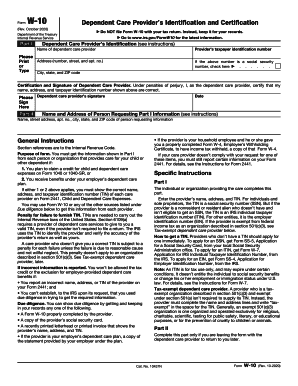

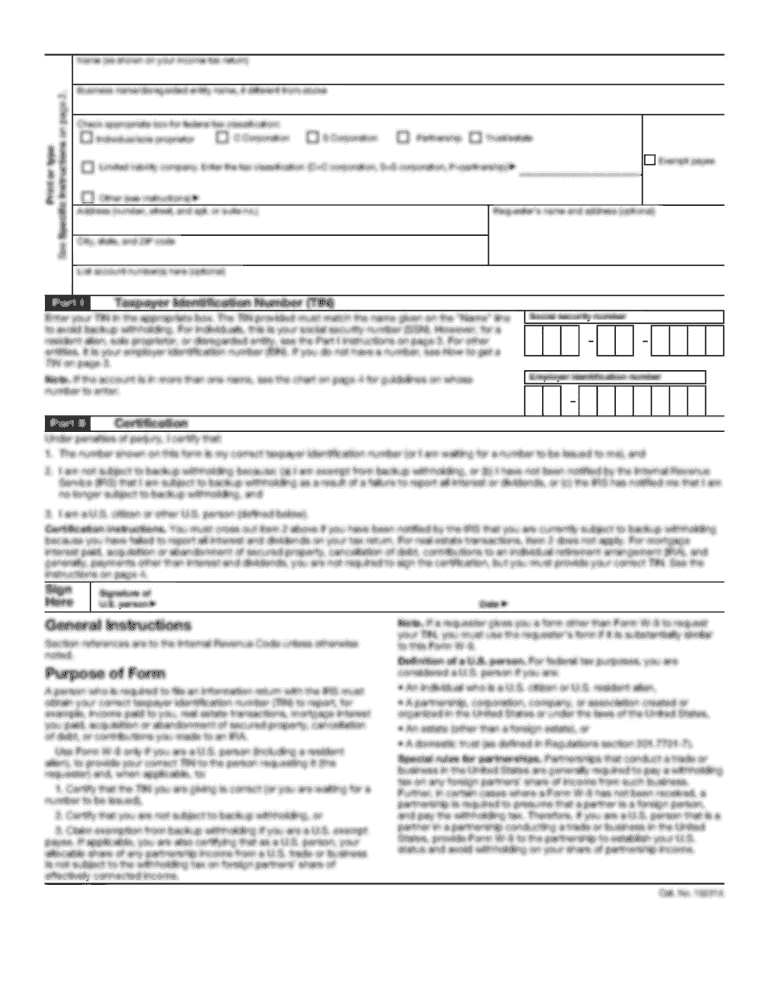

IRS W-10 2011 free printable template

Instructions and Help about IRS W-10

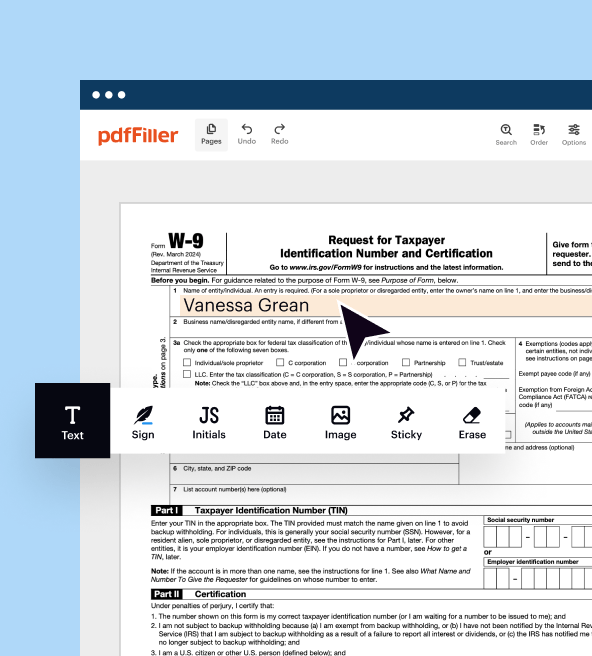

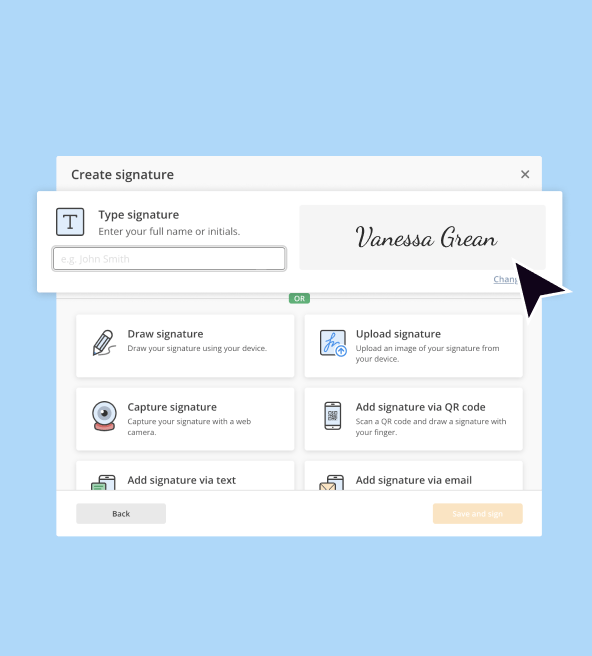

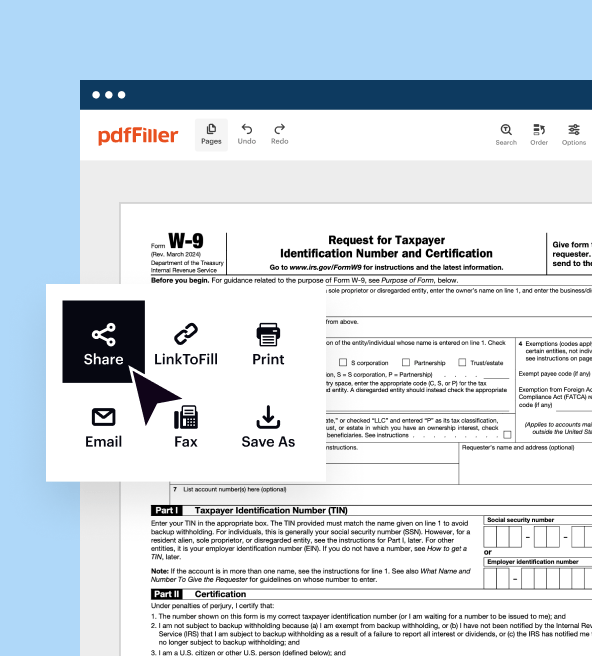

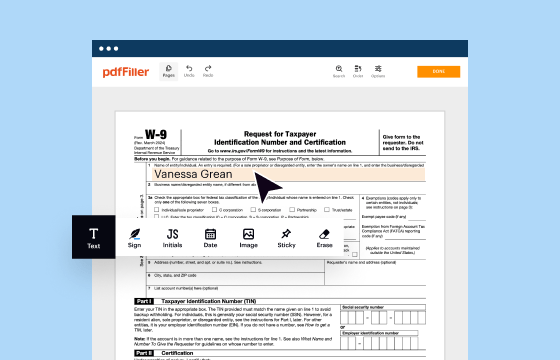

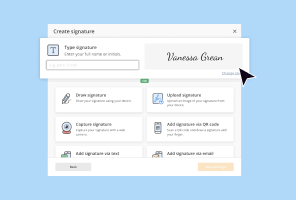

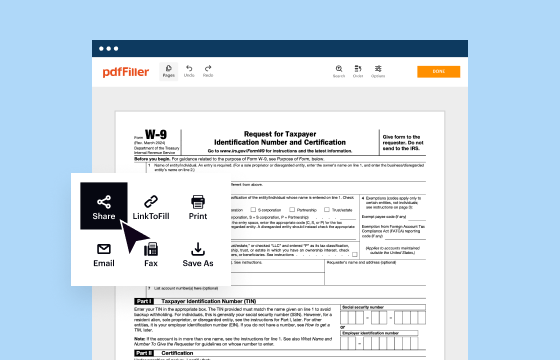

How to edit IRS W-10

How to fill out IRS W-10

About IRS W-10 2011 previous version

What is IRS W-10?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS W-10

What should I do if I realize I've made a mistake on my form w 10 rev after submission?

If you discover an error after submitting your form w 10 rev, you should file an amended form. Correct the errors on the new form, clearly indicate it's an amendment, and submit it as soon as possible to prevent any penalties. Keep records of both the original and amended submissions for your records.

How can I verify if my form w 10 rev has been received and processed?

To check the status of your form w 10 rev, you can contact the IRS directly or utilize their online tools if available. Common e-file rejection codes may also help you understand if there was an issue with your submission, allowing you to troubleshoot effectively.

Are there any circumstances where a nonresident can file a form w 10 rev?

Nonresidents may need to submit a form w 10 rev in specific cases where they are engaged in business activities within the United States. It's essential for foreign payees to understand their tax obligations and whether exemptions apply, so consulting with a tax professional is advisable.

What are some common errors filers make with the form w 10 rev, and how can I avoid them?

Common mistakes when filing the form w 10 rev include incorrect payer or payee information, failing to sign the form, or not providing necessary attachments. To avoid these errors, double-check all information before submission and ensure you meet all requirements specified by the IRS.

If my form w 10 rev gets rejected, what options do I have for resubmission?

If your form w 10 rev is rejected, review the rejection codes for guidance on the issue. You can correct the mistakes as indicated and resubmit the form. Depending on the nature of the rejection, you may also contact support if you need further clarification to successfully complete your filing.

See what our users say