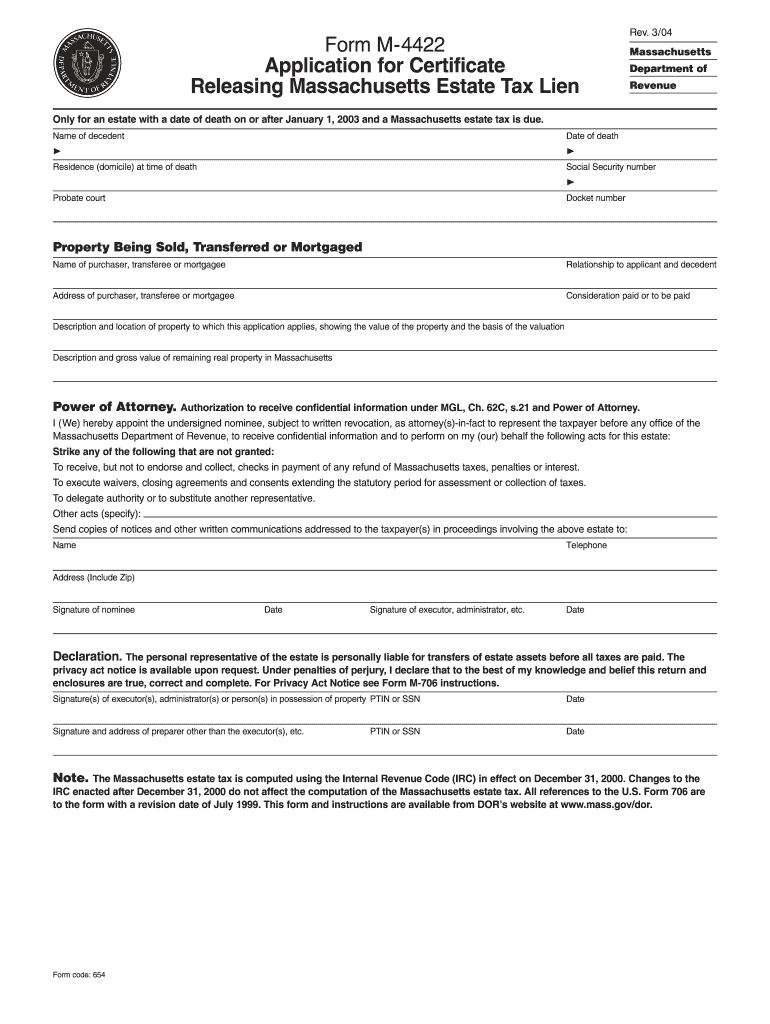

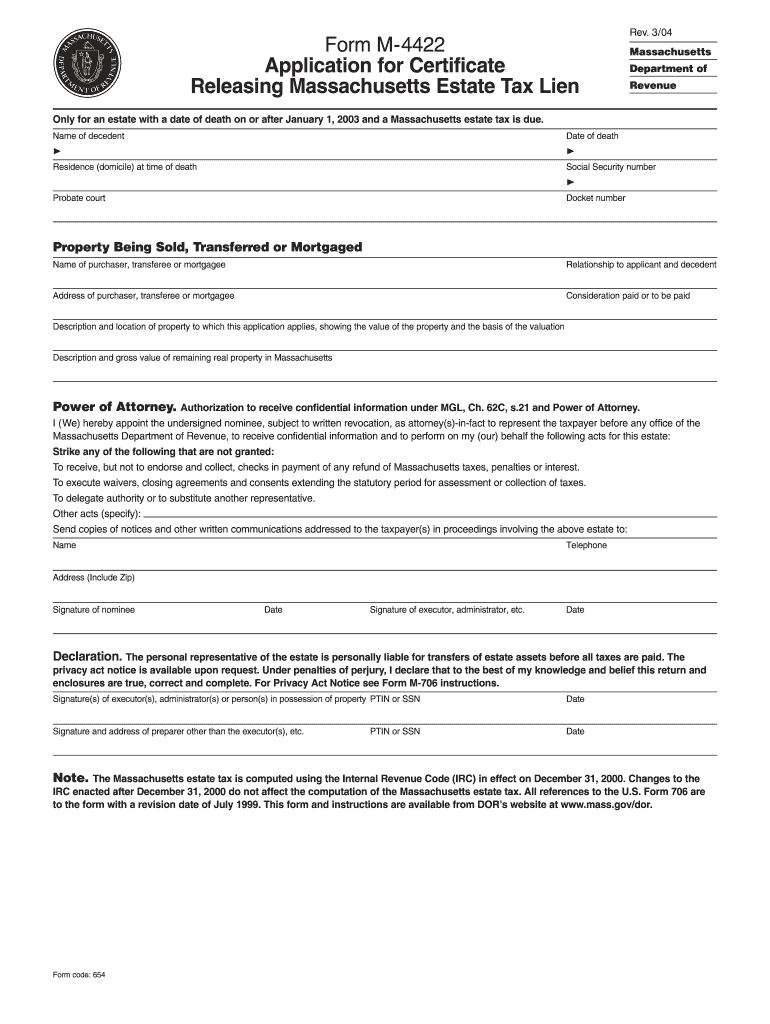

Note Form M-4422 is not a substitute for Form M-706 which must be filed within nine months of the decedent s death or before any approved extension date. Form M-4422 Application for Certificate Releasing Massachusetts Estate Tax Lien Rev. 3/04 Massachusetts Department of Revenue Only for an estate with a date of death on or after January 1 2003 and a Massachusetts estate tax is due. Name of decedent Date of death Residence domicile at time of death Social Security number Probate court Docket...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MA DoR M-4422

Edit your MA DoR M-4422 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MA DoR M-4422 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MA DoR M-4422 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit MA DoR M-4422. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA DoR M-4422 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MA DoR M-4422

How to fill out MA DoR M-4422

01

Obtain the MA DoR M-4422 form from the Massachusetts Department of Revenue website.

02

Fill out the personal information section, including your name, address, and social security number.

03

Provide the relevant tax period for which you are filing.

04

Enter the details of your income and any deductions you wish to claim.

05

Review all entered information for accuracy.

06

Sign and date the form where indicated.

07

Submit the form via mail or online as instructed.

Who needs MA DoR M-4422?

01

Individuals who are required to file a personal income tax return in Massachusetts.

02

Taxpayers seeking to report their income and claim deductions or credits.

03

Anyone needing to amend a previous tax return for the specified period.

Fill

form

: Try Risk Free

People Also Ask about

How do I avoid estate tax in Massachusetts?

You can avoid the estate tax in Massachusetts if you do not own any tangible property in the state in your own name. However, as mentioned above, transferring a property in Massachusetts into a revocable living trust does not remove that property from your taxable estate.

What is IRS Form 4422?

If the estate you're administering has a Form 706 or Form 706-NA filing requirement, and the property is administered by an executor or administrator appointed, qualified, and acting within the United States, apply for a discharge of the estate tax lien by submitting Form 4422, Application for Certificate Discharging

What is Form M 4422?

Form M-4422 Application for Certificate Releasing Massachusetts Estate Tax Lien.

What is the Massachusetts estate tax exemption for 2023?

For calendar years beginning on or after January 1, 2023, the exemption shall be $1,000,000 increased by an amount equal to $1,000,000 multiplied by the percentage, if any, by which the CPI for the preceding calendar year exceeds the CPI for calendar year 2022.

What is the Massachusetts estate tax waiver?

The Massachusetts estate tax exemption is $1 million. This means that if your estate is worth more than $1 million when you die, money will be owed to the state before it's disbursed to your heirs. However, if it's smaller than $1 million, then no state estate taxes will be owed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit MA DoR M-4422 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign MA DoR M-4422 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How can I fill out MA DoR M-4422 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your MA DoR M-4422 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

How do I complete MA DoR M-4422 on an Android device?

Use the pdfFiller app for Android to finish your MA DoR M-4422. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is MA DoR M-4422?

MA DoR M-4422 is a specific form used by the Massachusetts Department of Revenue for certain tax reporting purposes.

Who is required to file MA DoR M-4422?

Individuals or businesses that meet specific income thresholds or who have certain types of tax liabilities may be required to file MA DoR M-4422.

How to fill out MA DoR M-4422?

To fill out MA DoR M-4422, gather all relevant financial information, follow the form instructions carefully, and provide accurate details as required.

What is the purpose of MA DoR M-4422?

The purpose of MA DoR M-4422 is to provide the Massachusetts Department of Revenue with necessary information for tax assessment and compliance.

What information must be reported on MA DoR M-4422?

Information that must be reported on MA DoR M-4422 typically includes income details, deductions, credits, and any other relevant tax information.

Fill out your MA DoR M-4422 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MA DoR M-4422 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.