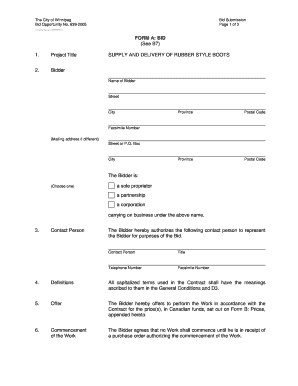

Canada GST190 E 2017 free printable template

Show details

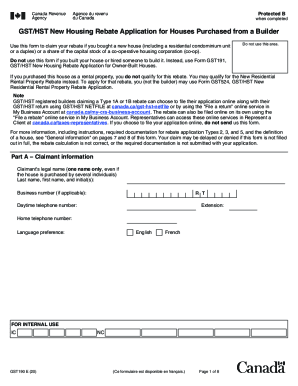

Clear DataHelpProtected B

when completest/HST New Housing Rebate Application for Houses Purchased from a Builder

Use this form to claim your rebate if you bought a new house (including a residential

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada GST190 E

Edit your Canada GST190 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada GST190 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada GST190 E online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Canada GST190 E. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada GST190 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada GST190 E

How to fill out Canada GST190 E

01

Obtain a copy of the Canada GST190 E form.

02

Fill in your personal information, including your name, address, and contact details.

03

Indicate your reason for applying for the GST/HST credit.

04

Provide your Social Insurance Number (SIN).

05

Ensure all sections are completed accurately.

06

Review the information for any errors or missing details.

07

Sign and date the form.

08

Submit the form to the appropriate tax office as instructed.

Who needs Canada GST190 E?

01

Individuals who have a low or modest income and wish to apply for the GST/HST credit.

02

Residents of Canada who meet the eligibility criteria for the credit.

03

People who have recently parted from a spouse or common-law partner and wish to update their information.

Fill

form

: Try Risk Free

People Also Ask about

How much is the GST rebate in BC?

The size of your GST/HST credit depends on your net family income, your marital status and whether you have children. For the 2021 tax year (which pays out from July 2022 to June 2023), the maximums are: $467 if you are single. $612 if you are married or have a common-law partner.

What is the GST rebate on new homes in Alberta?

How much is the new housing rebate? The new housing rebate is worth 36% of the GST or federal portion of the HST paid on a newly constructed home, up to a maximum of $6,300. The rebate is valid on homes that are considered fair to the market with a value of $350,000 or less.

How much is GST in Canada?

The current rates are: 5% (GST) in Alberta, British Columbia, Manitoba, Northwest Territories, Nunavut, Quebec, Saskatchewan, and Yukon. 13% (HST) in Ontario. 15% (HST) in New Brunswick, Newfoundland and Labrador, Nova Scotia, and Prince Edward Island.

How do I claim my GST refund Canada?

To claim your rebate, use Form GST189, General Application for GST/HST Rebate. You can only use one reason code per rebate application. If you are eligible to claim a rebate under more than one code, use a separate rebate application for each reason code.

Who qualifies for GST rebate in BC?

To receive the GST/HST credit you have to be a resident of Canada for tax purposes, and at least 1 of the following applies, you: Are 19 years of age or older; Have (or previously had) a spouse or common-law partner; or. Are (or previously were) a parent and live (or previously lived) with your child.

What is the GST rebate on new housing in BC?

The GST is a Federal tax of 5% on the purchase price of a new home or a substantially renovated home. New home buyers can apply for a rebate of up to a maximum of 36% of the tax if the purchase price is $350,000 or less. A partial GST rebate is available for new homes costing between $350,000 and $450,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find Canada GST190 E?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the Canada GST190 E in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I fill out Canada GST190 E using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign Canada GST190 E and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit Canada GST190 E on an iOS device?

Use the pdfFiller mobile app to create, edit, and share Canada GST190 E from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is Canada GST190 E?

Canada GST190 E is a form used by businesses in Canada to apply for an input tax credit for the Goods and Services Tax (GST) or Harmonized Sales Tax (HST) paid on purchases made in the course of their commercial activities.

Who is required to file Canada GST190 E?

Businesses that are registered for GST/HST and have incurred expenses related to their commercial activities may be required to file Canada GST190 E to claim input tax credits.

How to fill out Canada GST190 E?

To fill out Canada GST190 E, businesses must provide their GST/HST registration number, list the purchases for which they are claiming input tax credits, and provide the total amounts of GST/HST paid on those purchases.

What is the purpose of Canada GST190 E?

The purpose of Canada GST190 E is to enable businesses to recover the GST/HST they have paid on their inputs, thereby reducing their overall tax burden.

What information must be reported on Canada GST190 E?

Businesses must report their GST/HST registration number, the total amount of input tax credits being claimed, details of the eligible purchases, and any supporting documentation as required.

Fill out your Canada GST190 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada gst190 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.