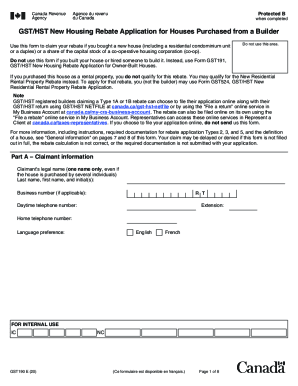

Canada GST190 E 2013 free printable template

Show details

Duplex Application Type (tick one box). See Guide RC4028, GST/HST New Housing Rebate, to verify that you meet the conditions to claim the rebate.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada GST190 E

Edit your Canada GST190 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada GST190 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada GST190 E online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Canada GST190 E. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada GST190 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada GST190 E

How to fill out Canada GST190 E

01

Download the GST190 E form from the Canada Revenue Agency (CRA) website.

02

Fill in your business information, including name, address, and GST/HST number.

03

Indicate the type of application you are submitting (e.g., to cancel your GST/HST registration).

04

Provide details about your business activities and reason for applying.

05

Specify any relevant dates related to your application.

06

Review the completed form for accuracy and make sure all required fields are filled.

07

Sign and date the form where indicated.

08

Submit the completed GST190 E form to the CRA, either by mail or through the online services if available.

Who needs Canada GST190 E?

01

Any business that is registered for GST/HST in Canada and wants to cancel their registration.

02

Individuals or entities seeking to update their business information related to GST/HST registration.

03

Businesses that have ceased operations and need to inform the CRA.

Fill

form

: Try Risk Free

People Also Ask about

Who qualifies for HST rebate Ontario?

To receive the GST/HST credit you have to be a resident of Canada for tax purposes, and at least 1 of the following applies, you: Are 19 years of age or older; Have (or previously had) a spouse or common-law partner; or. Are (or previously were) a parent and live (or previously lived) with your child.

How do I claim HST rebate in Ontario?

How to claim the GST/HST rebate. To claim your rebate, use Form GST189, General Application for GST/HST Rebate. You can only use one reason code per rebate application. If you are eligible to claim a rebate under more than one code, use a separate rebate application for each reason code.

Who qualifies for GST rebate in Alberta?

GST/HST credit eligibility requirements You are at least 19 years old. You have (or had) a spouse/common-law partner. You are (or were) a parent and live (or lived) with your child.

What is the GST rebate on new housing in BC?

The GST is a Federal tax of 5% on the purchase price of a new home or a substantially renovated home. New home buyers can apply for a rebate of up to a maximum of 36% of the tax if the purchase price is $350,000 or less. A partial GST rebate is available for new homes costing between $350,000 and $450,000.

How do I qualify for HST rebate in Ontario?

You are generally eligible for the GST/HST credit if you are considered a Canadian resident for income tax purposes the month before and at the beginning of the month in which the Canada Revenue Agency makes a payment. You also need to meet one of the following criteria: you are at least 19 years old.

What is the new home rebate in Nova Scotia?

Apply for a First-time Home Buyers' Rebate on a newly-built home. Apply for a rebate of up to $3,000 on the purchase of a newly-built home.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Canada GST190 E to be eSigned by others?

When you're ready to share your Canada GST190 E, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How can I get Canada GST190 E?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the Canada GST190 E in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit Canada GST190 E online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your Canada GST190 E to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

What is Canada GST190 E?

Canada GST190 E is a form used for reporting the GST/HST (Goods and Services Tax/Harmonized Sales Tax) to the Canada Revenue Agency (CRA) by certain registrants who are required to disclose their taxable supplies.

Who is required to file Canada GST190 E?

Businesses that are registered for GST/HST and have had taxable supplies during the reporting period are required to file Canada GST190 E.

How to fill out Canada GST190 E?

To fill out Canada GST190 E, you need to provide the total amount of taxable supplies, the GST/HST collected, any adjustments, and the reporting period. Ensure all amounts are accurate and consistent with your sales records.

What is the purpose of Canada GST190 E?

The purpose of Canada GST190 E is to allow businesses to report their GST/HST collected and to calculate the amount owed to or refundable from the Canada Revenue Agency.

What information must be reported on Canada GST190 E?

The Canada GST190 E requires reporting of total taxable supplies, GST/HST collected, input tax credits claimed, and any adjustments made during the reporting period.

Fill out your Canada GST190 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada gst190 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.