Get the free IAS 12 INCOME TAXES - cpaaustralia.com.au - cpaaustralia com

Show details

2 IAS 12 Income Taxes This fact sheet is based on existing requirements as at 31 December 2015, and it does not take into account recent standards and ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ias 12 income taxes

Edit your ias 12 income taxes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ias 12 income taxes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ias 12 income taxes online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ias 12 income taxes. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ias 12 income taxes

How to fill out IAS 12 income taxes:

01

Understand the relevant provisions: Begin by familiarizing yourself with the requirements and provisions outlined in IAS 12 - Income Taxes. This standard provides guidance on accounting for income taxes, including how to recognize, measure, and disclose tax assets and liabilities.

02

Gather necessary information: Collect all the relevant financial and tax information required for completing the income tax calculations. This includes information about taxable income, tax rates, tax credits, tax holidays, and any changes in tax legislation.

03

Determine temporary differences: Identify temporary differences between the carrying amount and tax base of assets and liabilities. Temporary differences may arise from accelerated depreciation methods, revaluation of assets, or unrecognized tax benefits. Evaluate these differences to determine their tax consequences.

04

Calculate deferred tax assets and liabilities: Calculate the deferred tax assets and liabilities resulting from the temporary differences. Deferred tax assets represent future tax benefits, while deferred tax liabilities indicate future tax obligations. Use the applicable tax rates and rules when making these calculations.

05

Analyze tax positions: Analyze and evaluate the tax positions taken by the entity to ensure compliance with the requirements of IAS 12. Assess the probability of future tax outcomes and determine appropriate provisions or adjustments to ensure accurate reporting.

06

Prepare tax provision and disclosures: Based on the above calculations and analysis, prepare the tax provision for inclusion in the financial statements. Provide detailed disclosures about significant tax uncertainties, tax strategies, and any unrecognized tax benefits as required by IAS 12.

Who needs IAS 12 income taxes?

IAS 12 applies to all entities that prepare financial statements and are subject to income taxes. This includes but is not limited to:

01

Publicly traded companies: Companies listed on stock exchanges are typically required to comply with international accounting standards, including IAS 12. This standard ensures consistency and transparency in reporting income taxes.

02

Privately held companies: Even if not mandated by regulations, private companies may opt to follow IAS 12 to enhance the quality and comparability of their financial statements. It can provide stakeholders with a clearer understanding of the company's tax positions.

03

Government entities: Government entities that are subject to income taxes must also comply with IAS 12. This ensures that tax revenues and expenses are properly accounted for and disclosed in their financial statements.

04

Non-profit organizations: Non-profit organizations that generate taxable income, such as from unrelated business activities, need to adhere to IAS 12 when reporting their income taxes.

In summary, any entity that prepares financial statements and is subject to income taxes can benefit from implementing the guidelines set forth in IAS 12 to accurately account for and disclose their income taxes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ias 12 income taxes for eSignature?

When your ias 12 income taxes is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I sign the ias 12 income taxes electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your ias 12 income taxes in minutes.

How do I fill out ias 12 income taxes using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign ias 12 income taxes. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is ias 12 income taxes?

IAS 12 Income Taxes is an international accounting standard that outlines the accounting treatment for income taxes.

Who is required to file ias 12 income taxes?

Companies that are subject to income taxes as per their respective jurisdiction are required to file IAS 12 Income Taxes.

How to fill out ias 12 income taxes?

IAS 12 Income Taxes should be filled out by following the guidelines and requirements set forth in the standard. It involves calculating income tax expenses, current and deferred tax liabilities and assets.

What is the purpose of ias 12 income taxes?

The purpose of IAS 12 Income Taxes is to ensure that companies account for income taxes in a consistent and transparent manner, providing relevant information to users of financial statements.

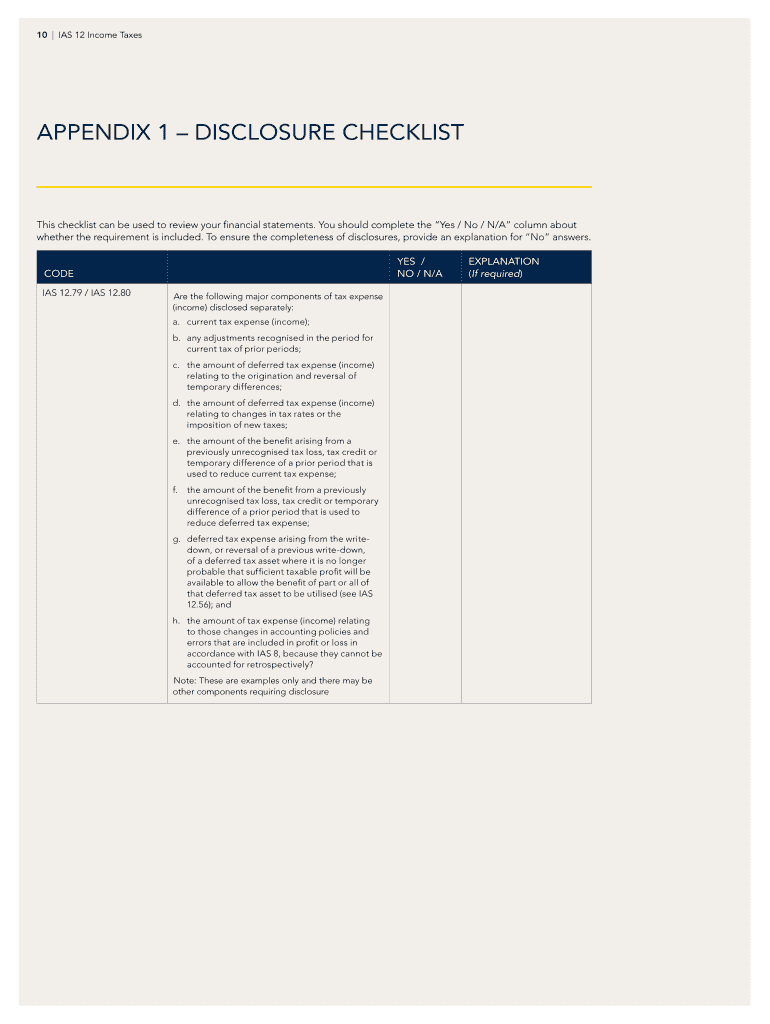

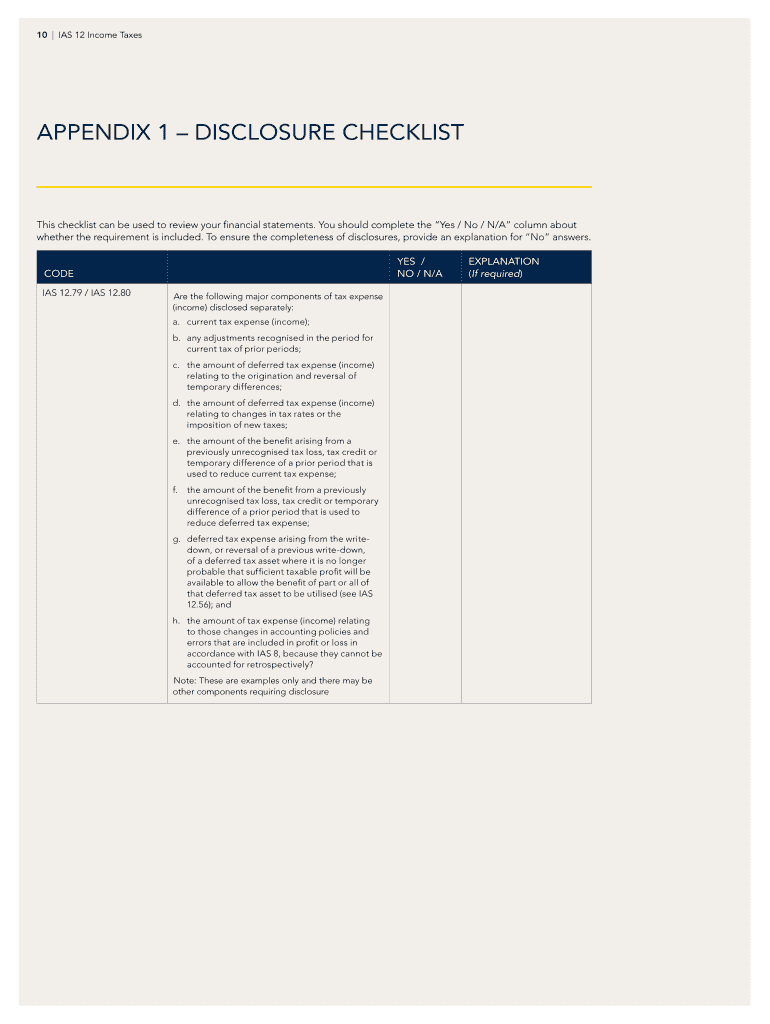

What information must be reported on ias 12 income taxes?

IAS 12 Income Taxes requires the reporting of current and deferred tax assets and liabilities, income tax expenses, any adjustments to unrecognized tax benefits, and other relevant tax information.

Fill out your ias 12 income taxes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ias 12 Income Taxes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.