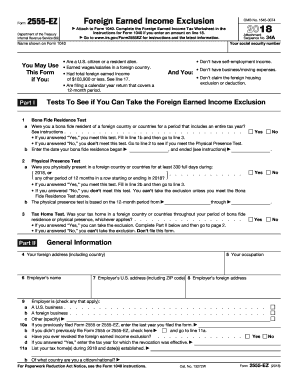

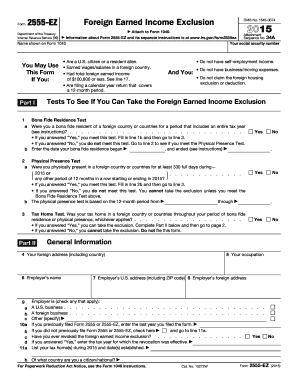

IRS 2555-EZ 2016 free printable template

Instructions and Help about IRS 2555-EZ

How to edit IRS 2555-EZ

How to fill out IRS 2555-EZ

About IRS 2555-EZ 2016 previous version

What is IRS 2555-EZ?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 2555-EZ

Can I create an electronic signature for the [SKS] in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your [SKS] in minutes.

Can I create an eSignature for the [SKS] in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your [SKS] directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out the [SKS] form on my smartphone?

Use the pdfFiller mobile app to complete and sign [SKS] on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

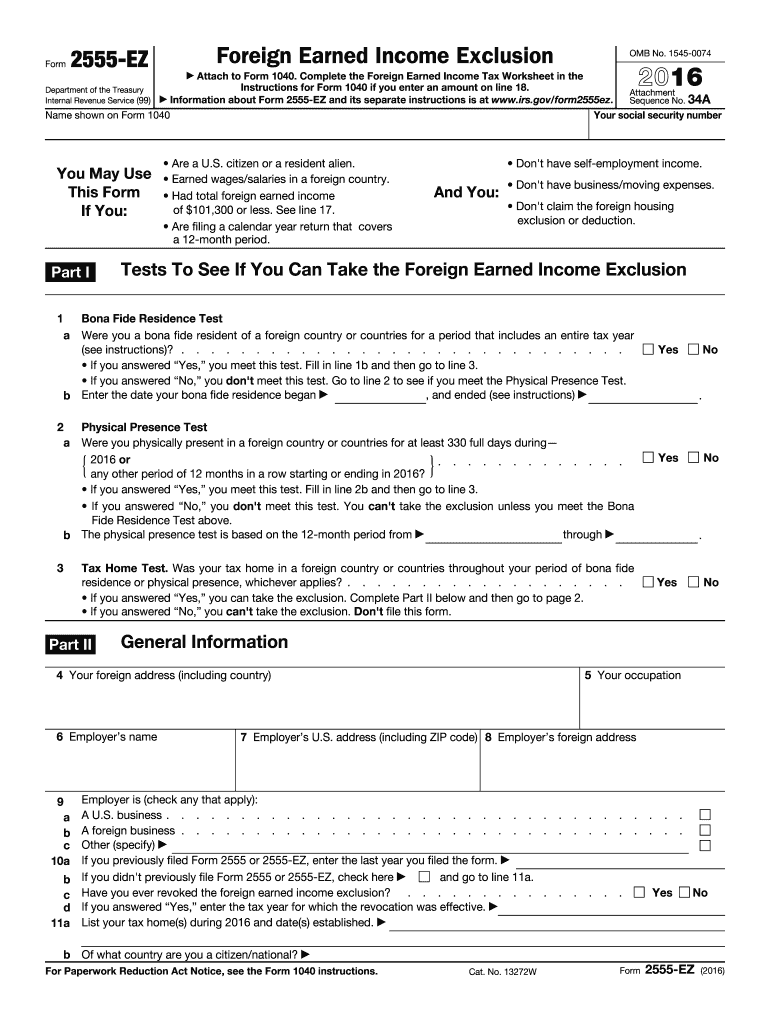

What is IRS 2555-EZ?

IRS Form 2555-EZ is a streamlined version of Form 2555 used by U.S. citizens and resident aliens to claim the Foreign Earned Income Exclusion and exclude certain foreign earned income from their U.S. taxation.

Who is required to file IRS 2555-EZ?

Taxpayers are required to file IRS Form 2555-EZ if they meet specific criteria, including having foreign earned income, qualifying for the Foreign Earned Income Exclusion, and not claiming a housing exclusion or deduction.

How to fill out IRS 2555-EZ?

To fill out IRS Form 2555-EZ, taxpayers must provide their personal information, document their foreign earned income, indicate their foreign residence status, and ensure they qualify under the requirements stipulated by the IRS.

What is the purpose of IRS 2555-EZ?

The purpose of IRS Form 2555-EZ is to allow eligible taxpayers to exclude a portion of their foreign earned income from U.S. taxation, thus reducing their taxable income and potential tax liability.

What information must be reported on IRS 2555-EZ?

The information that must be reported on IRS Form 2555-EZ includes the taxpayer's name, address, foreign earned income amount, proof of foreign residency, and dates of foreign residence.