Get the free Do not spend too much

Show details

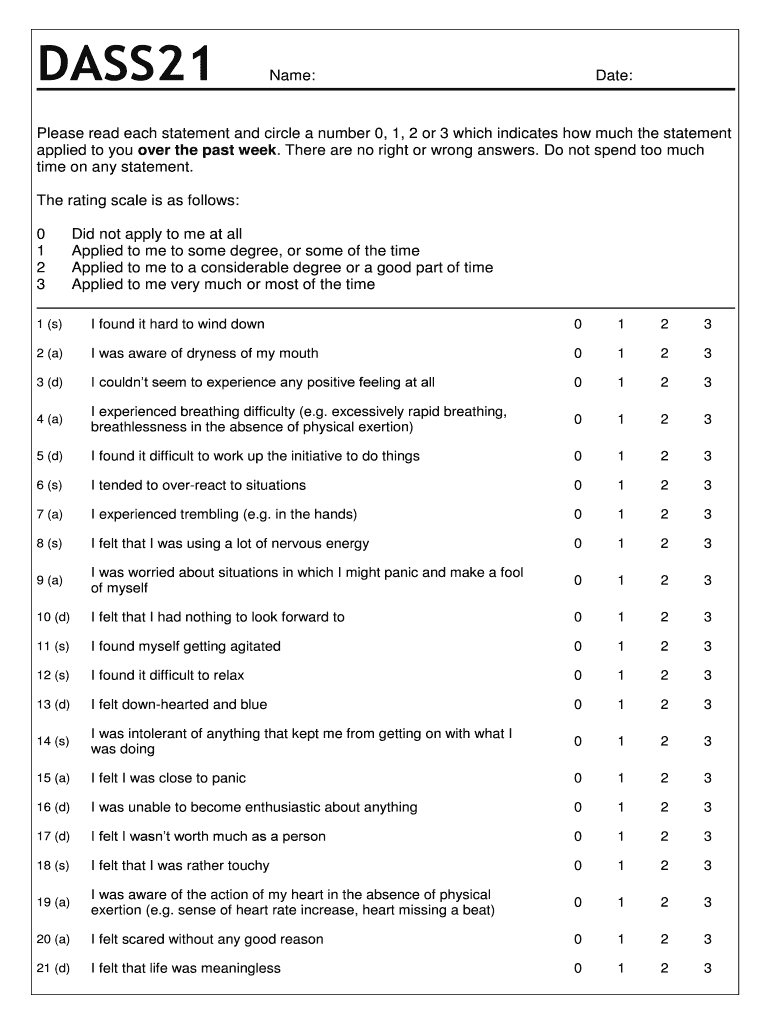

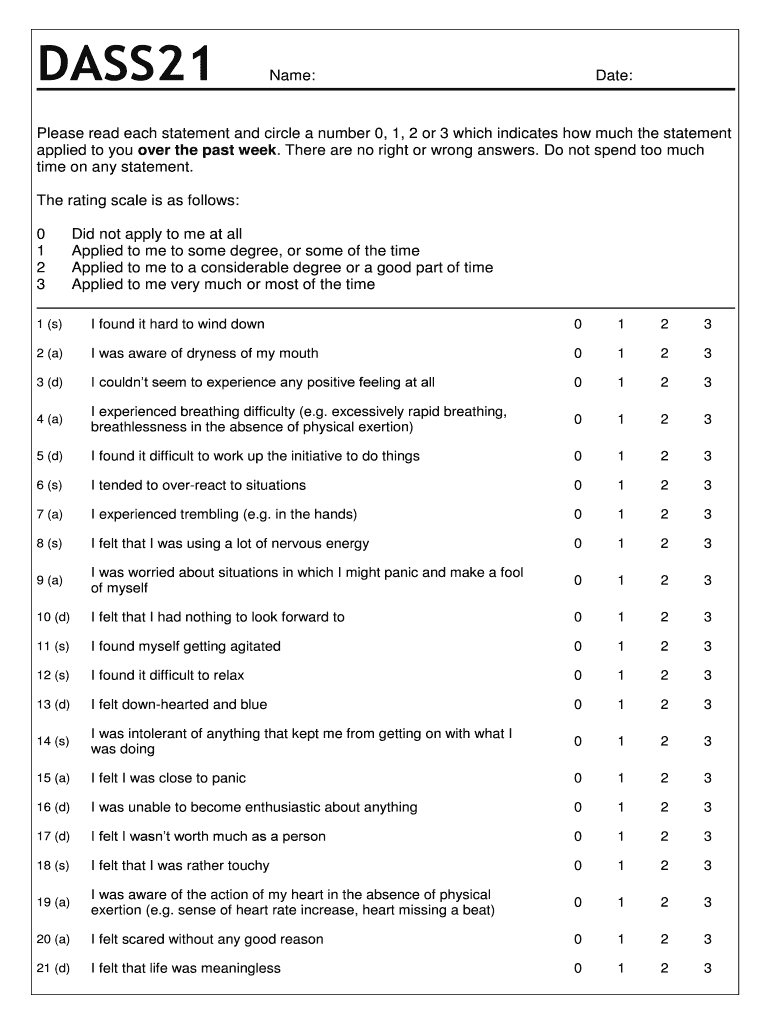

DASS21Name:Date:Please read each statement and circle a number 0, 1, 2 or 3 which indicates how much the statement

applied to you over the past week. There are no right or wrong answers. Do not spend

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign do not spend too

Edit your do not spend too form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your do not spend too form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing do not spend too online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit do not spend too. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out do not spend too

How to fill out "do not spend too"?

01

Start by assessing your financial situation: Before you can effectively manage your spending, it's important to understand your current financial situation. Take a look at your income, expenses, and any debts or financial commitments you have. This will give you a clear picture of where your money is going.

02

Set a budget: Once you have a clear understanding of your financial situation, create a budget that outlines your income and expenses. This will help you allocate your money to different categories such as bills, groceries, savings, etc. Make sure to leave some room for discretionary spending, but be mindful of not going overboard.

03

Track your expenses: Keep track of every penny you spend. This can be done using a spreadsheet, budgeting app, or even a simple pen and paper. By tracking your expenses, you will have a better idea of where your money is going and be able to identify areas where you can cut back.

04

Identify unnecessary expenses: Review your expenses and identify any unnecessary or discretionary spending. These might include eating out frequently, impulse purchases, or unused subscriptions. Cut back on these expenses to save more money and prevent unnecessary spending.

05

Set financial goals: Determine what your financial goals are. Are you saving for a down payment on a house, paying off debt, or building an emergency fund? By setting clear goals, you will have a specific focus and be less likely to spend money on unnecessary items.

06

Prioritize needs over wants: Differentiate between your needs and wants. Focus on fulfilling your needs first, such as paying bills, buying groceries, and covering essential expenses. Once your needs are taken care of, you can allocate a portion of your budget towards your wants.

07

Be mindful of sales and discounts: While sales and discounts can be tempting, be cautious of falling into the trap of unnecessary spending. Only take advantage of sales when it aligns with your needs or goals. Avoid buying things simply because they are on sale, as it can lead to impulse purchases and unnecessary expenses.

Who needs "do not spend too"?

01

Individuals on a limited budget: If you have a limited income or are trying to save money, it's crucial to avoid spending too much. By following these tips, you can make the most of your available funds and avoid falling into debt.

02

People trying to get out of debt: If you are burdened with debt, minimizing unnecessary spending is essential for improving your financial situation. By filling out "do not spend too," individuals can prioritize debt repayment and gradually eliminate their financial obligations.

03

Those saving for a specific goal: Whether you're saving for a vacation, a new car, or a house, minimizing excessive spending is crucial. By managing your expenses effectively, you can allocate more funds toward achieving your savings goals faster.

Remember, everyone can benefit from practicing responsible spending habits. It's never too late to start managing your finances wisely and filling out "do not spend too."

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete do not spend too online?

Easy online do not spend too completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How can I fill out do not spend too on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your do not spend too by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Can I edit do not spend too on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute do not spend too from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is do not spend too?

Do not spend too refers to a financial budgeting practice where individuals or organizations are advised not to exceed their allocated budget or spending limit.

Who is required to file do not spend too?

Anyone who is responsible for managing a budget or finances is required to practice do not spend too.

How to fill out do not spend too?

To fill out do not spend too, one must carefully monitor expenses, set a budget, track spending, and avoid unnecessary purchases.

What is the purpose of do not spend too?

The purpose of do not spend too is to manage finances effectively, prevent overspending, and stay within budget limits.

What information must be reported on do not spend too?

Information such as income, expenses, savings goals, and financial obligations must be reported on do not spend too.

Fill out your do not spend too online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Do Not Spend Too is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.