Get the free Customer Deposit Policy

Show details

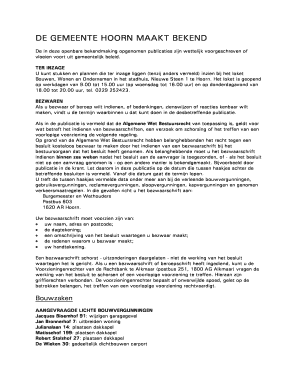

Customer Deposit Policy

Purpose:

This deposit policy is intended to assist in collection of all utility charges to minimize future rate increases. Deposits shall

be collected in advance of providing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign customer deposit policy

Edit your customer deposit policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your customer deposit policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing customer deposit policy online

Follow the steps below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit customer deposit policy. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out customer deposit policy

How to fill out a customer deposit policy:

01

Start by clearly defining the purpose of the customer deposit policy. This policy should outline the rules and procedures regarding how customer deposits are handled within your organization.

02

Include a section that explains the types of transactions that require a customer deposit. For instance, if your business requires deposits for custom orders or services, specify the circumstances where a deposit is required.

03

Outline the process for collecting customer deposits. This may include specifying the methods of payment accepted, any applicable deadlines for deposit submission, and the consequences of failing to submit a required deposit.

04

Specify the conditions under which deposits are refundable. For instance, if a customer cancels an order within a certain timeframe, clarify whether they are entitled to a full or partial refund.

05

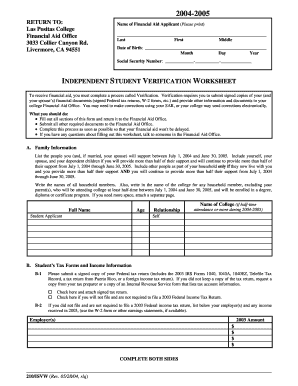

Include procedures for documenting and accounting for customer deposits. This may involve creating a standardized form or template that captures important details such as the customer's name, deposit amount, date received, and any relevant reference numbers.

06

Address any security measures in place to protect customer deposits. This could include details on how deposits are securely stored, who has access to deposit funds, and any applicable insurance or bonding arrangements.

07

Provide information on how customer deposit disputes or issues are resolved. Outline the internal escalation process and any external avenues available for customers to seek resolution if they are unsatisfied with deposit-related matters.

Who needs a customer deposit policy?

01

Businesses that require upfront payments or deposits from customers should have a customer deposit policy in place. This includes industries such as construction, event planning, and custom manufacturing.

02

Any organization that handles customer deposits and wants to establish clear guidelines for both employees and customers should have a customer deposit policy. This ensures consistency and transparency in deposit-related matters.

03

Companies looking to build trust and credibility with customers can benefit from a customer deposit policy. By clearly outlining how deposits are handled and refundable, customers will have confidence in dealing with the organization.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit customer deposit policy from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your customer deposit policy into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I complete customer deposit policy online?

pdfFiller has made it simple to fill out and eSign customer deposit policy. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I make edits in customer deposit policy without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing customer deposit policy and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

What is customer deposit policy?

Customer deposit policy is a set of guidelines and procedures established by a business to govern how deposits from customers are handled.

Who is required to file customer deposit policy?

Businesses that accept deposits from customers are required to file a customer deposit policy.

How to fill out customer deposit policy?

To fill out a customer deposit policy, businesses should detail their deposit acceptance procedures, refund policies, and any related terms and conditions.

What is the purpose of customer deposit policy?

The purpose of a customer deposit policy is to provide transparency and clarity to customers regarding how their deposits are handled by a business.

What information must be reported on customer deposit policy?

A customer deposit policy should include information on deposit acceptance procedures, refund policies, and any terms and conditions related to deposits.

Fill out your customer deposit policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Customer Deposit Policy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.