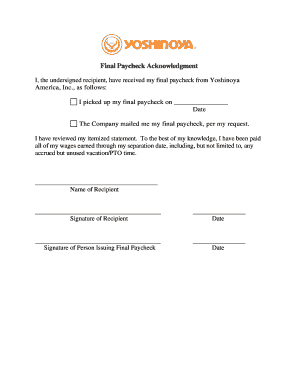

Get the free final paycheck acknowledgement form

Show details

EMPLOYEE PAYCHECK RECEIPT ACKNOWLEDGMENT AND UNDERSTANDINGS TO EMPLOYER envelope. To be provided to employees with each paycheck or payroll TO EMPLOYEE Please read carefully and sign below. If you require translation by signing below you acknowledge that this form has been read to you in your native language or otherwise translated and that you understand completely the contents of the form* I received my paycheck for the pay period. My paycheck accurately reflects wages including any...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign paycheck received form

Edit your paycheck receipt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your final pay acknowledgement form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit final paycheck acknowledgement form california online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit last paycheck final paycheck form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employee paycheck form

How to fill out paycheck received form?

01

Obtain the paycheck received form: The first step in filling out a paycheck received form is to obtain the form itself. You can typically obtain this form directly from your employer or download it from their website.

02

Fill in personal information: The next step is to include your personal information on the form. This might include your full name, address, social security number, and employee identification number. Make sure to double-check the accuracy of this information before proceeding.

03

Enter the payment details: After providing your personal information, you will need to enter the payment details. This typically includes the date of the paycheck, the pay period it covers, and the total amount received. You may also need to specify whether it is a regular paycheck, bonus, or any other type of payment.

04

Include any deductions or taxes withheld: If any deductions or taxes were withheld from your paycheck, you will need to include these in the form. This might include items such as federal income tax, state or local taxes, healthcare deductions, retirement contributions, or any other payroll deductions.

05

Sign and date the form: Once you have completed all the necessary information, you need to sign and date the form. By signing it, you are certifying that all the information provided is accurate to the best of your knowledge.

Who needs paycheck received form?

01

Employees: Employees receiving a paycheck from their employer are typically required to fill out the paycheck received form. It serves as a record of their earnings and is often required for various purposes like tax filing, proof of income, or tracking personal financials.

02

Employers: Employers also need the paycheck received form as it helps facilitate accurate payroll processing and record-keeping. It ensures that the correct payment is made to each employee, tracks deductions and tax withholdings, and helps in maintaining comprehensive payroll records.

03

Accounting or HR departments: Accounting or Human Resources departments within a company typically handle the payroll process. They utilize the paycheck received forms to ensure accurate record-keeping, prepare financial statements, calculate taxes, and provide necessary information for audits or compliance purposes.

Overall, the paycheck received form is essential for both employees and employers as it helps document payments, deductions, and serves as a vital financial record.

Fill

check received form

: Try Risk Free

People Also Ask about payroll paycheck signature sheet

How do I acknowledge my final paycheck?

I, the undersigned recipient, have received my final paycheck from __(Company Name)__. To the best of my knowledge, there is no additional money owed to me by the employer at the present time. Name of Recipient (please print) Dept.

How do you acknowledge a salary receipt?

I, _ (NAME), accept payment of my salary of Rs. _ /- for the period I worked with the Company, between _ (Date ex. 1 st JAN.

What is an example of Acknowledgement letter for payment?

Dear Ms Shruti, With this letter, we hereby acknowledge the invoice of Rs. 17,000 (seventeen thousand rupees only) as payment for office supplies from (date) to (date). I have attached our official invoice no—7890 acknowledging your payment for your reference.

How do I write a letter for my last paycheck?

Dear [employer name]: This is a demand for my final wages. My last day of work was [last day of work]. I have worked and not been paid for [number of hours] hours and I am owed [dollar-amount owed] at this time.

What is employee Acknowledgement mean?

An employee acknowledgement or policy acknowledgement form is a simple form employees are asked to sign to acknowledge that they have reviewed and understood the company's policies as expressed in onboarding material, the employee handbook, or documentation announcing policy changes.

What is Acknowledgement of salary payment?

Employee acknowledges and represents that the Company has paid all salary, wages, bonuses, accrued vacation, business expense reimbursements, commissions and any and all other benefits due to Employee as of the Effective Date of this Agreement.

How do I acknowledge receipt of paycheck?

I, the undersigned recipient, have received my final paycheck from __(Company Name)__. To the best of my knowledge, there is no additional money owed to me by the employer at the present time. Name of Recipient (please print) Dept.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify paycheck signature sheet without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your final paycheck form into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I create an eSignature for the pick up check acknowledgement form in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your final paycheck letter to employee template directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I complete payroll received form on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your paycheck pick up form from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is paycheck received form?

A paycheck received form is a document used to officially record the amount of money an employee receives from their employer during a specific pay period.

Who is required to file paycheck received form?

Employees who receive a paycheck from their employer may be required to fill out and file a paycheck received form for tax reporting purposes.

How to fill out paycheck received form?

To fill out a paycheck received form, an employee generally needs to provide their personal information, details of the payment received, the period for which the payment was made, and any deductions taken from the paycheck.

What is the purpose of paycheck received form?

The purpose of a paycheck received form is to provide a record of earnings for employees and ensure proper tax reporting and compliance.

What information must be reported on paycheck received form?

The information that must be reported on a paycheck received form typically includes the employee's name, Social Security number, employer's information, gross pay, deductions, and net pay.

Fill out your final paycheck acknowledgement form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Final Pay Letter To Employee is not the form you're looking for?Search for another form here.

Keywords relevant to final pay letter to employee template

Related to final paycheck

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.